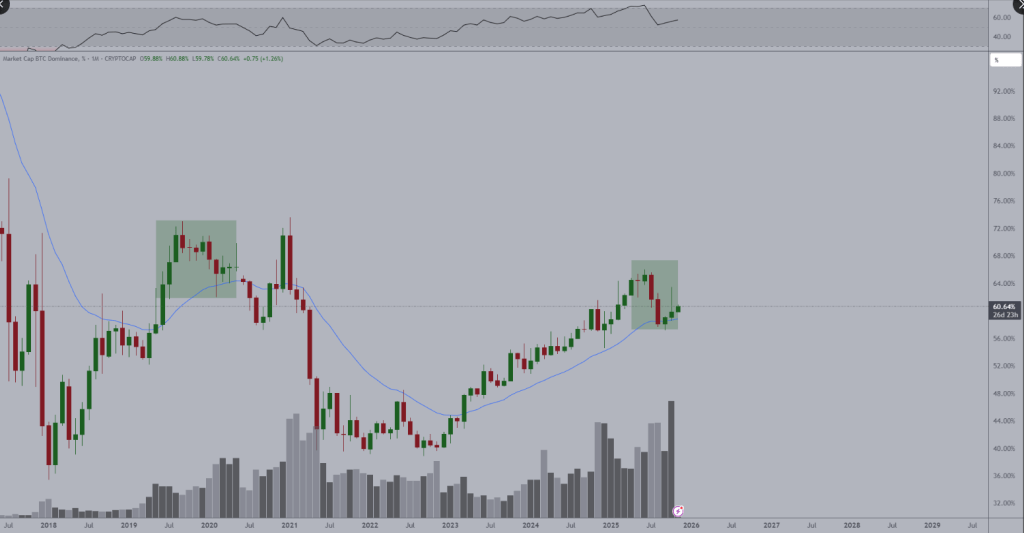

Bitcoin dominance sits at 60% and has been testing an important long-run help line. In accordance with market veteran Michaël van de Poppe, that help — the 20-month MA, close to 59% — is the sign merchants ought to watch.

He warned {that a} confirmed break below that degree may flip the market’s favor towards altcoins. Quick strikes can occur. Massive shifts observe.

Bitcoin Dominance At A Crossroads

Based mostly on stories and chart reads, The 20-month MA has been touched a number of instances just lately. In September, Bitcoin dominance briefly slipped beneath 59% earlier than bouncing again, a transfer that exhibits the index is being pushed and probed.

Van de Poppe drew a parallel to late 2019, when a long term above that shifting common finally gave approach and set the stage for an extended altcoin run. He advised followers it might be “occasion time” if the road is damaged with conviction.

The #Bitcoin dominance continues to be trending upwards, however on edge to be breaking south.

Why?

It’s mimicking This autumn 2019.

I’d wish to see a break beneath the 20-Month-to-month MA.

If that occurs, that’s occasion time. pic.twitter.com/m21WnBhKuj

— Michaël van de Poppe (@CryptoMichNL) November 4, 2025

Merchants say this check issues as a result of it isn’t only a small tug of battle. It’s a structural check that would change the place cash flows subsequent. Momentum would doubtless shift. Market habits may turn out to be extra favorable to smaller cash.

Historic Echoes From 2019

Again In September 2019, Bitcoin dominance peaked at 73% earlier than the index started a gradual slide. It examined the lengthy shifting common by February 2020, then in mid-2020 the construction modified and the drop continued till dominance hit 39% by December 2021.

Studies level to that interval as when many altcoins outperformed Bitcoin and noticed massive features. Some analysts imagine a repeat sample is feasible if the identical technical threshold fails.

Analyst Steve, from Crypto Crew College, flagged comparable chart shapes and resistance factors that got here earlier than the main altcoin rallies of 2017 and 2021.

He prompt the sample may reappear, maybe round 2026, which means an altcoin upswing may arrive later moderately than sooner.

What Merchants Are Watching

A number of clear markers are being adopted. The 20-month MA at 59.29% is one. A sustained shut beneath that degree could be the clearest technical set off.

Quantity traits and the way rapidly dominance strikes after a break can be watched carefully. As well as, analysts will watch whether or not main Bitcoin flows — similar to ETF exercise, trade balances, or massive holder strikes — change, as a result of these can pace up or decelerate an altcoin response.

Featured picture from Stronger by Science, chart from TradingView