Bitcoin is at the moment buying and selling under $92,000, and the market is exhibiting clear indicators of exhaustion as promoting stress intensifies. Worry has pushed sentiment towards the bearish finish of the spectrum, with many analysts now arguing that BTC could also be getting into a brand new bear market. The lack of key assist ranges and the fast acceleration of draw back volatility have solely fueled these issues, particularly as short-term holders proceed to capitulate at scale.

Associated Studying

Nonetheless, not all views are bearish. Some analysts consider that Bitcoin could also be forming an area backside, as the present correction resembles earlier mid-cycle retracements seen throughout sturdy bull markets. They argue that the broader macro surroundings stays supportive and that long-term holders haven’t proven indicators of structural weak spot. As promoting stress concentrates amongst weak fingers, the potential of a reversal will increase — particularly as soon as compelled sellers exhaust themselves.

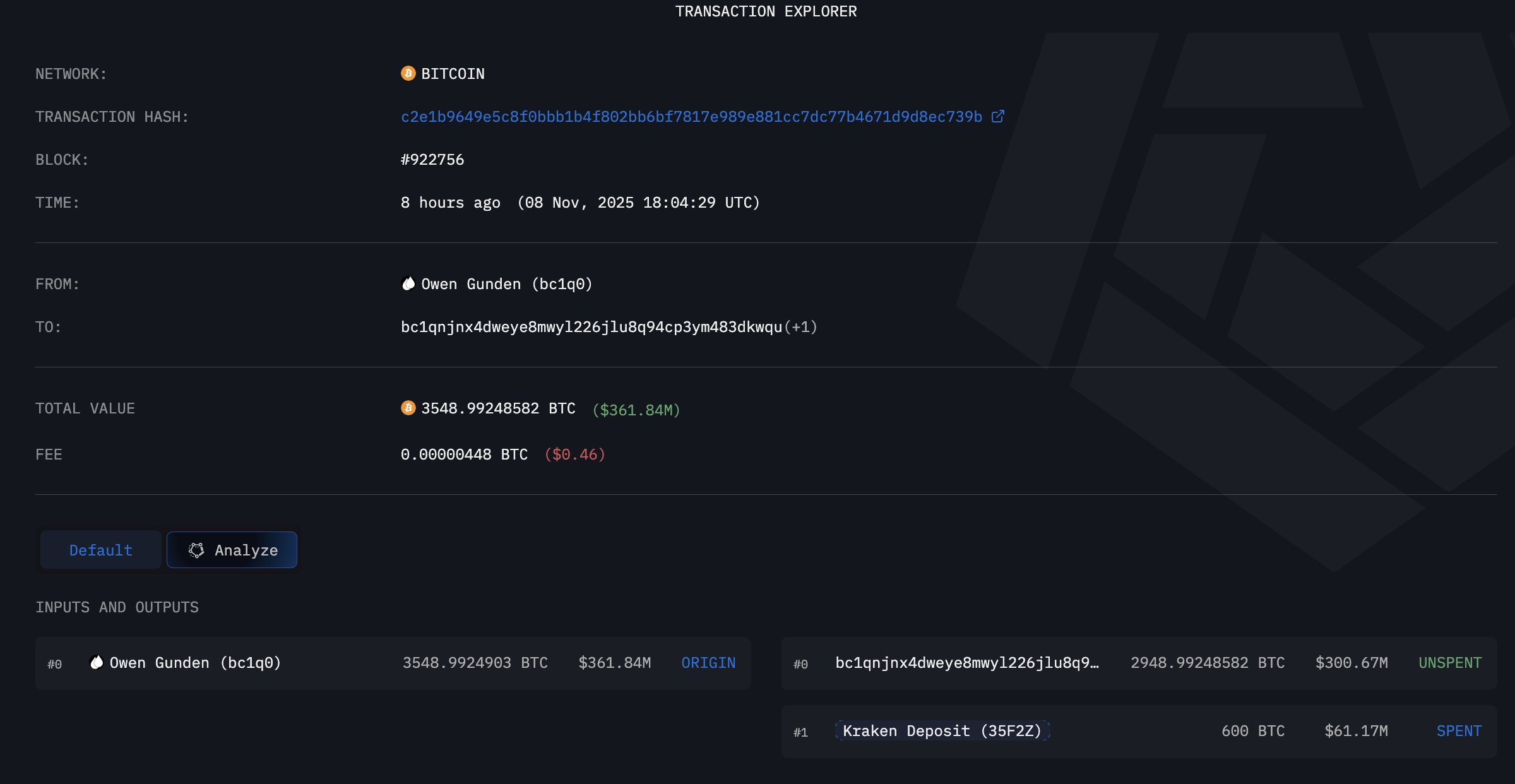

Including to the uncertainty, new on-chain knowledge from Lookonchain revealed that Bitcoin OG Owen Gunden simply deposited all his remaining 2,499 BTC into Kraken roughly an hour in the past. Strikes like this typically set off hypothesis, as trade deposits from early holders can sign potential promoting. But traditionally, comparable occasions have additionally occurred close to cycle bottoms when panic is at its peak.

A Large BTC Switch Sparks Market Hypothesis

In line with contemporary knowledge from Lookonchain, Bitcoin OG Owen Gunden has simply deposited his remaining 2,499 BTC (price $228 million) into Kraken roughly an hour in the past. This transfer has instantly raised questions throughout the market, as massive trade deposits from early whales typically sign potential promoting stress.

What makes this improvement much more notable is the context: simply two weeks in the past, Lookonchain reported that Gunden appeared prepared to dump his total 11,000 BTC stash — a place price over $1.12 billion on the time. Now, with this last deposit, it seems he has formally accomplished the transfer.

For a lot of merchants, this confirms that one of many oldest and largest long-term holders has totally exited or is making ready to exit the market. Such whale conduct can amplify worry throughout corrective phases, particularly as Bitcoin continues to battle under $92K. Strikes of this scale not solely contribute to short-term volatility but additionally affect sentiment by signaling that even early accumulators could also be decreasing publicity.

Nonetheless, traditionally, capitulation occasions from long-term holders have typically coincided with or preceded main turning factors. If this huge switch marks the tip of Gunden’s sell-off, the market could quickly soak up the stress — doubtlessly clearing the trail for a restoration as soon as the worry subsides.

Associated Studying

Quick-Time period Development Nonetheless Underneath Stress

Bitcoin’s 4-hour chart reveals a market that is still firmly beneath short-term promoting stress, regardless of occasional reduction bounces. The worth is struggling to reclaim $92,000, a degree that beforehand acted as assist however is now working as resistance. The sequence of decrease highs and decrease lows highlights a persistent downtrend that has formed BTC’s trajectory since early October.

All main shifting averages—the 50 SMA, 100 SMA, and 200 SMA—are positioned above present value motion and pointing downward. This alignment confirms a transparent short-term bearish construction. Every time BTC makes an attempt to get better, it meets sturdy resistance at these declining MAs, signaling that sellers stay in management. The latest bounce barely reached the 50 SMA earlier than being rejected once more, reinforcing the weak spot of purchaser momentum.

Associated Studying

Quantity stays elevated on downswings, which signifies that sell-offs proceed to be pushed by conviction relatively than random volatility. Consumers are stepping in across the $89,000–$91,000 zone, however up to now, this assist has solely produced short-term pauses relatively than significant reversals.

For a structural shift, BTC would want to reclaim no less than the $95,000 space and break above the 100 SMA. Till then, the development stays tilted towards additional draw back or continued consolidation close to present ranges.

Featured picture from ChatGPT, chart from TradingView.com