Crypto analyst VisionPulsed argues that Dogecoin is coming into a seasonal window of power in November—conditional on a broader “risk-on” handoff from US equities to crypto and, critically, Bitcoin sustaining assist at a key shifting common. In an Oct. 28 video replace centered on Dogecoin, he linked the coin’s near-term upside to a now-familiar sequence: S&P power → Russell 2000 catch-up → Ethereum breakout → DOGE momentum.

“November may very well be repeating itself the place we get an enormous push in November,” he stated, citing what he frames as a recurring sample of late-October bottoms adopted by November reversals in recent times. He pointed to 2022 and 2023 as examples and opened the session by noting ongoing fairness optimism, quipping that “the S&P is continuous to hole up,” and {that a} risk-bid in shares traditionally creates favorable situations for crypto beta.

November Preview For Dogecoin

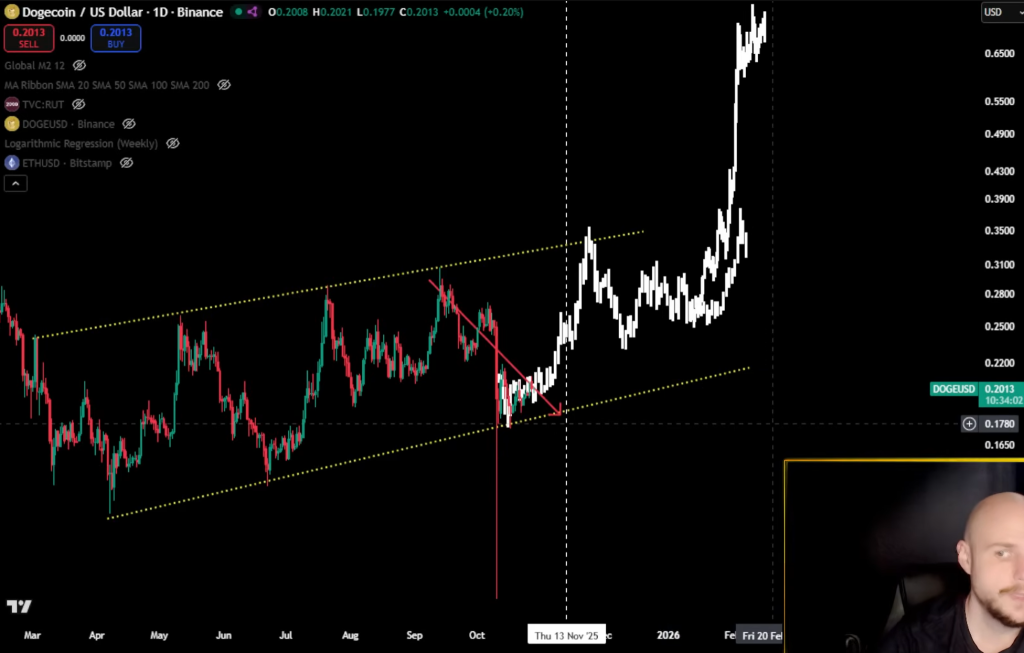

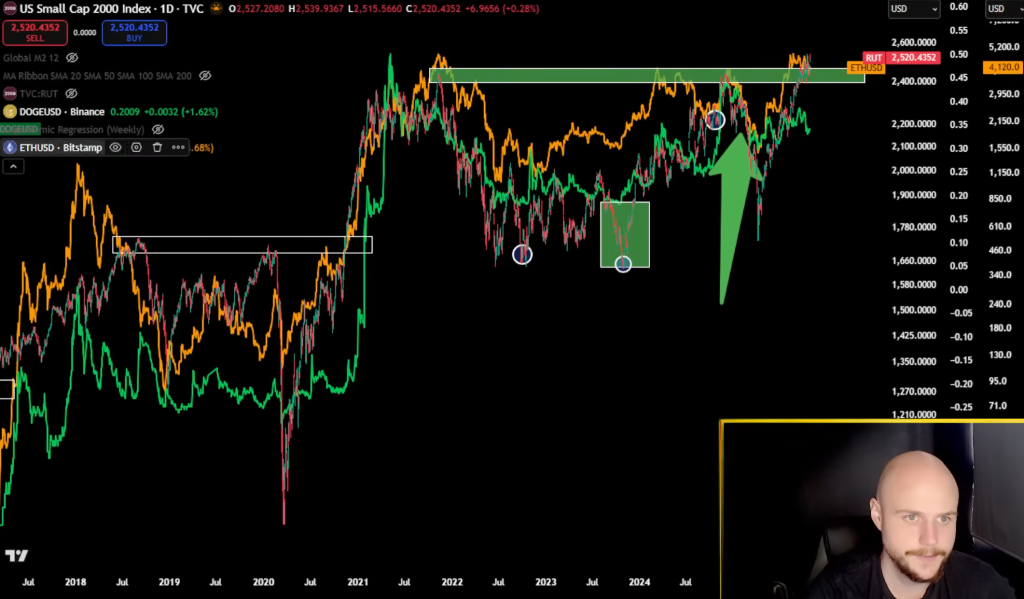

The pathway he sketches is express and hierarchical. “If the S&P can push greater, then the Russell 2000 may very well observe… And as we’ve stated 100 instances, when the Russell breaks out, that will increase the prospect that Ethereum breaks out. Occurred in 2017, occurred in 2020. And if the Russell can escape and Ethereum can escape, slap Dogecoin on there.” His Dogecoin view is framed inside a rising channel, with value “grinding upwards on the pattern line” into early November earlier than a possible acceleration towards the channel prime in mid-month.

Associated Studying

The analyst is emphatic that the setup is constructive however not a carried out deal. “There’s in all probability no large bull run simply but, nevertheless it appears to be like bullish from right here to not less than December.” From there, the branching outcomes hinge on whether or not an altseason materializes and whether or not DOGE can break past the higher boundary of its channel.

If momentum stalls at resistance with out proof of declining Bitcoin dominance—his shorthand for capital rotating into altcoins—he warns of a well-known whipsaw: “If we come as much as the highest of the channel and we get caught once more… we’re going to see a crash to the underside of the channel or not less than the center.”

In that draw back department, he cites a drawdown situation towards the low-teens, saying DOGE may “return to 13 cents.” Within the upside department, if an altseason ignites, he floats a run towards “80 cents, 90 cents, no matter,” with the caveat that such a surge into December may additionally mark an area cycle prime requiring reassessment in actual time.

Associated Studying

As a gating situation throughout all situations, Bitcoin’s pattern integrity stays the fulcrum. “If for no matter purpose, Bitcoin breaks this shifting common, then there’s no bull run in any respect. It doesn’t exist—we’re in a bear market. However so long as we maintain a shifting common… the bull run will proceed.”

He analogizes the dynamic to a “blue circle” bounce on the S&P and expects a comparable moving-average response from BTC to maintain the crypto threat cycle intact. The Ethereum leg is handled as each a beneficiary of small-cap fairness power and a validator for alt rotation: “If the S&P and the Russell can each push greater, that offers us a inexperienced mild for Ethereum. And if Ethereum can push greater, then Doge may push greater.”

Timing is central to his thesis. He anticipates a gradual “grind” into early November, a push towards DOGE’s channel prime “in all probability in the midst of November,” after which a decisive inflection because the market both confirms altseason into December—or fails and resets with yet another flush earlier than any sustained rotation. He additionally leaves room for a much less in style chance: “We all the time must maintain our open thoughts to the likelihood that there isn’t any altseason… I’m the final particular person that desires to say that… however we’ve received to be open to the chances.”

VisionPulsed characterizes the present second as tactically bullish with binary edges outlined by the channel and BTC’s shifting common. “I might say the highest of the channel is in play so long as we maintain the underside of the channel.” The message to Dogecoin merchants is in the end conditional and sequence-driven: November gives the opening, however equities, Bitcoin pattern assist, and an Ethereum affirmation are the levers that should all click on into place to show an encouraging drift right into a decisive breakout. As he signed off: “As all the time, none of that is monetary recommendation.”

At press time, DOGE traded at $0.19372.

Featured picture created with DALL.E, chart from TradingView.com