stBTC Launch: A New Bitcoin Yield Commonplace

Botanix Labs, a Bitcoin Layer Two with EVM capabilities, not too long ago launched stBTC, a one-to-one backed bitcoin asset that redistributes transaction charges on the community to holders as yield. Customers can stake bitcoin and earn further bitcoin with out inflationary token emissions, factors applications or obligatory lockups.

Botanix, based in 2023 at Harvard by Willem Schroé, operates as a Bitcoin Layer Two protocol or sidechain just like the Liquid Community and Rootstock — however with some novel variations, together with using extra fashionable scripting instruments in Bitcoin, the sharing of community charge income with stakeholders and a federation of 16 node operators as its custody basis. The mainnet has been reside for 2 months and has processed 10 million transactions with 100% uptime for peg-ins and peg-outs, in accordance with Schroé.

The place Does the Yield Come From?

Crucial query on the subject of any yield-bearing product is: the place does the yield come from? If you happen to can’t get a simple reply to that query, then you’re the yield.

Because the crypto trade matures from the Ponzi-like period of FTX, BlockFi and Celsius, which contributed to the 2022 crash, new, extra secure types of yield are rising throughout the trade. Money App, for instance, reported that it’s incomes over 9% APR on Lightning Community charges earlier this 12 months, a yield that may solely be earned by facilitating extra environment friendly routing of funds all through the Bitcoin community.

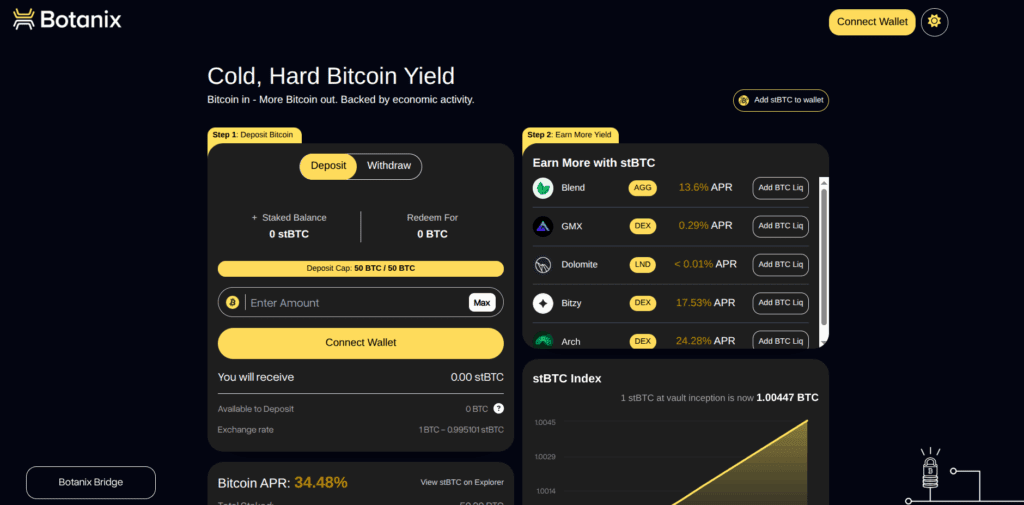

Taking the same, conservative strategy to yield, Botanix has arrange its new stBTC token to earn 50% of all transaction charges paid on the Botanix community, paying its stakeholders from the financial success of its ecosystem and integrations throughout the trade. Immediately, stBTC boasts a 34% yearly APR, although Schroé defined that that is due to an accumulation of undistributed rewards from its prelaunch; he expects the APR on stBTC to stabilize round 5-6% sooner or later.

In response to Schroé, the stBTC token contract, which is open supply and has been audited by Spearbit and Sigma Prime, follows the EIP-4626 customary. The stBTC tokens must be backed one-to-one and visual on-chain. Botanix has a step-by-step information on how one can confirm their proof of reserves.

Customers can deposit BTC into the Botanix federation through the Botanix bridge and declare the equal quantity of Botanix Layer Two bitcoin through an EVM-compatible pockets like Metamask. The terminology will get a bit complicated because the Botanix token has the ticker “BTC,” not like different considerably comparable merchandise (e.g., WBTC) that wrap bitcoin and bridge it to different blockchains. However, the Botanix BTC can transfer throughout the crypto EVM-compatible ecosystem as another comparable asset. After getting Botanix BTC, you possibly can stake it on the Botanix yield web page, which converts it into stBTC and begins incomes that candy yield. You may as well purchase stBTC with BTC at bitzy.app/swap.

Staking provides proof-of-stake model safety to the Botanix community and is more likely to unlock different advantages sooner or later, in addition to present customers with the ability to vote on necessary community occasions.

Get Paid to Take out a Mortgage??

The invention of a yield-bearing BTC-denominated asset shouldn’t be understated. Most of tradfi is chasing after Saylor’s inventory (NASDAQ: MSTR) as a result of it successfully produces yield. Having property “work” for you is a cornerstone of conventional finance and the funding fashions there derived. An excellent instance of what such a monetary product unlocks is the power to take out a mortgage in opposition to your bitcoin and have your bitcoin enable you repay the mortgage — just like the way you would possibly take out a mortgage on a rental house.

For instance, customers can at present take out USDC loans in opposition to their stBTC for as little as 0.6% APR through the Stargate defi protocol. You may check this out by logging into Dolomite together with your Botanix-connected Metamask pockets, for instance, and see USDC.e with a free-floating common APR of below 1%. That means your stBTC might make the USDC.e curiosity funds and nonetheless develop your complete stBTC steadiness. Bear in mind this seems to be a free-floating moderately than fastened rate of interest, so be certain that to know the dynamics of the mortgage earlier than making a monetary resolution.

In response to a latest Botanix press launch, there aren’t any lock instances, and customers can swap out and withdraw their funds at any time, settling their trades.

The Person Expertise

The consumer expertise and design of the Botanix community is similar to that of different EVM chains and defi protocols, with crypto-to-crypto swap bins, utilizing the identical terminology many crypto customers are acquainted with — akin to bridges and yield. The truth that the protocol permits customers to place bitcoin to work with out placing the underlying asset at nice threat is a significant achievement, though the product remains to be in its early phases.

The Yield and Bridge web site designs really feel clunky in comparison with the smooth design of different defi portals, akin to Uniswap, which most customers are doubtless acquainted with. And it could be complicated for customers at first as they wrap their heads across the tickers. The Botanix BTC ought to most likely observe conference and never copy the bottom asset ticker, choosing one thing like bBTC as an alternative, as Liquid did with L-BTC and Rootstock with rBTC.

Finally, Botanix is rapidly bringing Bitcoin into the world of programmable, decentralized finance and would possibly simply succeed at bridging it with the creator crypto ecosystem. Its product design will doubtless enhance simply as quick, maybe taking us a step nearer to having a Bitcoin financial institution in our on-line world, with all of the monetary providers the general public expects.