Public well being organizations proceed to push for excise taxes on sugar-sweetened drinks (SSBs). The World Well being Group, for instance, lately introduced its 3 by 25 Initiative, an effort to extend consumer-facing costs of tobacco, alcohol, and sugary drinks by not less than 50 % by 2035. A number of governments across the globe already levy an excise taxAn excise tax is a tax imposed on a selected good or exercise. Excise taxes are generally levied on cigarettes, alcoholic drinks, soda, gasoline, insurance coverage premiums, amusement actions, and betting, and usually make up a comparatively small and unstable portion of state and native and, to a lesser extent, federal tax collections. on sugary drinks. In as we speak’s submit, we look at the consequences of the taxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of normal authorities companies, items, and actions. in Catalonia, Spain.

The purpose of SSB taxes is to curb the rising weight problems epidemic. In principle, the pathway to attaining that consequence seems quite simple. Sugary drinks include easy-to-consume energy. If these energy have been faraway from a food regimen, holding the whole lot else fixed, much less caloric consumption would translate into much less physique weight. The decrease physique weight and decreased sugar consumption would alleviate some pressure on public well being establishments and reduce the expenditures wanted to deal with the issues with weight problems and diabetes.

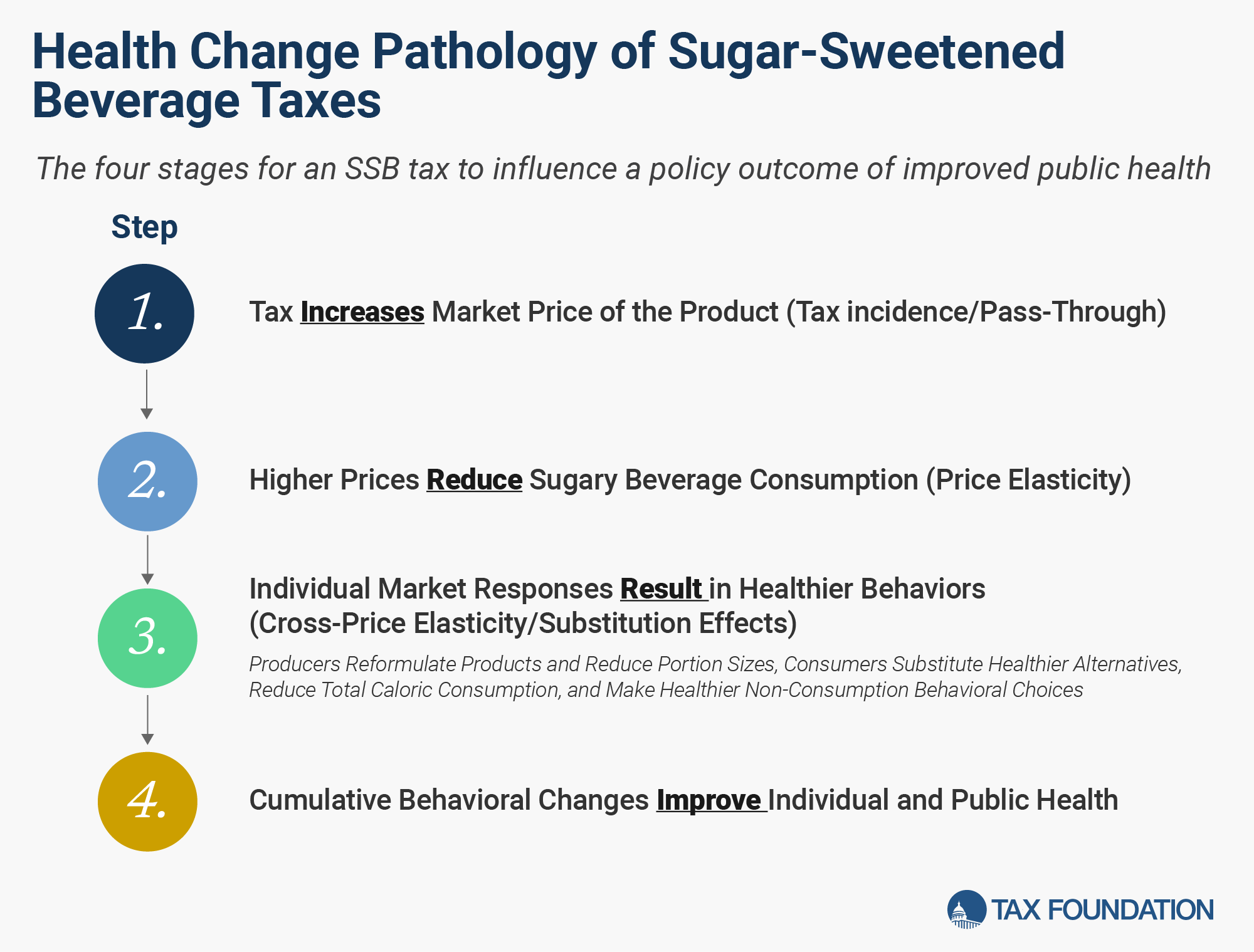

In actuality, the causal chain wanted to attach much less SSB consumption to improved well being outcomes usually accommodates damaged hyperlinks. We beforehand outlined the steps essential to translate an SSB tax into improved public well being outcomes.

Within the case of SSB taxes, the tax wants to extend the worth of the product to incentivize customers to buy much less. After consuming fewer SSBs, customers can not substitute the energy elsewhere of their food regimen, and SSB drinkers should preserve the identical stage of caloric output with the decreased caloric consumption. Solely then may these combination modifications translate into improved well being.

In 2017, Catalonia applied a tiered excise tax on SSBs. The tax charge varies by sugar content material, with drinks containing 5g or much less sugar per 100mL carrying no tax, drinks with 5g to 8g of sugar per 100mL being charged 10 cents per liter, and drinks with greater than 8g of sugar per 100mL having a 15 cents per liter tax.

The tax applies to nectars and a few dairy drinks, although drinkable yogurts and fermented milk are excluded. The tax doesn’t apply to any stable merchandise. The regulation additionally requires the tax to be handed on to the ultimate client, rising the probability that buyers expertise a tax-induced worth improve.

A number of educational research have examined the affect of the Catalonia SSB tax, with many of the focus being on the extent to which SSB consumption fell after the tax. Research recommend that SSB purchases fell between 7.7 % and 16.7 % following the tax.

Few research have explored the tax’s impact on the first outcomes of weight problems charges, physique mass index (BMI), sugar consumption, or diabetes charges. We current knowledge compiled by Catalan and Spanish well being organizations on these consequence measures.

Following the SSB tax, Catalan grownup weight problems elevated considerably from 2017 to 2023 in accordance with knowledge from the Catalan Well being Survey (ESCA) and the Statistical Institute of Catalonia (Idescat). Grownup weight problems charges elevated for each women and men.

The ESCA additionally quantifies childhood weight problems charges for kids ages 6-12. Childhood weight problems charges decreased barely following the SSB tax in 2017. Nonetheless, after 2019, childhood weight problems charges rebounded to close or above their preliminary ranges in 2017. This sample occurred for each girls and boys.

Subsequent, we look at diabetes charges in Catalonia. In 2016, the diabetes charge was 8.1 %, and by 2023, the diabetes charge was 9.1 %, a rise of greater than 12 share factors. Just like weight problems charges, Catalan charges of diabetes have elevated for the reason that imposition of the SSB tax.

Considerably extra Catalans report every day consumption of sugar-sweetened merchandise disregarded of the SSB tax baseThe tax base is the full quantity of earnings, property, belongings, consumption, transactions, or different financial exercise topic to taxation by a tax authority. A slender tax base is non-neutral and inefficient. A broad tax base reduces tax administration prices and permits extra income to be raised at decrease charges.. Amongst teenagers and younger adults aged 15 to 69, charges of every day consumption of SSBs have been almost half that of every day consumption of equally sugary however untaxed merchandise like non-home-made pastries. Amongst youngsters aged 3 to 14, charges of every day consumption of SSBs have been lower than half that of every day consumption of untaxed sugar-sweetened merchandise.

Catalonia’s SSB tax doesn’t seem to have solved its issues with weight problems or diabetes. An necessary query to contemplate is how Catalonia residents evaluate to these in different areas the place no SSB tax was applied. If the development in all Spanish cities consists of rising charges of weight problems and diabetes, the outcomes of Catalonia’s SSB tax won’t look so underwhelming.

In 2017, the yr the SSB tax was applied, Catalan adults had an weight problems charge of 14.9 %, in accordance with knowledge from the Instituto Nacional de Estadistica. By 2022, these knowledge recommend weight problems had fallen barely to 14.1 %.

Grownup weight problems in Madrid, the place there was no SSB tax, declined way more, from 15.9 to 11.8 %. This mirrors the nationwide Spanish common weight problems charge, which declined from 17.4 to 14.1 % over the identical time interval. In keeping with these knowledge, Catalonia lagged behind different regional and nationwide weight problems developments, regardless of the SSB tax.

The info present that the SSB tax hasn’t solved Catalonia’s issues with weight problems or diabetes. Customers drank fewer SSBs after the tax, however that hasn’t been ample to affect sugar consumption or any significant measures of public well being.

As at the moment designed, Catalonia’s SSB tax has such a slender base that buyers can substitute different sugary merchandise to keep up their stage of sugar consumption. If the exterior prices of weight problems are largely pushed by caloric, and particularly sugar, consumption, nutrient taxes on all meals and drinks, not simply SSBs, are one of the best tax base and would grant probably the most impartial tax remedy. A low-rate, particular tax based mostly on every product’s added grams of sugar or complete kilocalories would have a much better probability at reducing weight problems and enhancing public well being than narrowly focused SSB taxes.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

Share this text