03 Nov Bitfinex Alpha | Calmness Descends on BTC

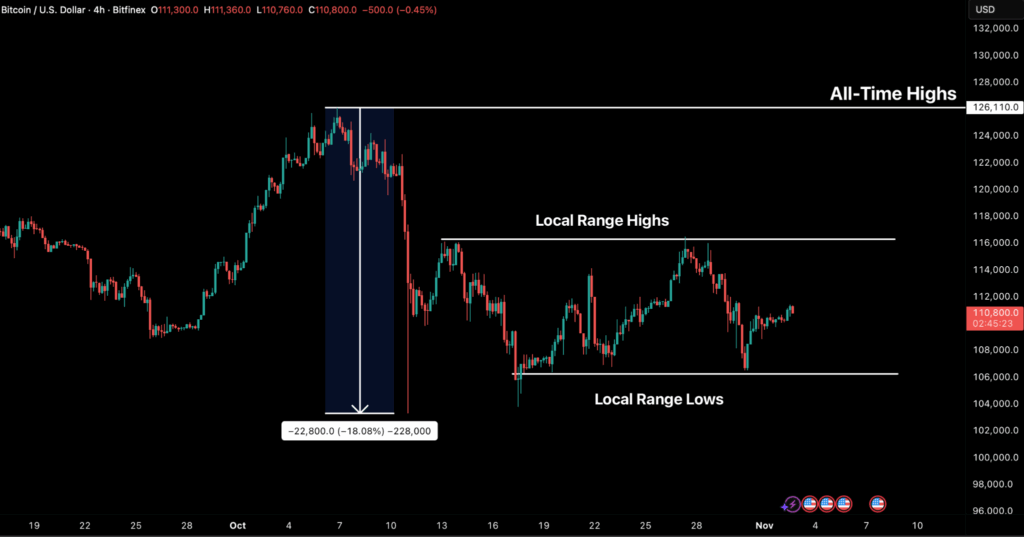

Bitcoin has spent the previous two weeks confined inside a slim $106,000–$116,000 vary. Regardless of a short aid rally to $116,500 final week, BTC stays weighed down by a short-term resistance cluster, that’s seeing continued distribution from long-term holders and weak institutional demand. Within the choices market implied volatility has continued to compress, and investor positioning has shifted to impartial, underscoring a broad lack of directional conviction following the October tenth liquidation occasion. The cautious tone in threat markets is exacerbated by blended macro indicators from the newest FOMC assembly, and has stored speculative urge for food muted and worth motion subdued.

Whereas structural assist nonetheless stays intact close to $106,000, the steadiness of proof factors to fragility beneath the floor. Analysing the Lengthy-Time period Holder Web Place Change metric reveals that this cohort is deeply adverse at –104K BTC per thirty days, signalling persistent profit-taking, whereas the Quick-Time period Holder Web Unrealised Revenue/Loss metric exhibits waning conviction amongst latest consumers. Except ETF inflows or new spot demand returns to soak up ongoing distribution, BTC is prone to stay range-bound, with a threat bias towards retesting the $106,000–$107,000 zone. A sustained break beneath this stage might open the trail to $100,000 per BTC, whereas a decisive reclaim above $116,000 would mark the primary signal of structural restoration heading into November.

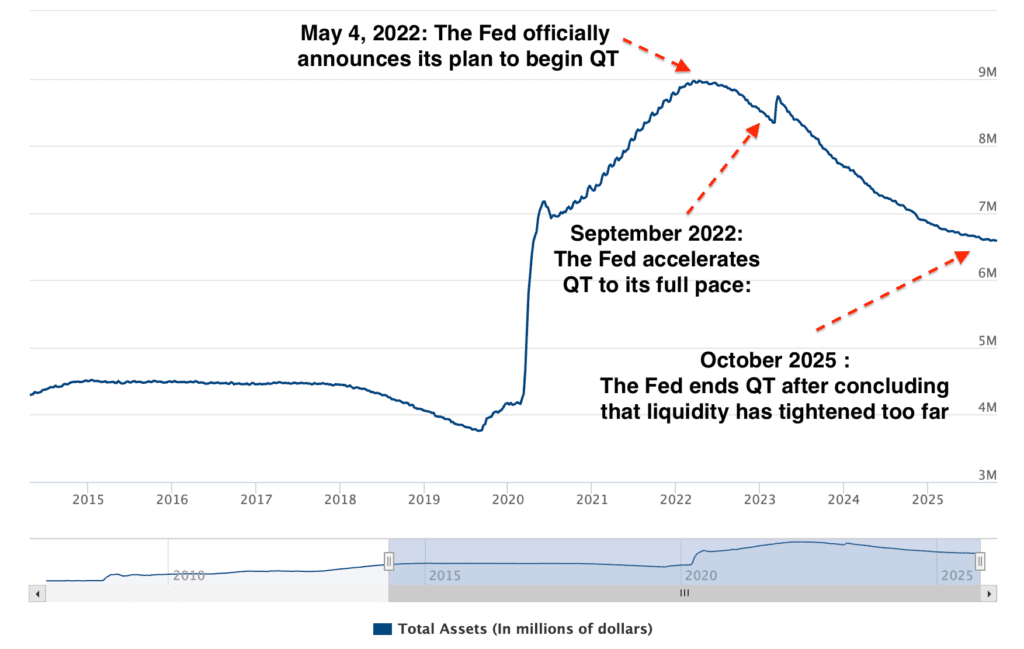

Underpinning the temper in crypto markets is a US economic system that’s transferring into a brand new stage of coverage recalibration because the Federal Reserve shifts from tightening to liquidity administration as progress slows and inflation eases.

At its assembly on October thirtieth, the Federal Open Market Committee ended its steadiness sheet runoff coverage and lower rates of interest by 25 foundation factors to a variety of three.75–4 %. The transfer responds to tightening liquidity circumstances, as money-market funds pull money from the Fed’s reverse repo facility to purchase Treasury payments, draining reserves from the banking system.

The bond market has been signalling expectations of slower progress and extra fee cuts for the reason that Summer season, with 10-year Treasury yields dropping to round 4 % and 30-year yields to 4.6 %. Extra lately, nonetheless, the time period premium, which is the additional return demanded by bond traders for taking up threat, has turned optimistic for the primary time in years. It displays the market view that despite the fact that recession fears are easing, considerations over fiscal and inflation dangers are rising.

The labour market additionally exhibits indicators of fatigue. In accordance with the Bureau of Labour Statistics, wage progress slowed to three.7 % in August from 4.7 % final 12 months. Client confidence has dipped as properly: the Convention Board’s index fell to 94.6 in October, reflecting unease amongst lower- and middle-income households whilst fairness markets stay sturdy.

Final Monday, ETHZilla Company offered roughly US$40 million in Ether to fund an aggressive share repurchase program, signalling a shift in how crypto-native companies handle treasury belongings. By changing a part of its ETH holdings into buybacks, ETHZilla goals to slim the low cost between its share worth and web asset worth, successfully turning its crypto reserves into a company finance lever. Only a day later, Western Union entered the crypto area with the announcement of its US dollar-pegged stablecoin, constructed on the Solana blockchain in partnership with Anchorage Digital Financial institution. The launch is indicative of one other conventional monetary establishment modernising cross-border funds by decreasing settlement instances and prices by means of blockchain expertise. In the meantime, in Asia, Japan took a daring step towards state-linked crypto integration. Mining {hardware} producer Canaan revealed a deal with a significant Japanese utility to deploy hydro-cooled Avalon A1566HA miners for a grid-stability challenge. The initiative makes use of Bitcoin mining to steadiness renewable vitality hundreds, illustrating how blockchain infrastructure can improve energy grid effectivity fairly than pressure it.