The Bitcoin market has witnessed a big downturn, with costs plummeting beneath the $66,000 mark. This abrupt -5.6% value motion may be attributed to 4 main elements: a protracted liquidation occasion, a rising US Greenback Index (DXY), profit-taking by buyers, and spot Bitcoin ETF outflows.

#1 Lengthy Liquidations

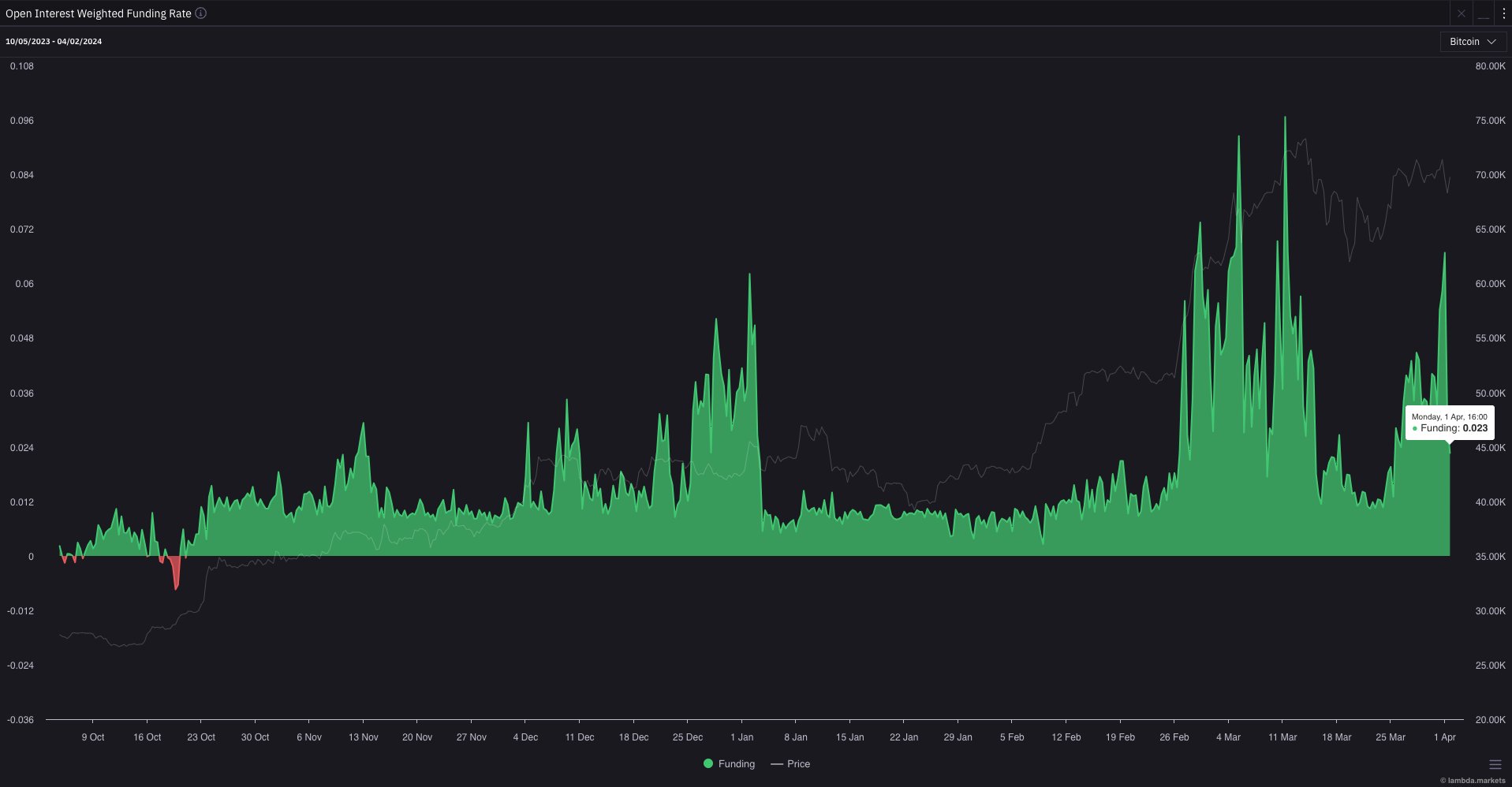

The principle power resulting in at the moment’s downturn in Bitcoin’s value was a big deleveraging occasion characterised by an unusually excessive stage of lengthy liquidations. Earlier than the downturn, Bitcoin’s Open Curiosity (OI) Weighted Funding Fee was unusually excessive, indicating that leveraged merchants have been paying premiums to keep up lengthy positions in anticipation of future value will increase. This optimism, nevertheless, made the market susceptible to sudden corrections.

Crypto analyst Ted, often known as @tedtalksmacro on X (previously Twitter), remarked, “As we speak was the biggest lengthy liquidation occasion for the reason that nineteenth March.” He additional elaborated on the results of this correction by noting, “Good reset in general positioning at the moment, even on only a 5% drop decrease for Bitcoin… Subsequent leg greater is loading I feel.” This remark highlights the severity of the liquidations and suggests a possible rebound or restructuring throughout the market because it stabilizes.

Coinglass information reveals that during the last 24 hours, 120,569 merchants have been liquidated, amounting to $395.53 million in complete liquidations, with $311.97 million being lengthy positions. Bitcoin-specific lengthy liquidations have been at $87.42 million.

#2 DXY Places Stress On Bitcoin

With 105.037, the DXY closed at its highest stage since November yesterday, evidencing a strengthening US greenback. Given Bitcoin’s inverse correlation with the DXY, the stronger greenback might need shifted investor choice in the direction of safer belongings, shifting away from riskier investments like Bitcoin.

This correlation stems from the worldwide market’s danger sentiment, the place a rising DXY typically alerts a shift in the direction of safer investments, detracting from riskier belongings like Bitcoin. Nonetheless, analyst Coosh Alemzadeh supplied a counter perspective, suggesting by a Wyckoff redistribution schema that regardless of the DXY’s current uptick, the subsequent transfer may favor danger belongings, probably together with Bitcoin.

#DXY ⬆️4 weeks in a row/broke out of its downtrend so consensus is {that a} new uptrend is beginning but danger belongings are consolidating at ATH

Subsequent transfer ⬆️in danger belongings on deck IMO pic.twitter.com/u6ORa76vkj

— “Coosh” Alemzadeh (@AlemzadehC) April 2, 2024

#3 Revenue Taking By Traders

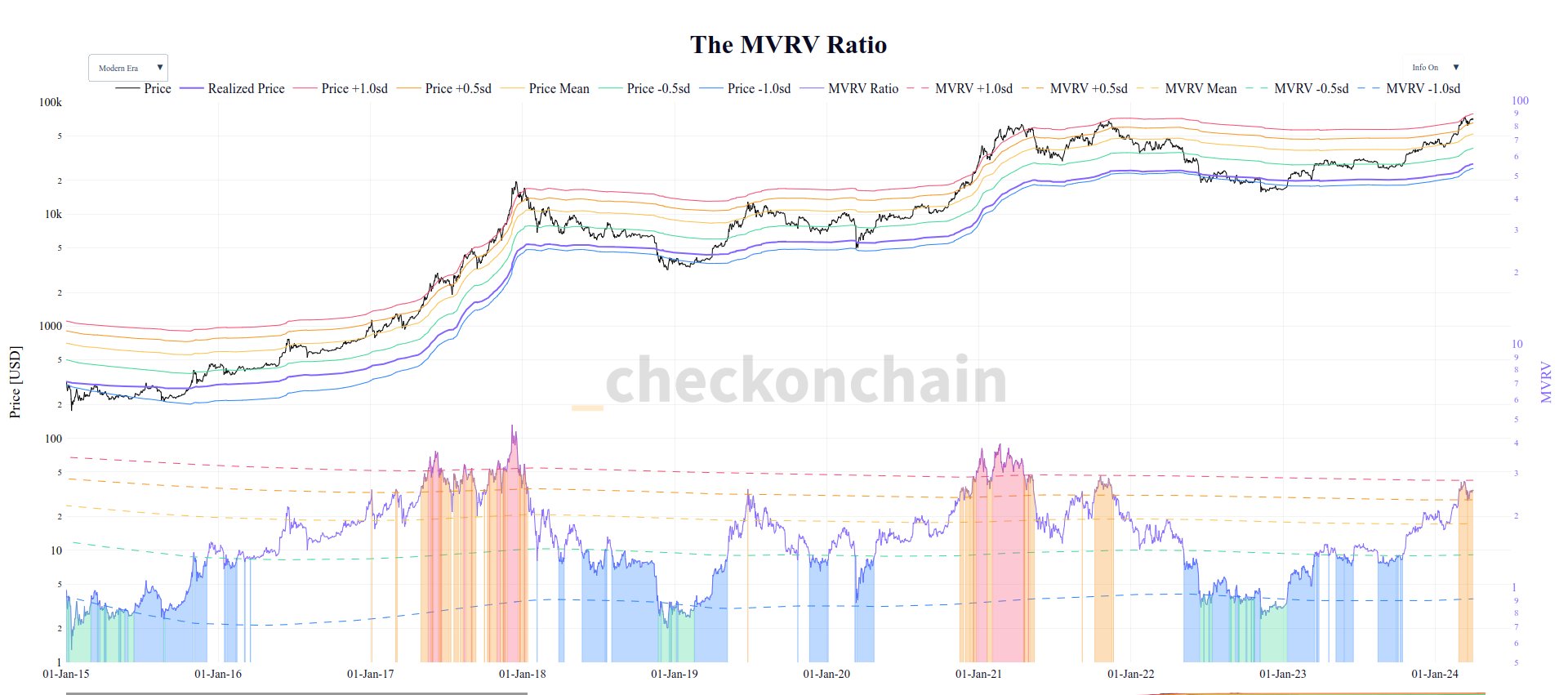

Revenue-taking by buyers has additionally performed a big function within the current value changes. The Bitcoin on-chain evaluation platform Checkonchain reported a spike in profit-taking actions.

Glassnode’s lead on-chain analyst, Checkmatey, shared insights by way of X, stating, “The traditional Bitcoin MVRV Ratio hits circumstances we characterize as ‘heated, however not but overcooked’. MVRV = above +0.5sd however beneath +1sd. This means that the typical BTC holder is sitting on a big unrealized revenue, prompting an uptick in spending.”

The profit-taking coincided with Bitcoin reaching a peak of $73,000, marking a cycle excessive in revenue realization with over 352,000 BTC bought for revenue. This promoting habits is typical in bull markets however performs an important function in creating resistance ranges at native value tops.

#4 Bitcoin ETF Outflows

Lastly, the market witnessed notable outflows from Bitcoin ETFs, marking a reversal from final week’s substantial inflows. The overall outflows amounted to $85.7 million in a single day, with Grayscale’s GBTC experiencing probably the most vital withdrawal of $302 million.

In the meantime, Blackrock’s IBIT and Constancy’s FBTC reported constructive inflows, totaling $165.9 million and $44 million, respectively. Commenting on this, WhalePanda remarked, “General destructive day however not as destructive as the value implied. Closing of Q1 so taking revenue right here is sensible. Some fuckery round [the] new quarter and halving is to be anticipated.”

At press time, BTC traded at $66,647.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site solely at your personal danger.