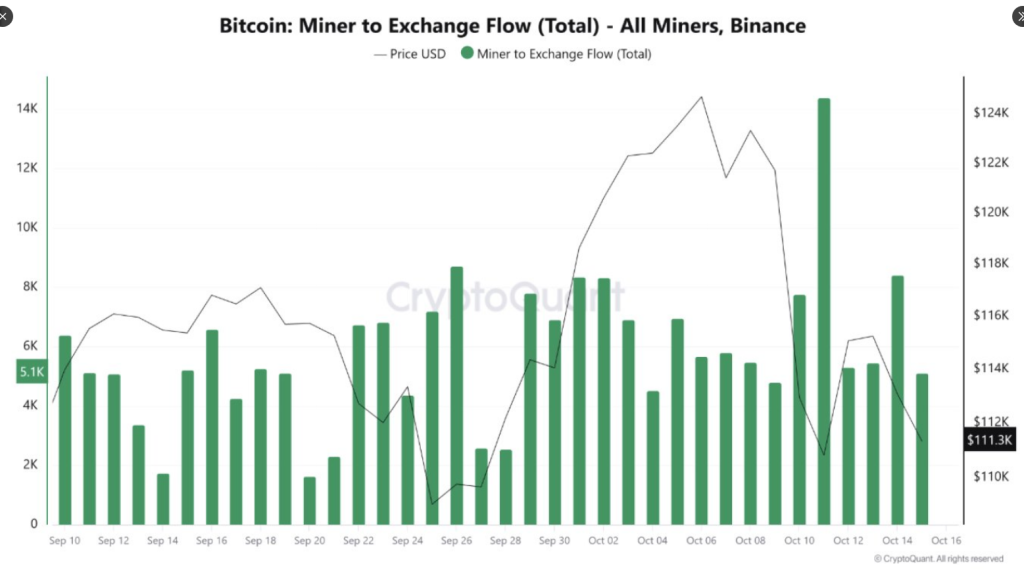

In response to on-chain trackers, bitcoin miners have moved an enormous quantity of cash to a significant trade in latest days, signaling a transparent change in habits that the market will watch intently.

Reviews have disclosed miner transfers totaling 51,000 BTC — price over $5.7 billion — to Binance since October 9. That could be a very massive circulate of provide into a spot the place cash may be bought rapidly.

Miners Transfer Massive Quantities To Exchanges

On October 11, there was a dramatic spike when miners deposited greater than 14,000 BTC to Binance, a day after the market plunged and bitcoin briefly fell to $104,000, an occasion that worn out almost $20 billion in leveraged positions.

Based mostly on knowledge, the outflow on that day was the most important miner switch since final July. Market members usually learn such strikes as a tilt from holding towards promoting, and that shift can change short-term sentiment quick.

Binance Knowledge Signifies That Since October 9, Miners Have Deposited a Whole of 51K Bitcoin

“The deposit of 51,000 Bitcoins inside seven days represents a transparent shift in miner habits from holding to promoting or liquidating.” – By @ArabxChain pic.twitter.com/qSN6WGK5bu

— CryptoQuant.com (@cryptoquant_com) October 16, 2025

CryptoQuant and different analytics corporations warning that shifting cash to an trade doesn’t at all times equal a direct sale. Some miners could also be posting bitcoin as collateral for futures, funding operational wants, or shifting reserves between wallets for bookkeeping.

Nonetheless, the market tends to react rapidly to seen provide flows. Merchants might act on that seen motion even when the cash aren’t bought straight away, rising worth strain by means of buying and selling habits alone.

Whales And Funds Shopping for The Dip

Reviews have proven that enormous consumers have been energetic on the identical time. One new pockets reportedly bought $110 million price of BTC from Binance, whereas one other contemporary deal with purchased 465 BTC (about $51 million) from FalconX.

As well as, US spot Bitcoin ETFs have recorded inflows. These consumers might take in a few of the miner-supplied cash and restrict how far the worth falls.

Market Momentum Stays Fragile

After a wild week that erased massive quantities of market worth, bitcoin has struggled to regain clear momentum. Based mostly on Bloomberg knowledge, the coin was buying and selling close to $109,000 on Oct. 17 in Singapore.

Bitcoin had hit an all-time excessive of $126,250 on October 6, so the pullback has been sharp and quick. For the week to Oct. 12, bitcoin slid as a lot as 6.5%, the most important weekly fall since early March.

Analysts put a key assist close to $107,000. A agency break under that degree might invite deeper losses, they warn. On the flip facet, regular shopping for by massive holders and continued ETF demand would possibly hold the market from sliding a lot additional. The tug of battle is obvious: miners including potential provide versus large consumers taking the opposite facet.

Featured picture from Unsplash, chart from TradingView