![]()

2025.8 Replace: There’s a brand new as much as $500 supply. Solely DD is required. Deadline: 2026.1.31.

2025.2 Replace: The $300 supply prolonged the deadline to 2025.5.31. [Update] Prolonged to six.30. [Update] Prolonged to 7.31.

Software Hyperlink

Advantages

- New Checking Account Bonus: as much as $500. See under for the necessities to get this bonus. Provide ends on 2026.1.31.

- There’s a month-to-month upkeep charge of $4.95/$12/$25 relying on the kind of the checking account. You’ll be able to keep away from this by following the steps under.

- BoA Most well-liked Rewards program: When you’ve got this BoA checking account, and you’ve got sufficient belongings in checking/financial savings/brokerage account in BoA or Merrill Edge, you’ll be able to earn further factors based mostly on the quantity of asset. Earn further 25% rewards in case you are in Gold tier ($20k or extra in steadiness); 50% if Platinum tier ($50k or extra in steadiness); 75% if Platinum Honors tier ($100k or extra in steadiness).

Not like most different banks, transferring cash out of BoA (i.e. ACH push from BoA) has a charge! To keep away from this charge, you’ll want to begin the switch from the receiving financial institution (i.e. ACH pull from different financial institution).[Update] Ranging from Jun 2023, this charge is not charged by BoA.- No early termination charge.

- BoA is without doubt one of the largest banks in America, so their department and ATM community is huge.

Bonus Necessities

- When you’ve got a BoA checking account prior to now 12 months, you aren’t eligible for this supply. Knowledge factors present that in case you shut an outdated BoA checking account and apply for a brand new one after 12 months, you might be eligible once more for the bonus.

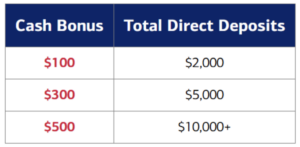

- Direct Deposit (DD) requirement: obtain qualifying direct deposits totaling $2,000/$5,000/$10,000 or extra inside 90 days, and get $100/$300/$500 bonus.

Totally different BoA Checking Accounts

- Financial institution of America Benefit SafeBalance Banking (Previously BoA Core Checking for College students)

- Financial institution of America Benefit Plus Banking (Previously BoA Core Checking)

- Financial institution of America Benefit Relationship Banking (Previously BoA Curiosity Checking)

Right here is a comparability and distinction on the official web site. The Benefit Plus Banking is the most well-liked one.

Easy methods to Keep away from the Month-to-month Payment (Meet Any One of many Necessities Under)

Financial institution of America Benefit SafeBalance Banking (Previously BoA Core Checking for College students): $4.95 month-to-month charge

- College students underneath age 24 are eligible to have this charge waived whereas enrolled at school.

- Enroll in Most well-liked Rewards.

Financial institution of America Benefit Plus Banking (Previously BoA Core Checking): $12 month-to-month charge

- College students underneath age 24 are eligible to have this charge waived whereas enrolled at school.

- Have not less than a $250 Direct Deposit every month.

- Keep a each day common steadiness of not less than $1,500.

- Enroll in Most well-liked Rewards.

Financial institution of America Benefit Relationship Banking (Previously BoA Curiosity Checking): $25 month-to-month charge

- Keep a each day common steadiness of not less than $10,000.

- Enroll in Most well-liked Rewards.

Abstract

Financial institution of America is the biggest retail financial institution within the US, and many individuals use it as their main checking account. The $300 supply is an effective one, get it if you’ll be able to arrange a direct deposit.

Historic Affords Chart

Software Hyperlink

If you happen to like this put up, do not forget to provide it a 5 star score!