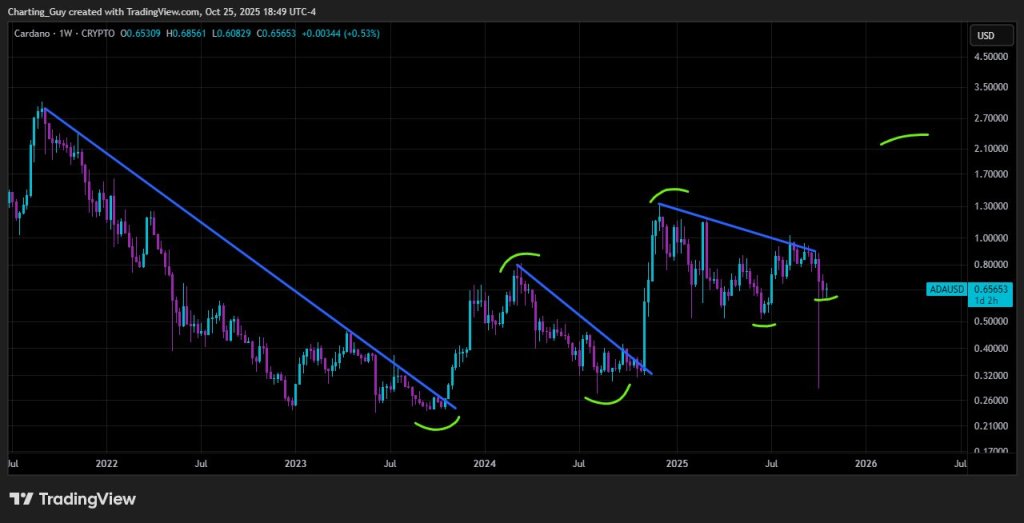

The Cardano weekly chart remains to be trying strongly bullish in response to unbiased technician Charting Man (@ChartingGuy on X) who resurfaced his long-running Fibonacci roadmap and channel research.

Can Cardano High $6 This Cycle?

His newest publish on X on October 26 famous that “ADA is ok so long as uptrend holds,” a view that’s anchored in a multi-year rising channel that has contained value motion because the 2018–2019 base. The channel encompasses a decrease rail now passing by way of roughly the $0.33–$0.35 space, a midline that has behaved as a recurring pivot since 2020, and overhead parallels that intersect with Fibonacci extension targets later within the cycle.

The chart historical past mapped on his visuals is orderly. The 2021–2022 bear development, drawn as a steep descending line from the prior peak, ended into the channel’s decrease assist and resolved by way of a collection of falling trendline breakouts throughout 2023 and early 2024. Since This fall 2023, the chart has proven a collection of upper highs and better lows. At the moment, the ADA value is once more guided by a falling trendline.

Associated Studying

All the things within the format revolves across the Fibonacci ladder. The retracement set on the appropriate margin—derived from the 2021 peak to the cycle low—marks 0% at $0.23488, then $0.33360 (0.136), $0.43180 (0.236), $0.62932 (0.382), a mid-range 0.5 at $0.85, $1.15694 (0.618), $1.43911 (0.702), $1.78464 (0.786), $2.32189 (0.888), and $3.09981 (1.000). Above that stack, the cycle extensions are plotted at $6.25325 (1.272), $9.00941 (1.414) and $15.26831 (1.618).

These numbers are according to how the analyst framed the market earlier within the 12 months. On April 27 he wrote that “ADA fibs are essential right here. The 0.618 is a STRONG resistance… the 0.382 MUST maintain… impartial till one in all these breaks on a weekly shut.” That roadmap has aged intact.

Rallies by way of spring and summer season repeatedly stalled within the 0.500–0.618 zone, with the 0.618 degree at $1.15694 capping advances. Pullbacks, in flip, have discovered bids close to the 0.382 pivot at $0.62932.

On September 18, after that rejection, he up to date that “ADA increased low ✅ … increased excessive pending… nonetheless concentrating on 1.272 fib this cycle,” tying the value construction again to the extension grid. The implication just isn’t informal moon-math; it’s geometric. If ADA continues to defend the uptrend outlined by the channel’s decrease rail and, crucially, converts the 0.618 retracement at $1.15694 into assist on weekly closes, the trail reopens into the higher retracement shelf—$1.43911 at 0.702 and $1.78464 at 0.786—earlier than confronting the 0.888 marker at $2.32189.

A yellow waypoint for a better excessive (on the primary chart) sits close to ~$2.30, intentionally aligning with that 0.888 degree to flag a logical checkpoint for the following impulsive leg beneath the total retrace at $3.09981.

Associated Studying

Solely past that zone does the headline query come into play. The analyst’s cycle goal is the 1.272 extension at $6.25325. On his canvas, that concentrate on just isn’t an orphaned value label; it intersects with the higher parallels of the multi-year rising channel additional out in time, which suggests the extension is technically according to the identical construction that has ruled ADA because the final cycle’s base.

The chance administration facet of the ledger stays equally express: lose the 0.382 at $0.62932 on a weekly closing foundation and the neutral-to-constructive stance is impaired, pushing focus again to $0.43180 and $0.33360, with the 0% anchor at $0.23488 defining absolutely the boundary of the cycle ground contained in the channel’s decrease third.

As the most recent candles on the charts present, ADA sits mid-channel with the upper low confirmed and the vary unresolved beneath descending trendline provide. The triggers are unchanged and numerically clear. A sustained weekly shut above $1.15694 would validate an try towards $1.44, $1.78, and $2.32, with $3.10 the ultimate retrace earlier than extension math takes over.

A failure by way of $0.62932 would flatten the uptrend name. Between these guardrails, the analyst’s October 26 message reads much less like bravado and extra like a conditional assertion embedded within the chart itself: Cardano can nonetheless attain $6.25 this cycle—however provided that the uptrend continues to carry and the 0.618 ceiling lastly offers approach.

At press time, ADA traded at $0.67.

Featured picture created with DALL.E, chart from TradingView.com