A widely known crypto commentator has set off recent debate by laying out a dramatic purchase plan for Cardano (ADA), whereas market information factors to a extra cautious near-term image.

Associated Studying

Analyst Lays Out Wild Upside Targets

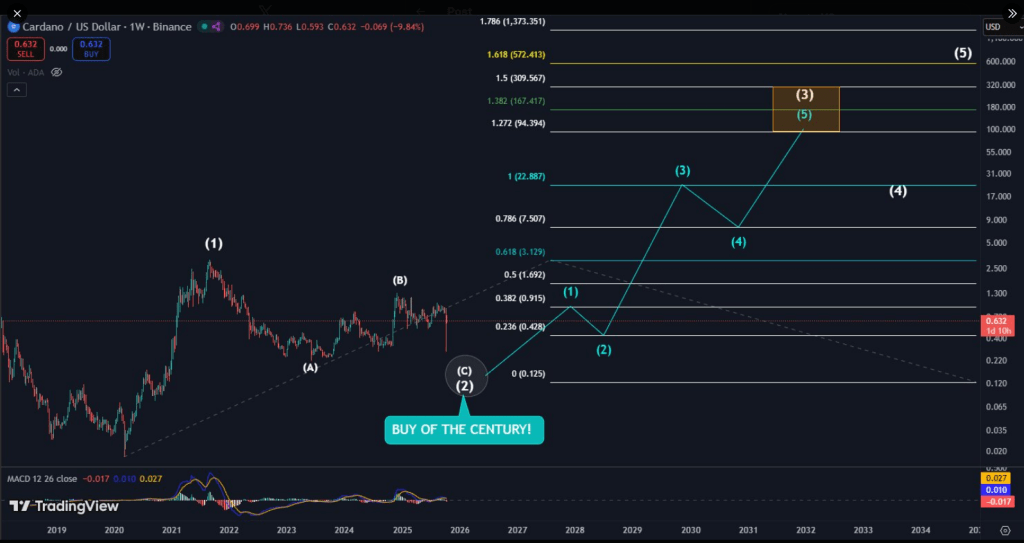

In keeping with Mr. Brownstone, Cardano may provide a once-in-a-lifetime shopping for probability if value motion follows a particular sample. He highlighted sniper entry factors and sketched a five-wave transfer that may, on his chart, elevate ADA into three-digit territory.

On the time stories had been filed, ADA had risen 4% in 24 hours and was buying and selling round $0.67. That adopted a pullback of greater than 20% over the prior two weeks and a flash crash low close to $0.27 on Binance on October 10.

Wave Forecasts That Purpose Very Excessive

Based mostly on the analyst’s wave depend, ADA would first rebound to about $0.91 earlier than slipping again to roughly $0.42. The third wave in his sequence is proven at $22.89. That quantity represents a 3,34% achieve from the then-current value.

$ADA ‼️ BUY OF THE CENTURY! ‼️

📢The chance of Cardano could possibly be life altering!

Q1 2026 may present among the finest investments this century, by buying $ADA beneath $0.20

If this decline happens, I count on value targets for the next years:

🔷 Intermediate wave (3) =… pic.twitter.com/KgsTp6lapR

— Mr Brownstone (@GunsRoses1987) October 18, 2025

A corrective transfer to $7.5 would come after that, with a later goal of $167 on the 1.38 Fibonacci extension. The chart’s most excessive path factors to the 1.61 extension at $572 — a projection that Mr. Brownstone ties to long-term cycles, with a doable arrival 12 months of 2034, which is about 9 years away from now.

In keeping with his view, one final deep dip close to $0.20 would set the stage for all the construction. He suggests {that a} fall to about $0.20 — roughly a 70% drop from the market value on the time of his forecast — may occur within the first quarter of 2026.

Derivatives Present Decrease Confidence

However market indicators level in a unique route as we speak. Reviews have disclosed that futures Open Curiosity for ADA fell to over $112 million, the bottom year-to-date and ranges not seen since November 2024, based mostly on Coinglass information.

Open Curiosity dropping often means fewer new positions are being taken. On the identical time, quick bets rose and dealer participation waned. ADA had corrected almost 7% within the earlier week and was hovering round $0.65 on the time of writing.

Associated Studying

Large Targets, Large Questions

Taken collectively, the image is blended. The analyst’s situation provides enormous upside numbers: $22.89, $167.4, and the eyebrow-raising $572.4. However these figures relaxation on a strict wave interpretation and the belief of recent, robust shopping for after a dramatic low close to $0.20.

Market breadth and derivatives information don’t but assist that type of conviction. Participation is decrease and quick curiosity is greater, which often factors to weaker near-term momentum.

Reviews have proven either side: a vivid long-term plan and information that favors warning proper now. Merchants and buyers might want to weigh the maths of wave counts in opposition to actual buying and selling flows and the chance that costs may keep subdued for a while.

Featured picture from Gemini, chart from TradingView