Bitcoin value has began to indicate clear indicators of weak point, and the current transfer again under six figures has compelled a reassessment of the near-term outlook. With a number of vital technical and on-chain ranges now misplaced, I’ve recalibrated my base case in order that the chance of retesting new all-time highs within the coming weeks has fallen under 50%. That may change rapidly if main ranges are reclaimed, however till then, the circumstances resemble a market shifting away from trending power and towards a deeper corrective section.

Bitcoin Value: Is “Shopping for The Dip” Nonetheless the Proper Transfer?

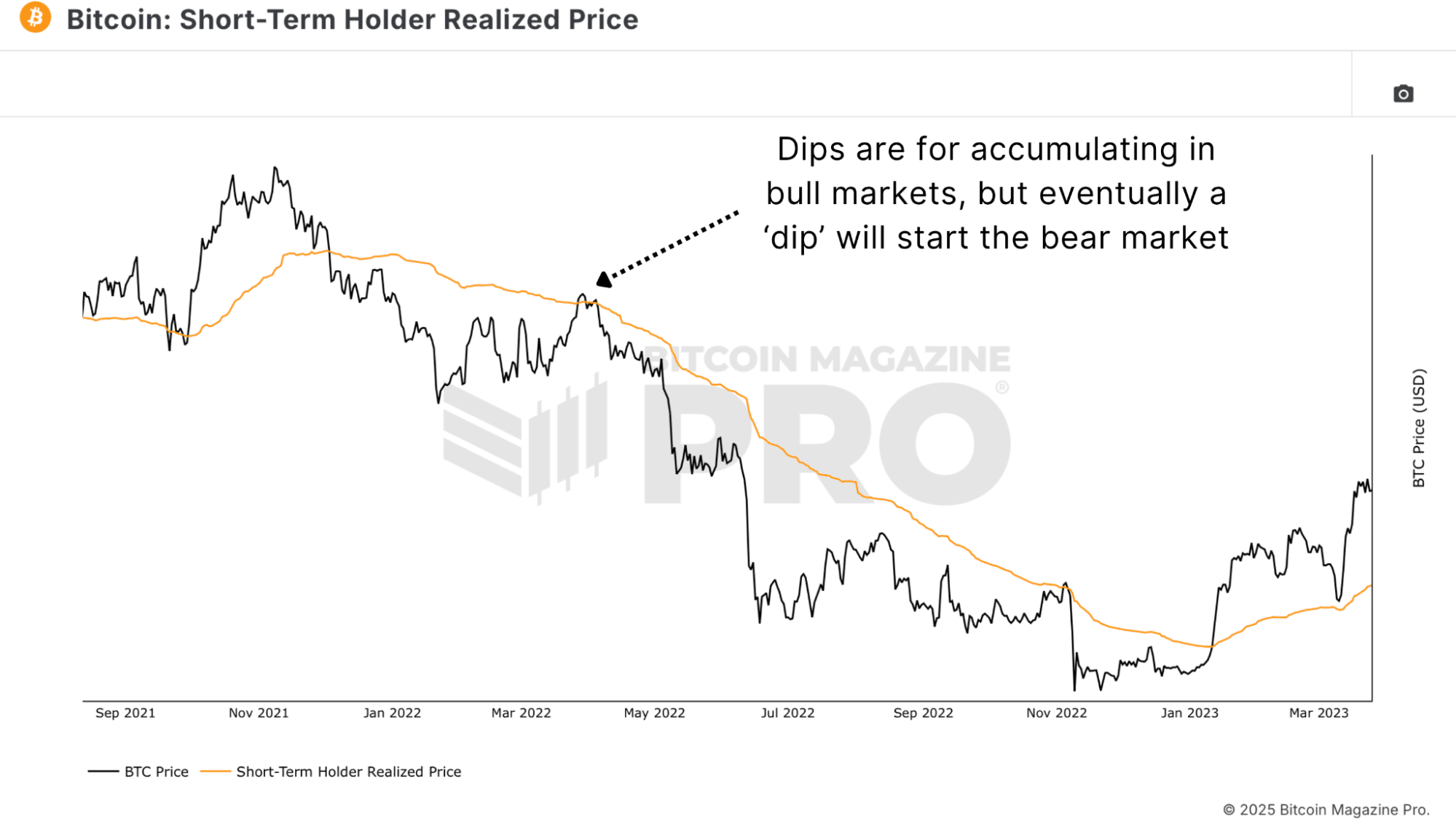

Bitcoin is already in a sizeable pullback, however shopping for each decline isn’t all the time the optimum method outdoors of a confirmed bull development. In a bear-market surroundings, what seem like engaging dips can nonetheless result in considerably decrease costs. Quick-term rallies and sharp retracements are typical in downtrending markets, so reacting to information somewhat than pre-emptively predicting a backside turns into much more vital.

This sample of a number of dips is clear after we analyze the Quick-Time period Holder Realized Value chart over the last cycle. It’s also clear to see how this metric acted as a key resistance all through this section, with sustained restoration solely skilled as soon as BTC reclaimed STH Realized Value ranges.

There’s one caveat: if value meaningfully reclaims key ranges, your entire image shifts. That’s why a small allocation on this dip could make sense, whereas holding off on additional shopping for till we see deeper macro confluence is a extra defensive method.

Black Friday Sale: 40% Off Annual Plans!

The BEST saving of the yr is right here. Get 40% off all our annual plans.

Unlock +100 Bitcoin charts.

- Entry Indicator alerts – so that you by no means miss a factor.

- Personal TradingView indicators of your favourite Bitcoin charts.

- Members-only Stories and Insights.

- Many new charts and options coming quickly.

All for simply $17/month with the Black Friday deal. That is our largest sale all yr!

Bitcoin Value: Key Ranges You Should Watch Proper Now

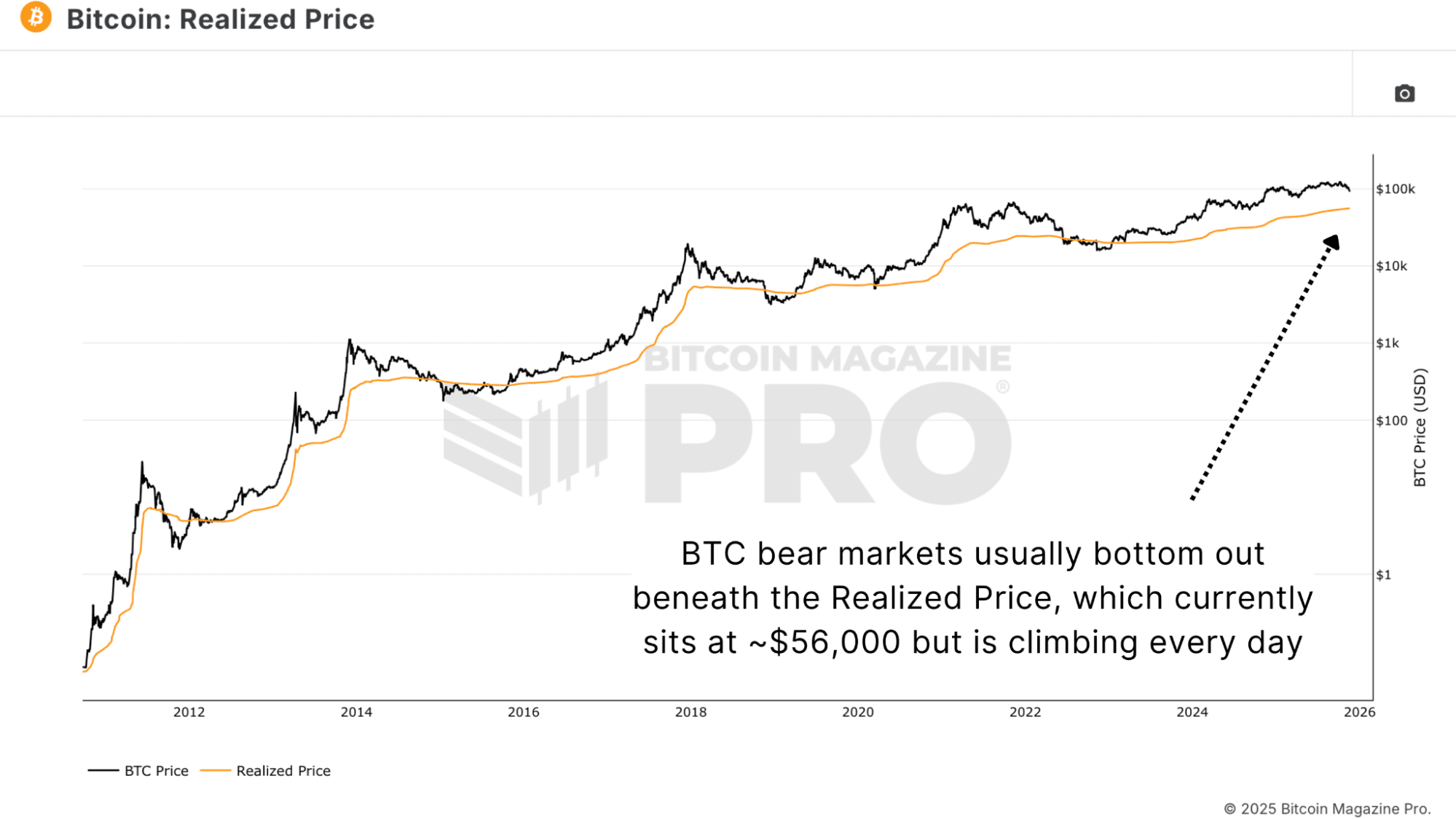

The MVRV Z-Rating and the Bitcoin Realized Value give a clearer sense of the place the broader market’s value foundation sits. The realized value foundation of the community at present clusters across the mid-$50,000s, however this determine continues rising every day.

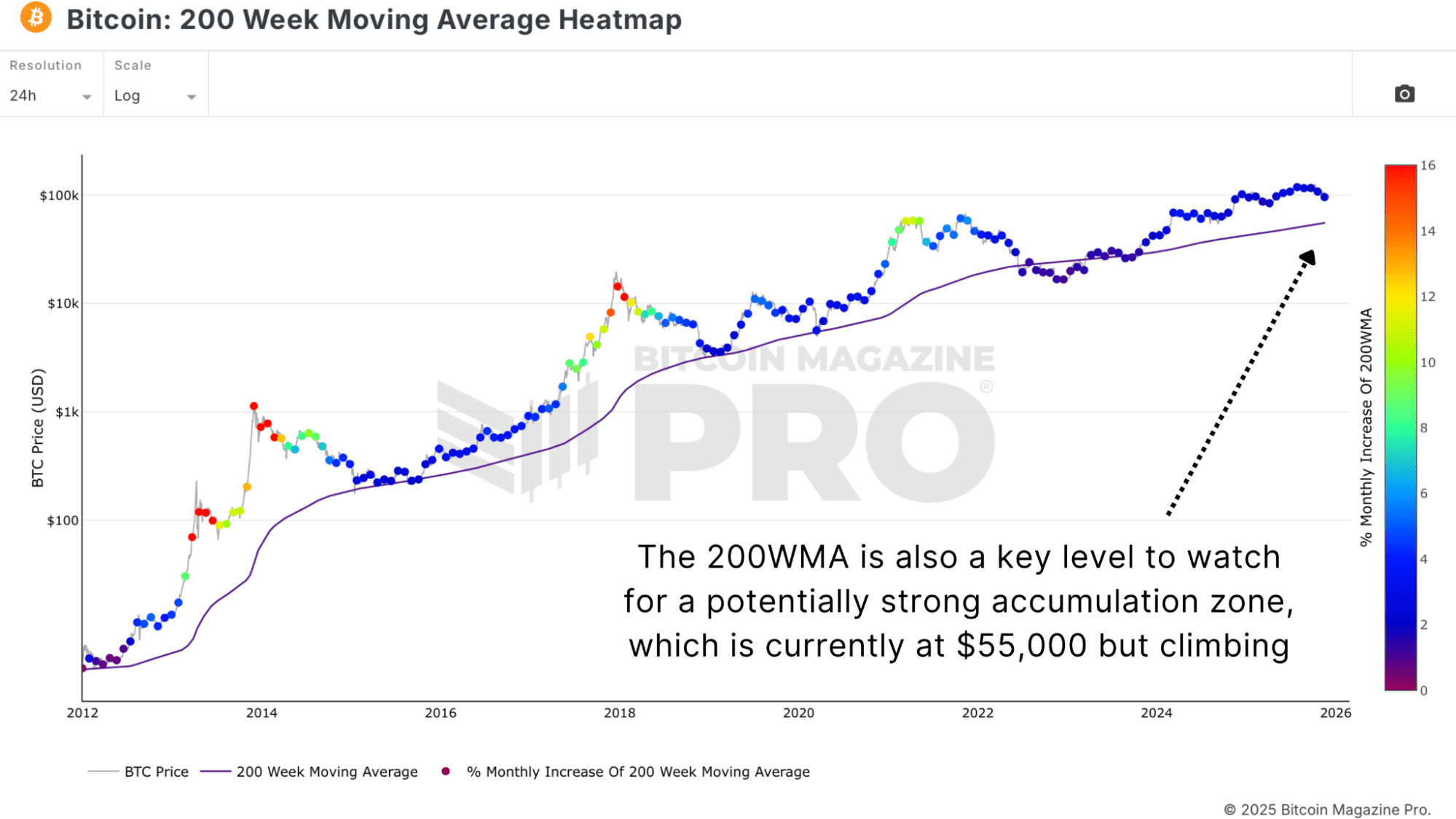

The same narrative emerges from the 200-Week Shifting Common, as this additionally at present sits within the mid-$50,000. Traditionally, factors the place this metric meets value have offered robust long-term accumulation alternatives.

These ranges rise slowly every day, which means a possible backside might kind at $60,000, $65,000, or larger, relying on how lengthy Bitcoin spends trending downward. The vital level is that worth tends to emerge when spot value trades near the common historic value of the community, and confluence is supplied from key ranges of purchase help.

Bitcoin Value: What Provide & Demand Alerts Are Actually Saying

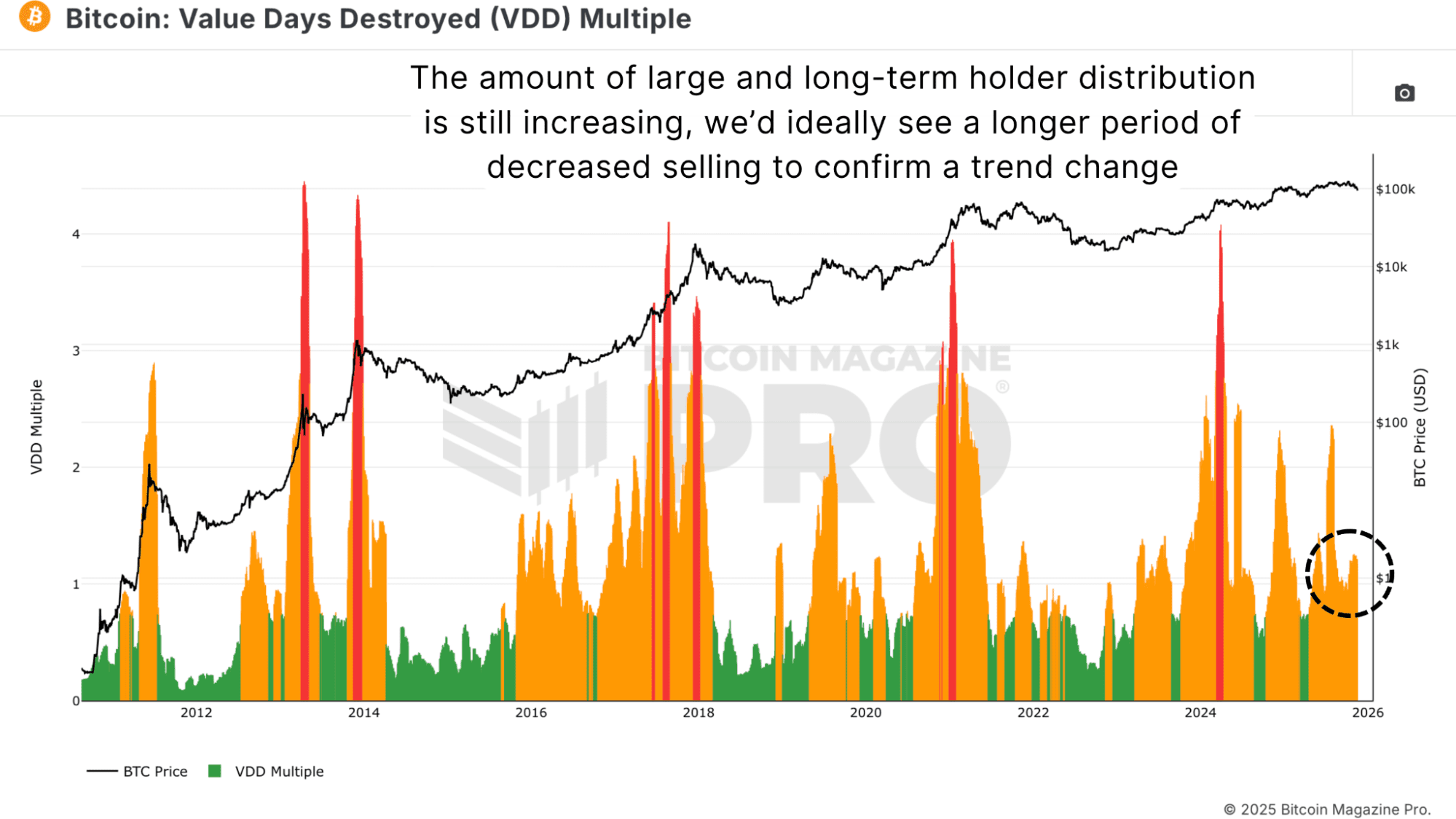

Worth Days Destroyed (VDD) A number of stays an vital metric in figuring out stress factors amongst long-term and skilled holders. Very low readings counsel giant, previous cash usually are not shifting, which has usually aligned with market bottoms. A pointy spike, nevertheless, can point out capitulation strain, which regularly accompanies or precedes important market turning factors.

Proper now, the metric continues rising as value falls, suggesting many holders are distributing into weak point. That’s not attribute of a cycle backside, the place compelled promoting is often excessive and compressed into a brief window. At this stage, the market nonetheless seems to be unwinding somewhat than exhausting. Alongside this, Lengthy-Time period Holder Provide has been in a downtrend. Ideally, this stabilises and begins to extend once more earlier than calling any main backside, as bottoms kind when essentially the most affected person members start holding, not exiting.

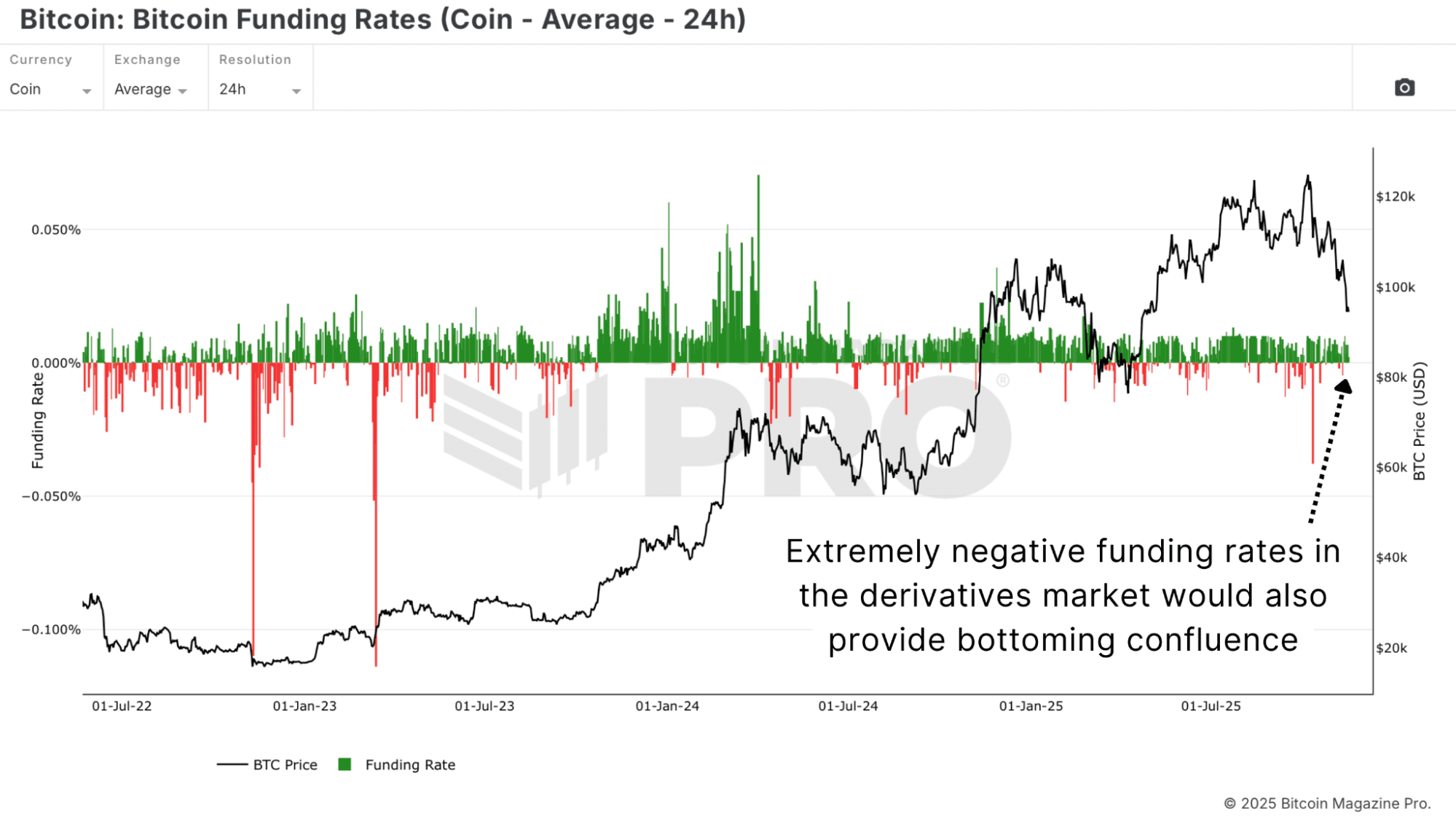

Bitcoin Value: What Funding Charges Reveal About Capitulation (Or Lack Thereof)

Durations of peak worry have a tendency to indicate up clearly by heavy quick positioning, destructive funding as proven within the Bitcoin Funding Charges, and enormous realized losses. These circumstances sign that weaker palms have capitulated, and stronger palms are absorbing that offer.

The market has not but proven the signature panic promoting and shorting usually related to main cyclical lows. With out stress in derivatives and with no rush of loss-taking, it’s tough to argue that the market has totally flushed out.

Bitcoin Value: The Precise Ranges That Should Be Reclaimed to Kill the Bear Case

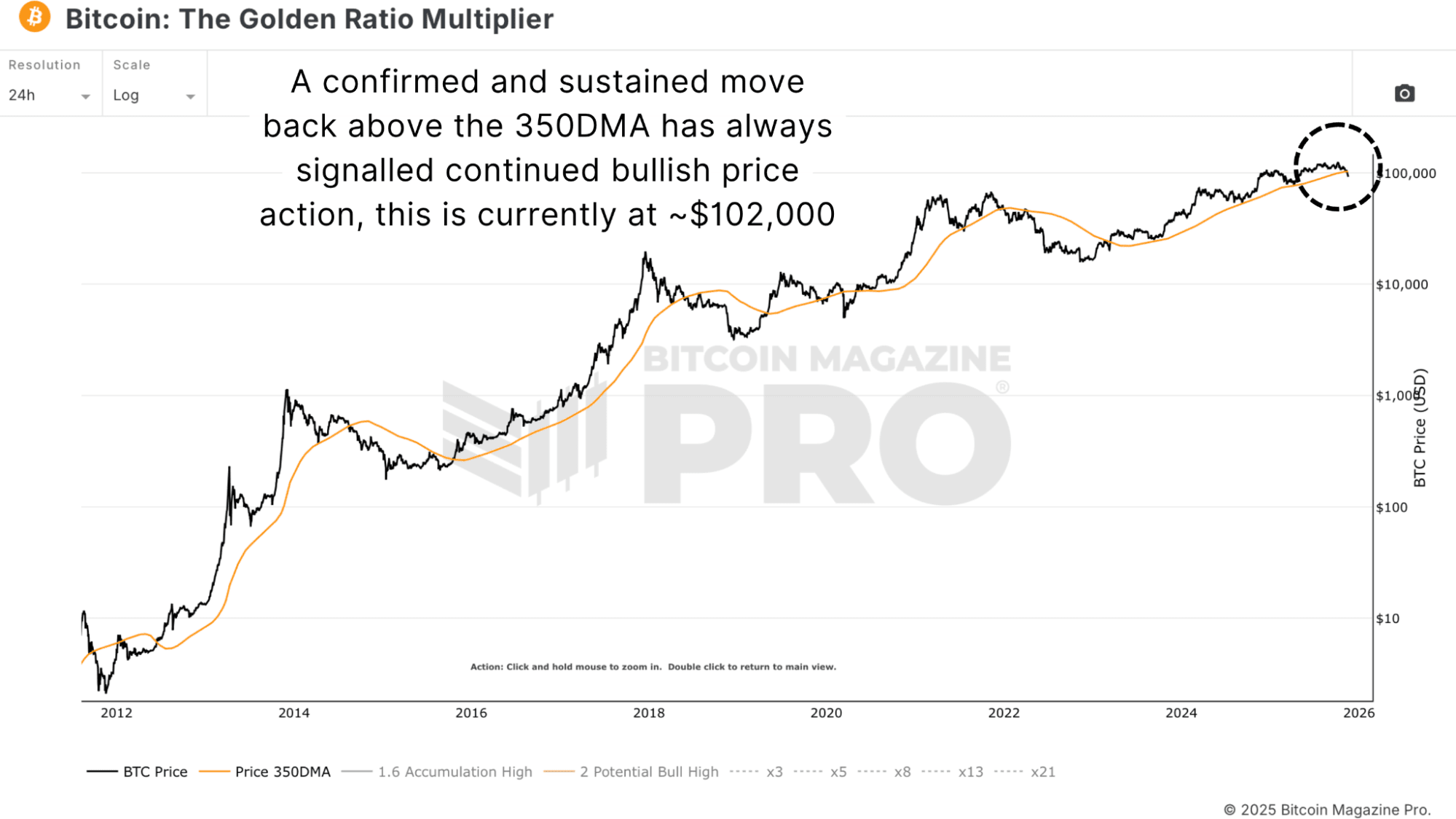

Suppose the bearish state of affairs is improper, which in fact can be the popular end result. In that case, Bitcoin wants to start reclaiming key structural ranges, together with the $100,000 psychological zone, the Quick-Time period Holder Realized Value, and the 350-day shifting common as depicted within the Golden Ratio Multiplier chart.

Short-term wicks or single-day closes usually are not sufficient. Sustained closes above these ranges, together with power in danger property globally, would counsel the development is shifting. However till that occurs, the info leans cautious.

Bitcoin Value Outlook: Ultimate Ideas on Dip vs. New Bear Market

Since breaking under a number of vital ranges, the outlook has turn out to be extra defensive. There’s no structural weak point in Bitcoin’s long-term fundamentals, however the short-term market construction doesn’t resemble a wholesome bull development.

For now, the really helpful technique consists of not shopping for at each dip, ready for confluence earlier than heavy scaling in, respecting macro circumstances and ratio traits, and solely turning aggressive as soon as the market proves power. Most traders by no means determine the precise prime or backside; the aim is to place close to areas of excessive chance with sufficient affirmation to keep away from months of pointless drawdown.

For a extra in-depth look into this matter, watch our most up-to-date YouTube video right here: My Bitcoin Technique Going Ahead

For deeper information, charts, {and professional} insights into bitcoin value traits, go to BitcoinMagazinePro.com. Subscribe to Bitcoin Journal Professional on YouTube for extra knowledgeable market evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your personal analysis earlier than making any funding choices.