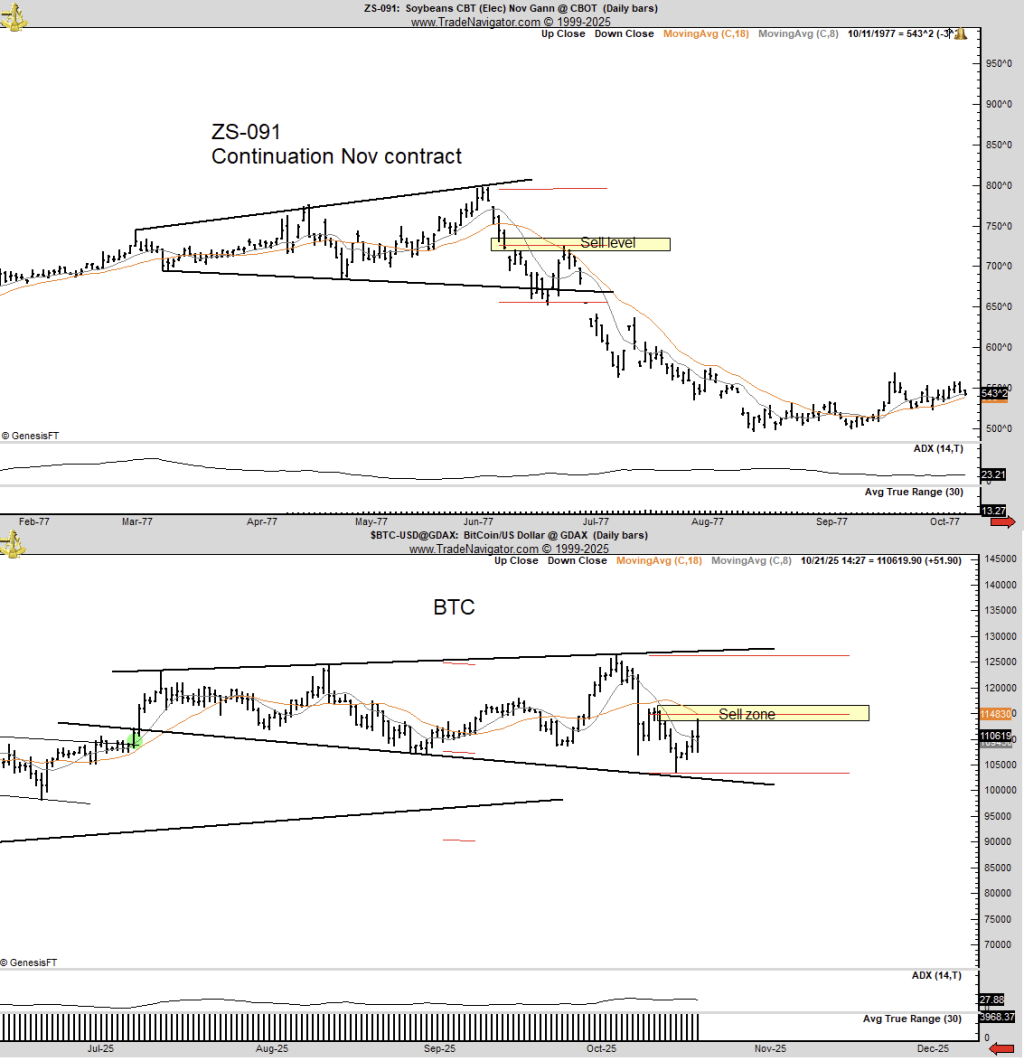

Veteran chartist Peter Brandt ignited a contemporary technical debate on X after publishing two annotated charts—one in all as we speak’s Bitcoin day by day bars, the opposite of Chicago Board of Commerce soybeans from 1977—arguing that the cryptocurrency could also be carving out a broadening high akin to the historic commodity sample that preceded a 50% collapse.

“In 1977 Soybeans fashioned a broadening high after which declined 50% in worth,” Brandt wrote. “Bitcoin as we speak is forming an identical sample. A 50% decline in $BTC will put MSTR underwater. Whether or not I’m proper or flawed, it’s important to admit this previous man has the gonads to make large calls.”

What This Means For Bitcoin Worth

Brandt’s side-by-side comparative overlay is central to his thesis. The soybean chart marks an “Ascending Megaphone” that resolved sharply decrease, whereas his present Bitcoin chart reveals an increasing vary bounded by rising higher and decrease trendlines with a highlighted “promote zone” close to the mid-range round $114,800. Whereas the higher boundary sits simply above $125,000, the decrease trendline now tracks a descending band round $102,000–$100,000.

Associated Studying

The BTC panel additionally contains short-term transferring averages (8-period and 18-period) and a modestly elevated ADX studying, capturing a market that has been unstable inside a widening hall fairly than trending cleanly. On Brandt’s rendering, latest bounces have stalled beneath a horizontal resistance band, in line with the “promote zone” annotation.

The put up triggered quick pushback from sample specialists, most notably Francis Hunt (TheMarketSniper), who argued that the similarity is superficial as a result of the path of the megaphone issues. “In case you have #HVFmethod you’d discover while the broadening buildings look the identical. The Soybeans was an Ascending Megaphone on a bull development => Bearish. Bitcoin is a Descending construction on a bull development, ultimately => Bullish. Place a splitter between every for internet gradient.”

Associated Studying

Brandt, who has a protracted file of public calls throughout FX, commodities, and crypto, framed his view as a reside speculation fairly than a certainty, including an vital nuance a number of hours later: “I’m a Bayesian. I deal in prospects, not chances and positively not certainties. At any given time I’ve binary TA and macro narratives enjoying in my head — $250k Bitcoin or $60k Bitcoin. I contemplate all prospects and search for asymmetrical bets in both path.”

He additionally acknowledged the choice learn from Hunt: “I’ll be first to confess you would be proper. I’m prepared to go together with it in both path. If BTC goes up I wish to be lengthy, if it goes down I wish to be quick.”

On the coronary heart of Brandt’s warning is second-order publicity: Technique (MSTR), the business-intelligence agency that has amassed the world’s largest Bitcoin treasury, would, in his phrases, be “underwater” if BTC fell by half from present ranges. The agency’s common acquisition value is at the moment about $74,010 per BTC (inclusive of charges and bills), primarily based on the corporate’s newest disclosure this week placing whole holdings at 640,418 BTC for roughly $47.4 billion.

At press time, BTC traded at $107,998.

Featured picture created with DALL.E, chart from TradingView.com