As Bitcoin (BTC) resumes recording new all-time highs (ATH), focus is again on key worth ranges that would present traders with an concept concerning the subsequent potential resistance ranges which will see a sell-off in BTC. Recent on-chain information affords a map of BTC’s most necessary worth ranges.

Bitcoin Could Face Resistance At These Ranges

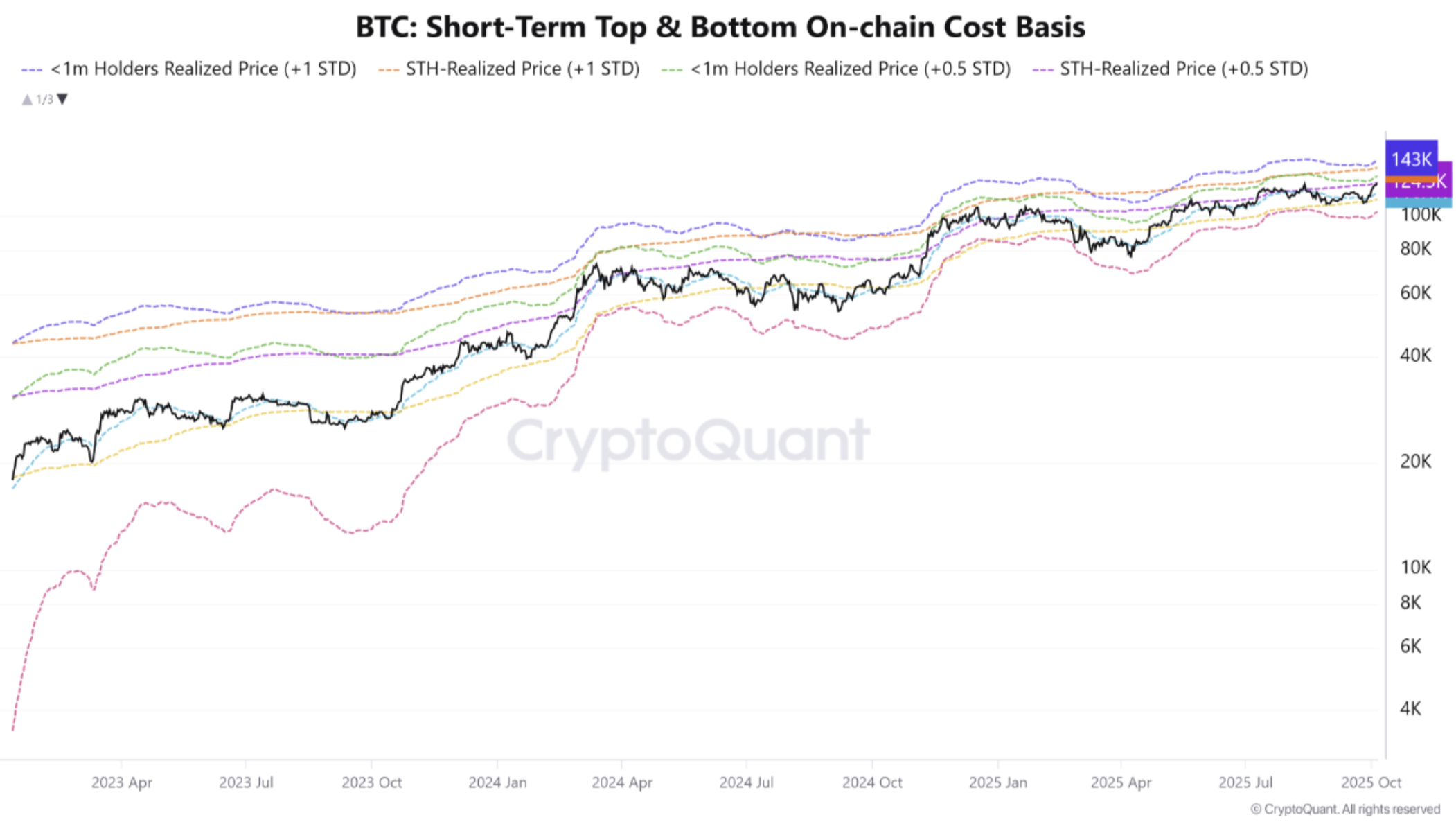

In keeping with a CryptoQuant Quicktake publish by contributor Crazzyblockk, the price foundation (Realized Value) of BTC Quick-Time period Holders (STH) offers a snapshot of necessary help and resistance zones.

Associated Studying

Notably, the STH Realized Value highlights the combination worth at which current market members acquired their BTC. This info may give analysts an concept about potential worth ranges that may affect traders’ habits to both take income or maintain their positions.

Crazzyblockk highlighted a number of worth ranges that would perform as potential profit-taking zones. As an illustration, <1 month Holders Realized Value, +1 Commonplace Deviation, hovers at $143,170.

To clarify, $143,170 is the value degree the place current patrons (holding BTC for beneath a month) would, on common, be up by about one customary deviation on their value – a zone that may set off promoting and function a near-term resistance.

Equally, the <1 month Holders Realized Value, 0.5 Commonplace Deviation, is presently round $133,239. In the meantime, the STH-Realized Value, +1 Commonplace Deviation, presently sits at $131,310.

The analyst added that the present BTC spot worth is buying and selling barely above the “pivotal mid-point” degree, which may decide the market’s subsequent short-term transfer.

As well as, the CryptoQuant contributor famous a number of key help zones that would perform as potential re-accumulation zones for BTC traders. These ranges embody $117,763, $111,963, and $103,239.

Fellow crypto analyst, Titan of Crypto, famous that whereas BTC has made a new ATH above $125,000, it should now break above the ascending channel and intention for a $130,000 goal. Failure to interrupt by means of may result in worth correction for the cryptocurrency.

Potential BTC Targets?

Whereas some analysts concern that BTC is near topping out for this market cycle, others are comparatively extra optimistic. For instance, seasoned crypto analyst Ali Martinez predicts that BTC might attain $140,000 based mostly on pricing bands.

Associated Studying

Equally, crypto analyst Alex Adler Jr. forecasted that BTC might surge as excessive as $160,000 if two key situations are met. Additional, depleting BTC reserves on crypto exchanges might hasten the digital asset’s upward worth trajectory.

Lastly, if Bitcoin follows its trajectory from the 2021 market cycle, then it may goal no less than $136,000, with an prolonged goal of $147,000. At press time, BTC trades at $122,113, down 2.2% over the previous 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com