Bitcoin continues to commerce across the $110,000 degree, unable to reclaim increased floor after weeks of unstable worth motion. The market remains to be digesting the affect of the October 10 flash crash, which erased billions in open curiosity and despatched shockwaves throughout altcoins. Regardless of a gradual restoration in on-chain metrics and institutional inflows, sentiment stays fragile, with merchants hesitant to take new lengthy positions.

Associated Studying

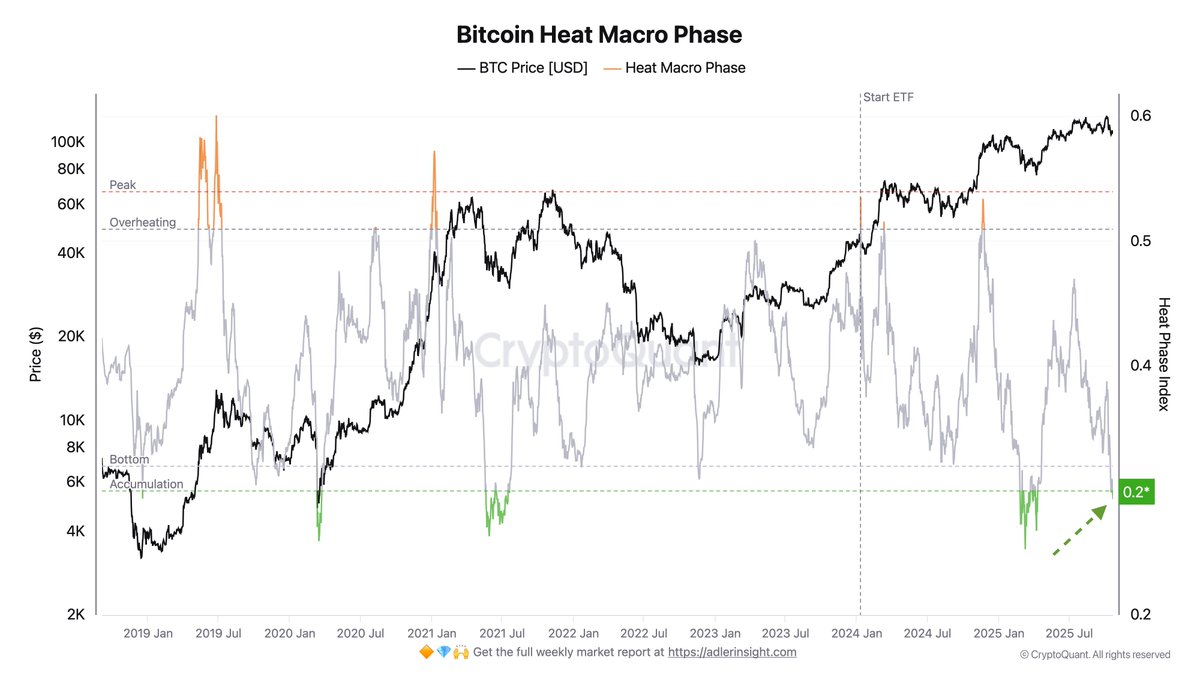

In line with high analyst Axel Adler, the Bitcoin Warmth Macro Part — a key indicator used to measure speculative strain and market overheating — has now entered the Backside or Accumulation zone. This indicators a cooling-off interval in hypothesis, suggesting that short-term buying and selling exercise is fading whereas long-term accumulation quietly resumes.

Nonetheless, Adler warns that this section requires stability to play out successfully. For Bitcoin to provoke a sustainable rally, volatility should proceed to lower, and no main macro shocks — corresponding to a surge in gold or US bond demand — ought to disrupt the present equilibrium. The approaching weeks might outline whether or not BTC consolidates or slips into renewed risk-off territory.

Bitcoin Accumulation Alerts Power, However Stability Is Key

Axel Adler explains that when the Bitcoin Warmth Macro Part drops into the Backside or Accumulation zone, it typically represents a pivotal second inside a broader bull market. Traditionally, such readings coincide with durations the place speculative strain fades, leverage resets, and market individuals start quietly accumulating positions forward of the following progress section. These zones have a tendency to look after main corrections, when weak arms exit and the market regains structural steadiness — a mandatory situation for sustained restoration.

This section displays a shift from emotional buying and selling to strategic accumulation. Throughout these phases, on-chain exercise usually reveals elevated pockets balances amongst long-term holders, whereas short-term merchants cut back publicity. Nonetheless, for this accumulation to translate right into a significant rally, one crucial situation should be met: volatility should decline. Excessive volatility implies uncertainty and danger aversion, discouraging new capital inflows. A gradual cooling of volatility creates the steadiness wanted for market confidence to rebuild.

The analyst emphasizes that Bitcoin’s present setup requires at the least a brief stretch — roughly every week — with out main adverse international catalysts. Exterior shocks corresponding to surging bond yields, geopolitical pressure, or renewed macro risk-off sentiment may simply disrupt the delicate restoration course of.

In essence, the market seems to be in a fragile steadiness: the speculative cycle has cooled sufficient to permit accumulation, however stability stays the lacking piece for momentum to return. If volatility continues to say no and macro circumstances maintain regular, this accumulation section may function the muse for Bitcoin’s subsequent main rally, mirroring earlier transition factors seen in previous bull cycles.