On-chain analytics agency CryptoQuant has defined how there aren’t any indicators of a Bitcoin value peak but, based mostly on this indicator.

Bitcoin Web Realized Revenue/Loss Is Nonetheless At Average Ranges

In a brand new publish on X, CryptoQuant has shared the most recent development within the Bitcoin Web Realized Revenue/Loss. This indicator tells us about whether or not the Bitcoin traders are promoting their cash at a internet revenue or loss.

The metric works by going by way of the transaction historical past of every token being spent to see what value it was moved at earlier than this. If this earlier promoting value for any coin was lower than the spot value it’s now being transacted at, then the token’s sale is assumed to be resulting in the conclusion of some internet revenue.

The diploma of revenue realized is of course equal to the distinction between the 2 costs. In tokens of the other case (that’s, the final value is greater than the most recent spot BTC worth), the sale realizes a loss as a substitute.

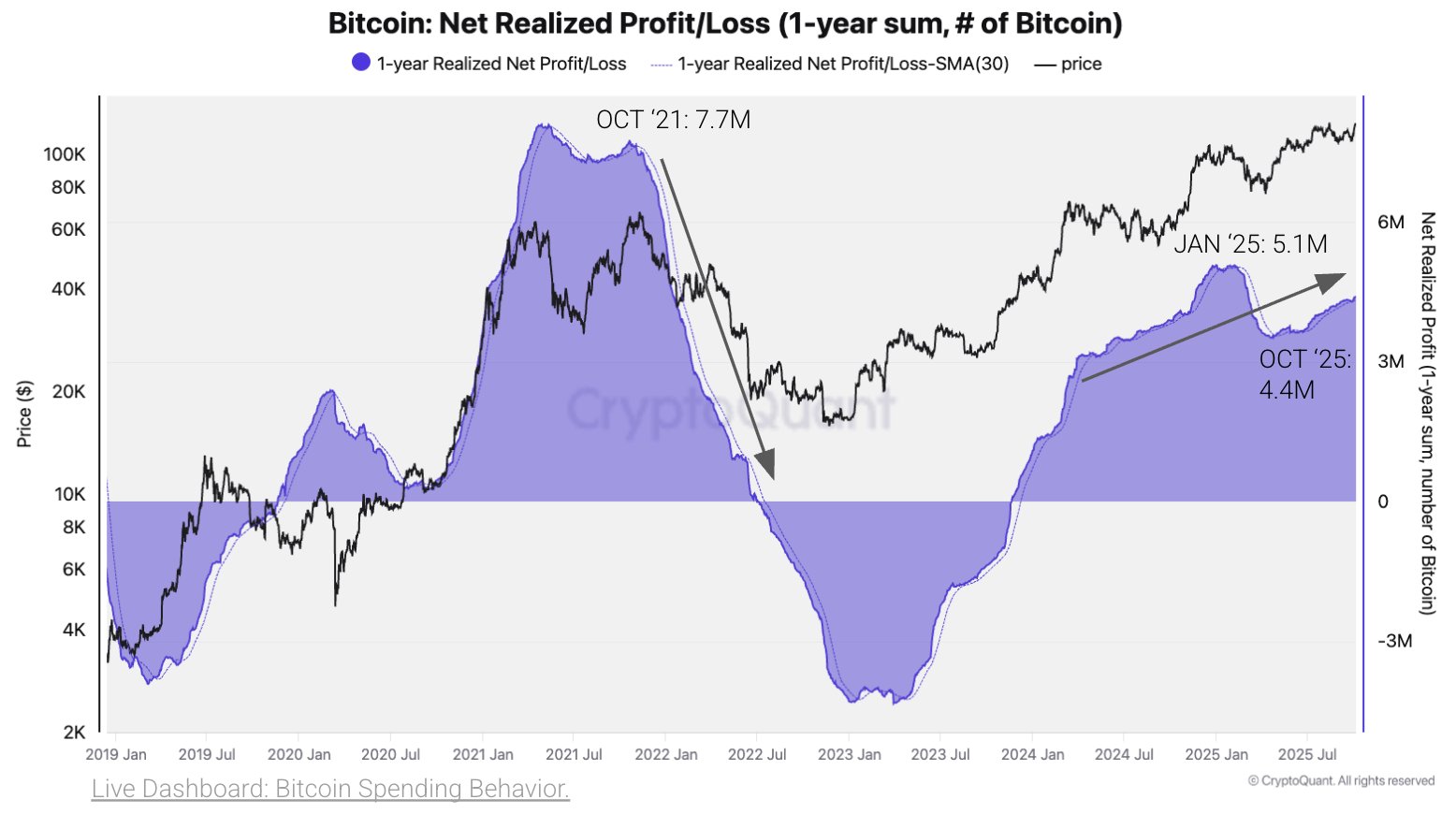

Within the context of the present dialogue, the model of the Web Realized/Revenue Loss that’s of curiosity is particularly the 1-year sum, denominated in BTC. Beneath is the chart for the metric that exhibits how its worth has fluctuated over the previous few years.

From the graph, it’s seen that the Bitcoin Web Realized Revenue/Loss witnessed an uptrend in 2024 and reached a excessive of 5.1 million BTC in January 2025. This implies that the market took half in a big quantity of profit-taking that 12 months.

After the January peak, nevertheless, the metric reversed course and began happening as a substitute. This decline in revenue realization was a results of the bearish value motion that the cryptocurrency confronted within the first few months of the 12 months.

After bullish winds returned for the cryptocurrency, although, the Web Realized Revenue/Loss as soon as once more started to maneuver up. This upward trajectory has naturally continued alongside BTC’s newest rally to a brand new all-time excessive (ATH) and the indicator has reached the 4.4 million BTC mark.

Although this worth is critical, it’s clearly decrease than the January 2025 high. This earlier peak itself was nonetheless decrease than the 7.7 million October 2021 excessive from the earlier cycle.

“Bitcoin’s rally nonetheless appears to be like intact,” notes CryptoQuant based mostly on the development. “No indicators but of a value peak.” It now stays to be seen how BTC’s value motion will look within the close to future and whether or not the Web Realized Revenue/Loss will observe any shift.

BTC Value

Bitcoin has been down since setting its ATH above $126,000, as its value presently floats round $122,700.