The state of Bitcoin (BTC) worth motion throughout a number of time frames has analysts on the fringe of their seats. As of February 7, numerous technical formations counsel that the main crypto seems poised for a important breakout from the present consolidation.

Is Bitcoin Getting ready For A Huge Transfer?

Taking to X, Mags thinks Bitcoin is in for a “large transfer,” contemplating the candlestick association within the weekly chart. The analyst notes that costs have been transferring horizontally up to now 9 weeks, falling throughout the anticipated vary.

The Bitcoin market has ranged between 8 and 30 weeks up to now. Thus far, the present consolidation has lasted for 9 weeks. Amid this, Bitcoin costs have examined each side of the vary with notable “fake-outs.”

In gentle of the present state of affairs within the Bitcoin market, Mags is assured that the extended consolidation means that the coin, guided by historical past, might edge increased.

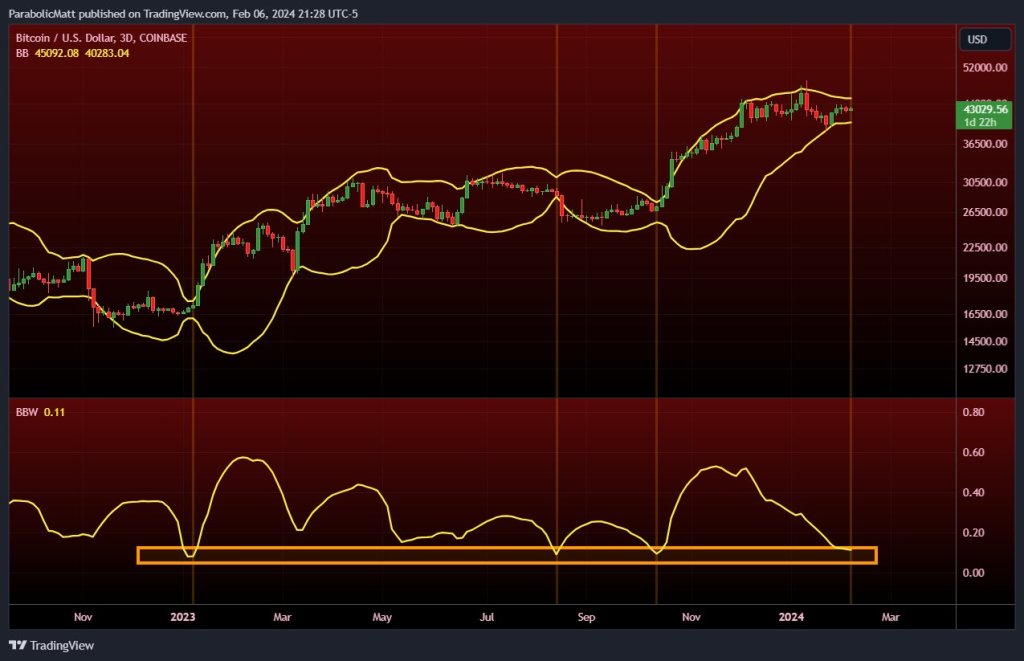

Past the ranging market, one other analyst notes that the Bitcoin 3-day Bollinger Bands, a technical indicator that measures volatility, is narrowing. The squeeze, the dealer notes, is at historic ranges, typically adopted by a breakout. Nevertheless, as it’s, how costs will evolve within the weeks and months forward stays unsure.

Including to the intrigue, Jason Goepfert on X factors out that the S&P 500, a inventory market index, is presently inside 0.35% of its 3-year excessive. The uptrend is evident though lower than half of all shares constituting the index are buying and selling above their 10-day transferring common.

On the similar time, lower than 60% are above their 50-day transferring common, and fewer than 70% are above their 200-day transferring common. This uncommon confluence means that the monetary market could possibly be at a important turning level, probably impacting crypto.

Eyes On Spot ETF Issuers And United States Federal Reserve

Solely time will inform whether or not Bitcoin will rally or tank from spot charges. Nevertheless, what’s evident is that the Bitcoin uptrend stays clear, with fundamentals aligning to help optimistic bulls. As an instance, spot Bitcoin ETF issuers are shopping for extra cash from the market. On the similar time, the thrill across the upcoming Bitcoin halving occasion is including gasoline to the optimism.

The broader market can be watching the US Federal Reserve. Market consensus is that the central financial institution will slash rates of interest in March 2024 and embark on quantitative easing. With extra money circulating, some will discover their method to Bitcoin, driving costs to file highs of $69,000 or past within the coming months.