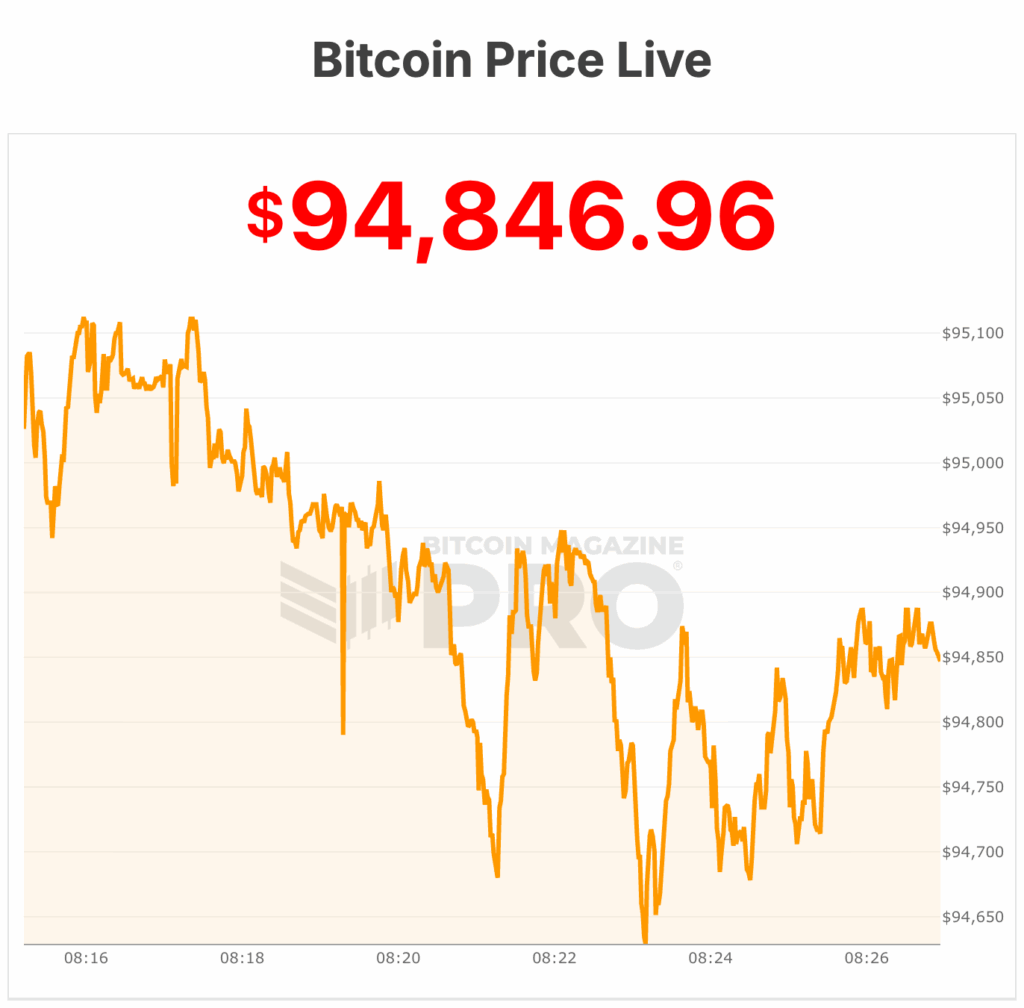

Bitcoin value fell sharply at present, sliding from an intraday excessive of $104,000 to $94,480, wiping out earlier positive factors and marking a decisive breakdown in value motion.

Twelve hours in the past, the Bitcoin value hit above $100,000 after which constantly bled down from the higher $101,000s to lows of $94,480.

Ethereum dropped under $3,100 at instances and crypto shares like Coinbase ($COIN) and Technique ($MSTR) are buying and selling within the crimson in pre-market buying and selling.

Additionally, the Bitcoin Concern and Greed Index has plunged to a brand new “Excessive Concern” low, signaling deep market anxiousness at the same time as long-term holders keep the course.

The worth dropped to those ranges after weeks of weakening demand, heavy long-term holder sell-offs, and protracted outflows from spot Bitcoin ETFs. Greater than 815,000 BTC — almost $79 billion — have been offered by long-term holders in 30 days, whereas ETFs noticed a whole bunch of tens of millions in each day outflows, draining liquidity on the worst second.

Futures funding have turned damaging, roughly $550 million in positions have been liquidated as of November 13, and choices merchants rushed to purchase protecting places forward of a $4 billion expiry, reinforcing bearish momentum.

Macro stress is including gas: tech shares are sliding, key U.S. financial information is delayed, and uncertainty across the Federal Reserve’s fee path is elevating threat aversion.

Bitcoin has damaged main technical helps, together with its 200-day shifting common and key Fibonacci ranges, with analysts warning {that a} decisive drop under $97,000 might open the trail towards $92,000–$74,000.

In response to Bitcoin Journal Professional information, the final time Bitcoin value was close to these ranges (sub $94,000) was in early Could.

Bitcoin value: Who’s promoting Bitcoin?

One potential purpose why the bitcoin value is dropping is long-term holders unloading at report ranges. Knowledge from CryptoQuant reveals they’ve offered about 815,000 BTC in 30 days — probably the most since early 2024 — whereas spot and ETF demand weaken.

Institutional shopping for has additionally dropped under each day mining provide, intensifying promote stress. Costs hover close to the essential 365-day shifting common round $102,000, and failure to rebound might set off deeper losses, in line with Bitcoin Journal Professional evaluation.

Analysts at Bitfinex say the present bitcoin pullback mirrors previous mid-cycle retracements, with the drop from October’s excessive matching the standard 22% drawdown seen all through the 2023–2025 bull market.

“It is very important notice too, that even on the $100,000 stage, roughly 72 % of the full BTC provide stays in revenue,” Bitfinex analysts wrote to Bitcoin Journal yesterday. They consider a brief reduction rally is probably going however {that a} sustained restoration would require contemporary demand.

In response to The Block, JPMorgan analysts say bitcoin value’s present estimated manufacturing value of $94,000 acts as a historic value ground, suggesting the bitcoin value is close to the underside now.

The analysts consider that rising community problem has pushed manufacturing prices larger, preserving bitcoin’s price-to-cost ratio close to historic lows. The analysts keep a daring 6–12 month upside projection of about $170,000.

Giant bitcoin value swings aren’t pushed by small retail traders—they’re pushed by whales, establishments, and leveraged market buildings. Whale wallets holding 1000’s of BTC can transfer extra quantity than whole exchanges, and even a single switch can shift sentiment in low-liquidity situations.

In the meantime, ETF flows, hedge funds, and company treasuries now dominate each day market route, with billions in inflows or outflows dictating whether or not Bitcoin rallies or plunges.

All this comes because the U.S. authorities has reopened after a report 43-day shutdown, the longest in historical past, following President Trump’s signing of a funding invoice late Wednesday.

Beneath the invoice Trump signed Wednesday night time, funding for many federal businesses will run out at midnight on Jan. 30.

Whereas federal operations are resuming, restoration might be gradual. On the time of writing, Bitcoin’s value is $94,470.