The bitcoin worth has been chopping sideways for months, however liquidity knowledge that has tracked this cycle virtually completely is hinting that would quickly change. International M2, stablecoin provide, and Gold correlations all recommend BTC is constructing strain for its subsequent breakout.

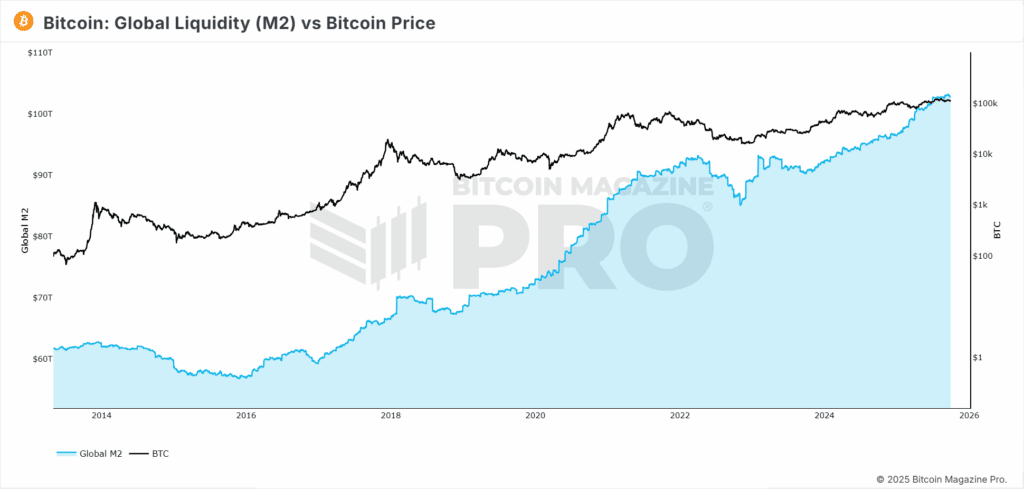

International M2 and the Bitcoin Value

The international M2 cash provide has traditionally proven a powerful hyperlink with Bitcoin cycles. Growth tends to coincide with bull markets, whereas contraction or stagnation has lined up with durations of chop and draw back. Over the previous few months, International M2 progress has slowed, and BTC has mirrored that with stagnant worth motion after hitting an all-time excessive close to $124,000. When International M2 accelerates once more, it has persistently flowed into speculative belongings, with Bitcoin one of many greatest beneficiaries.

Stablecoin Provide and Bitcoin Value Developments

Stablecoin provide throughout the crypto ecosystem has confirmed to be an excellent stronger indicator than International M2. Correlations with BTC have reached above 95%, and on a year-on-year foundation the alignment stays close to excellent. When the speed of change in stablecoin provide crosses above its 90-day shifting common, it has traditionally signaled a super interval to build up bitcoin forward of robust rallies. The other has held true as effectively, with contractions lining up with durations of weak point.

Gold Correlations and the Bitcoin Value

All through 2025, Bitcoin has most carefully tracked Gold with a few 40-day lag, displaying a correlation of over 92%. Gold’s relentless push to new all-time highs this 12 months has offered a tailwind for BTC, which regularly follows as buyers rotate into tougher and extra speculative belongings. If this relationship holds, BTC may see a breakout towards $150,000 in early November.

US Greenback Energy vs. Bitcoin Value

Whereas liquidity and Gold correlations have leaned bullish, the US Greenback Energy Index has been displaying the alternative. Bitcoin sometimes trades inversely to the greenback, and the DXY has bounced in latest weeks. On a year-on-year foundation, the inverse correlation stands round minus 40%. This means some near-term chop or draw back strain may stay, even when the bigger development favors larger costs.

The confluence of International M2, stablecoin provide, and Gold correlations all level towards BTC being on the verge of a significant breakout, with This autumn seasonality including additional weight to the bullish case. Nonetheless, conflicting indicators from the greenback remind us that sideways buying and selling and false begins are a part of each cycle. The bitcoin worth has a historical past of lengthy consolidations earlier than explosive strikes, and present knowledge suggests we could also be proper on the sting of 1 now.

For a extra in-depth look into this subject, watch our most up-to-date YouTube video right here:

Bitcoin Is PERFECTLY Following THIS Knowledge Level

For deeper knowledge, charts, {and professional} insights into bitcoin worth developments, go to BitcoinMagazinePro.com.

Subscribe to Bitcoin Journal Professional on YouTube for extra skilled market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding selections.