Bitwise Chief Funding Officer Matt Hougan is now making use of his long-standing Bitcoin framework to Solana — and he’s calling the setup “explosive.”

In an October 29 memo, Hougan says the perfect trades in crypto are those the place you get “two methods to win” with one place. For Bitcoin, he defines these two bets as: “1) The worldwide ‘retailer of worth’ market will develop. 2) Bitcoin will take an growing share of that market.” He says solely a type of outcomes needs to be true for Bitcoin to work.

Hougan sizes that “retailer of worth” market at roughly $27.5 trillion right this moment, together with about $25 trillion in gold and $2.5 trillion in Bitcoin. He argues traders focus an excessive amount of on Bitcoin changing gold and never sufficient on the general market itself increasing.

Associated Studying

He notes that this market has already grown by roughly 10x within the final 20 years, from beneath $3 trillion in 2005 to $27.5 trillion right this moment. In his view, if that repeats, Bitcoin can 10x while not having to totally displace gold. If, on high of that, Bitcoin additionally closes the hole with gold and finally ends up with half of the full store-of-value market, “each bitcoin can be price $6.5 million.” He provides, “I’m not saying that may occur,” however he makes use of the maths to point out how highly effective the dual-bet construction may be.

Solana’s Twin Development May Mirror Bitcoin

Hougan now argues Solana suits the identical mannequin. “Once I spend money on Solana, I’m additionally making two bets without delay,” he writes. These two bets are: “1) The stablecoin and tokenization infrastructure market will develop. 2) Solana will win an growing share of that market.”

He defines that market because the set of blockchains that energy stablecoin funds and asset tokenization right this moment. He names Ethereum as “the market chief,” and lists Tron, Solana, and Binance Good Chain as main challengers in stablecoins. Collectively, he says, these networks symbolize $768 billion in market worth. Solana’s share of that’s $107 billion, or roughly 14%.

For Hougan, that’s the opening. He says he has “lots of confidence that the stablecoin and tokenization infrastructure market will develop,” and argues most individuals “considerably underestimate how a lot these applied sciences will remake markets.”

His long-run declare is blunt: “Over time, I believe practically all funds can be in stablecoins and practically all belongings can be tokenized.” If that performs out, “the blockchains that facilitate this progress can be extraordinarily precious.” He calls it “simple to think about this market rising by 10x or extra.”

Associated Studying

The second half, in his view, is Solana’s means to seize extra of that enlargement. He calls Solana “quick” and “user-friendly,” backed by a group with a “ship-fast angle.” He additionally notes that Solana continues to be “enjoying catch-up” in successful institutional mandates, however says that’s beginning to change. For instance, he cites Western Union’s introduced stablecoin effort this week, and factors out that Western Union selected Solana because the underlying blockchain.

Hougan’s argument is that if the general marketplace for stablecoin settlement and tokenized belongings 10xes, and Solana grows its share of that market from 14%, the consequence will not be linear — it compounds. “If I’m proper,” he writes, “the mix of a rising market and a rising share of that market can be explosive for Solana. Simply as with bitcoin.”

He closes with a word on positioning. Crypto, he says, rewards humility as a result of “even probably the most seasoned specialists don’t know precisely how issues will play out.” However he says you’ll be able to nonetheless tilt odds in your favor by proudly owning belongings that embed two high-conviction bets without delay. In his view, Bitcoin already suits that profile. Solana now does too.

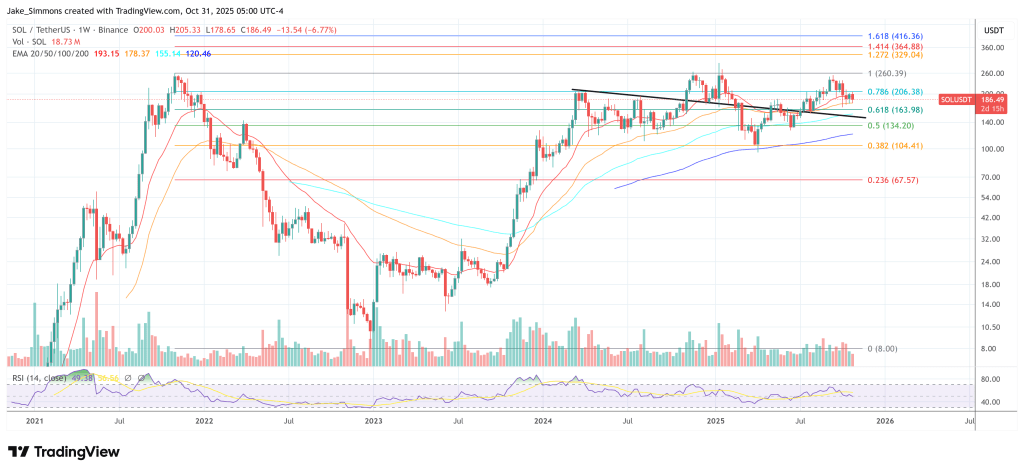

At press time, SOL traded at $186.

Featured picture created with DALL.E, chart from TradingView.com