In 1993, the economist Richard Auty coined the time period “useful resource curse” to explain the paradox that nations with plentiful pure assets typically develop extra slowly and fewer equitably than these with out. The UK shouldn’t be normally positioned in that class. In my view, it must be.

What occurred to Britain from the early Nineteen Eighties onwards was not an unintentional encounter with the useful resource curse. It was a deliberate political selection. Thatcher’s then Tory authorities, with huge North Sea revenues, selected to make use of them to not renew the economic material of the nation however to destroy it. That’s the first a part of the story.

The second is that because the oil and fuel ran down, finance took their place because the supply of a brand new curse, and the implications of each nonetheless form our financial system as we speak.

Let me clarify these options.

First, the Thatcher authorities inherited a windfall that few states in fashionable historical past have loved. North Sea oil and fuel revenues surged simply as what appeared like a government-generated recession hit. Somewhat than getting used to modernise British manufacturing, rebuild infrastructure, or create sovereign wealth for future generations, oil and fuel revenues had been channelled into funding mass unemployment, reducing taxes for the rich, and, most significantly, sustaining an industrial closure programme that hollowed out a lot of Britain’s productive capability. Britain burned its future to fund the anti-socialist neoliberal challenge.

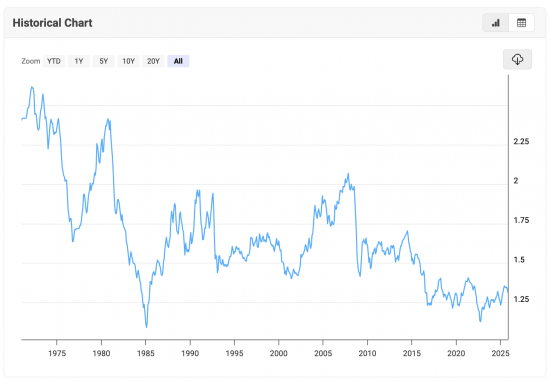

Second, the early Nineteen Eighties noticed one other consequence of the useful resource windfall: after preliminary shocks, sterling elevated in worth, a development that continued towards all the percentages till the time of the worldwide monetary disaster in 2008, with Brexit being the one factor that broke the development:![]()

Trade charges rise when an financial system is flooded with demand for its foreign money from overseas, on this case, initially, on account of oil after which as a consequence of an over-inflated monetary sector.

A powerful pound might really feel like a supply of satisfaction, however for manufacturing, it’s deadly. British exports grew to become more and more uncompetitive because of this. Our price base rose while home producers confronted a flood of cheaper imports. Whole sectors from shipbuilding to metal, engineering, textiles, and electronics had been pushed into decline. The federal government blamed unions and inefficiency, however the artificially inflated trade charge did a lot of the work.

Third, the finance added to the woes. As soon as the oil bonanza started to fade, the Metropolis of London grew to become the brand new engine of progress, and once more, not accidentally however by design. The Large Bang of 1986, deregulation, and the embedding of the UK’s tax haven community had been deliberate methods to draw world sizzling cash. Britain exported industrial items in 1970. It exported monetary claims by 2000. One is rooted in actual work. The opposite is rooted in hire.

Fourth, the Financial institution of England has been complicit on this story for 4 a long time. Rates of interest had been saved excessive below Thatcher to draw world capital. That inflated the pound additional and, by rising the UK price base, accelerated deindustrialisation. And now, whilst inflation has fallen, the Financial institution’s programme of quantitative tightening as soon as once more props up extreme rates of interest, strengthens sterling, and damages British exporters who’ve by no means recovered from the primary wave of destruction.

The result’s an financial system with a persistent progress drawback. However, crucially, it additionally has a structural drawback: our foreign money is constantly overvalued as a result of our financial technique nonetheless relies on attracting international cash slightly than constructing home capability.

That creates penalties.

To start with, Britain stays hooked on sizzling cash. Rates of interest which can be increased than financial situations counsel are acceptable solely serve one goal, which is to drag in speculative capital. The Financial institution of England denies this, however the proof is obvious. Too typically, when sterling dips, rate of interest expectations mysteriously rise. This isn’t inflation management. It’s trade charge engineering.

Subsequent, trade nonetheless pays the worth. A powerful pound squeezes exporters, discourages funding, and pushes manufacturing offshore. Companies which may in any other case thrive in a secure, low-rate, competitive-currency setting as a substitute shrink, automate prematurely, or disappear fully. The UK’s persistent commerce deficits usually are not a thriller; they’re a coverage final result.

An additional consequence is regional inequality. When finance turns into the dominant sector, wealth is sucked into the Metropolis’s Sq. Mile and its satellites. The remainder of the nation, and most particularly the previous industrial areas, are nonetheless left with the legacies of the Nineteen Eighties. They’re low productiveness, insecure employment, and a scarcity of coherent industrial technique. The oil and fuel curse grew to become the finance curse, which then morphed right into a geography of decline.

And at last, democracy suffers. When a state builds its financial system on world capital flows, it turns into hostage to them. Governments worry market reactions. Ministers communicate of credibility with traders, not accountability to residents. Financial coverage turns into an train in appeasing bond merchants and foreign money markets, even when these insurance policies are dangerous, pointless, or irrational. That’s exactly what we see now. Fiscal guidelines are designed to reassure markets, and to not meet social want; rates of interest are indifferent from financial actuality; and the political tradition treats finance as its grasp slightly than treating it as a servant.

What does all this imply?

First, Britain must abandon the fantasy that an financial system constructed on attracting sizzling cash can ever be secure or affluent. Finance have to be put again as a substitute as a utility, and never be seen because the ruler we should serve.

Second, the Financial institution of England should cease utilizing rates of interest as an alternative choice to industrial technique. Excessive charges don’t create productiveness. They destroy it. Quantitative tightening ought to finish. Rates of interest should replicate home situations and never the calls for of worldwide capital.

Third, we’d like a contemporary industrial technique with a aggressive pound at its coronary heart. Which means concentrating on full employment, supporting funding by decrease borrowing prices, and utilizing public banks to channel financial savings into productive exercise and never hypothesis.

Fourth, we have to dismantle the UK’s tax haven infrastructure. It serves just one goal, which is to maintain Britain enticing to cellular monetary wealth whereas undermining our personal tax base and distorting our trade charge.

And final, we have to inform the reality. Britain didn’t decline as a result of staff had been inefficient or as a result of trade was hopeless. Britain declined as a result of governments selected finance over manufacturing, hypothesis over funding, and short-term political benefit over long-term nationwide prosperity.

The oil and fuel curse was actual. The finance curse that adopted has been even worse. We will break each, however provided that we admit that they exist, perceive how they work together, and resolve to construct an financial system primarily based on actual work, truthful reward and democratic management. That’s our process now.

Feedback

When commenting, please pay attention to this weblog’s remark coverage, which is out there right here. Contravening this coverage will end in feedback being deleted earlier than or after preliminary publication on the editor’s sole discretion and with out rationalization being required or provided.

Thanks for studying this submit.

You’ll be able to share this submit on social media of your selection by clicking these icons:

There are hyperlinks to this weblog’s glossary within the above submit that specify technical phrases utilized in it. Observe them for extra explanations.

You’ll be able to subscribe to this weblog’s each day e-mail right here.

And if you need to assist this weblog you’ll be able to, right here: