Bitcoin has proven indicators of resilience after setting a recent low close to $108,000, staging a restoration that lifted the value again above the $113,000 degree. Bulls now attempt to reclaim the $115,000 degree, however momentum weakens as sellers push again. The restoration eased strain within the brief time period, but uncertainty builds whereas the market tracks main macro dangers.

Associated Studying

The largest concern comes from Washington, the place the specter of a US authorities shutdown looms giant. Merchants count on volatility if policymakers fail to strike a deal, and threat belongings like Bitcoin typically react sharply to such headlines. Because the deadline approaches, buyers develop cautious and worth motion displays that pressure.

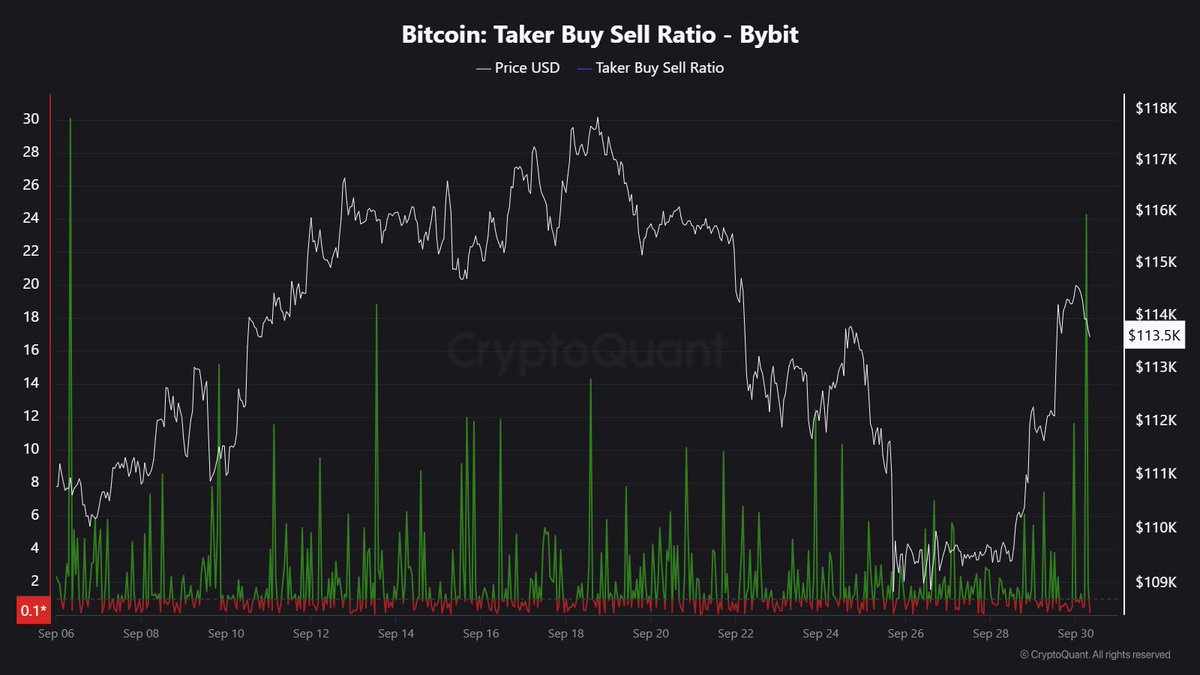

Amid this backdrop, prime analyst Maartunn flagged a notable Bitcoin Alert on Bybit. The Taker Purchase/Promote Ratio surged to unusually excessive ranges, signaling that merchants opened aggressive lengthy positions. Such spikes typically reveal robust bullish conviction, however they will additionally create instability if these positions unwind.

Bybit Information Exhibits Surge in Lengthy Positions

Analyst Maartunn highlighted a putting improvement in Bitcoin’s market construction: the Taker Purchase/Promote Ratio on Bybit has surged to 24.26, marking the very best degree since September. This uncommon spike indicators that merchants have opened an aggressive wave of lengthy positions, a transfer typically interpreted as a robust bullish sign.

In line with Maartunn, any such imbalance displays a market the place purchase orders considerably outweigh promote orders, pointing to a sudden shift in sentiment. When the ratio reaches such extremes, it means that a considerable amount of recent capital is getting into by the lengthy facet of the order ebook. This means confidence amongst merchants that Bitcoin’s rebound above $113,000 might have additional room to increase if momentum holds.

Nevertheless, the implications aren’t one-sided. A surge in lengthy positioning can add gasoline to rallies, however it may possibly additionally improve vulnerability if worth motion turns towards overleveraged merchants. In such instances, the market dangers a cascade of liquidations, which might speed up downward strikes simply as shortly as they amplify upward momentum.

The approaching days might be vital as Bitcoin exams the $115,000 resistance zone. A decisive breakout may validate the bullish positioning and pave the way in which towards $117,500. Alternatively, failure to push greater might set off profit-taking or liquidations, pulling the value again towards $110,000.

Associated Studying

Bitcoin Holds Key Assist However Faces Sturdy Barrier

Bitcoin trades close to $113,100 after bouncing from lows round $109,200, exhibiting resilience within the face of current promoting strain. On the 3-day chart, the value sits between vital ranges: assist from the 50-period transferring common (blue) and resistance on the $117,500 zone, highlighted in yellow. This vary has outlined Bitcoin’s habits for a number of weeks, and the market continues to consolidate inside it.

The broader construction reveals a sequence of decrease highs for the reason that July peak close to $125,000, suggesting waning momentum within the medium time period. Nevertheless, the long-term development stays intact, with the 100-period (inexperienced) and 200-period (crimson) transferring averages trending upward and offering a robust base round $100,000 and $80,000 respectively.

Associated Studying

A decisive break above $117,500 would invalidate the present lower-high construction and open the door for a retest of $120,000 and past. Conversely, failure to carry above $110,000 may drag Bitcoin decrease, exposing the $105,000 area and testing investor confidence.

Featured picture from Dall-E, chart from TradingView