What to Know:

- Bitcoin loans mark a shift from passive holding to energetic $BTC deployment, broadening entry and reinforcing Bitcoin’s financial function.

- Lively $BTC lending can tighten liquidity loops: extra collateralization, deeper markets, and stronger institutional incentives to carry $BTC.

- Bitcoin Hyper goals to make $BTC quick and programmable by way of an SVM-based Layer 2 with ZK settlement to Bitcoin.

- $HYPER’s sturdy presale momentum and enormous whale purchases match completely into the present $BTC-focused cycle – one which’s fueled by actual utility moderately than pure hype.

A Canadian Bitcoin-native firm simply issued its first Bitcoin-backed mortgage.

That’s not a small tweak to the established order. It’s a sign that $BTC is edging from ‘digital gold’ into an energetic monetary asset, one which non-crypto customers can lastly entry by a well-known product: lending.

The agency’s aim is easy: accumulate $BTC and deploy it productively, but the implication is large.

Extra methods to borrow and construct with Bitcoin normally imply stronger demand, deeper liquidity, and a broader person funnel.

This design shift issues as a result of utility beats narrative over a full cycle. Loans let establishments put idle $BTC to work and provides companies a strategy to leverage $BTC with out promoting it.

The suggestions loop is apparent: lending platforms entice debtors, debtors supply $BTC, hodlers see new yield paths, and liquidity improves for everybody.

Each service that treats $BTC as collateral, moderately than a speculative asset, boosts its financial credibility.

That units a well timed backdrop for Bitcoin Hyper ($HYPER), a $BTC-centric Layer 2 challenge constructed to make Bitcoin quick, programmable, and dApp-ready, and one many buyers are already eyeing because the subsequent 1000x crypto.

If Bitcoin is entering into mainstream finance, a sequence that bridges $BTC into high-throughput sensible contracts sits proper within the slipstream.

Bitcoin Hyper ($HYPER) Turns $BTC Into A Excessive-Pace, Programmable Asset

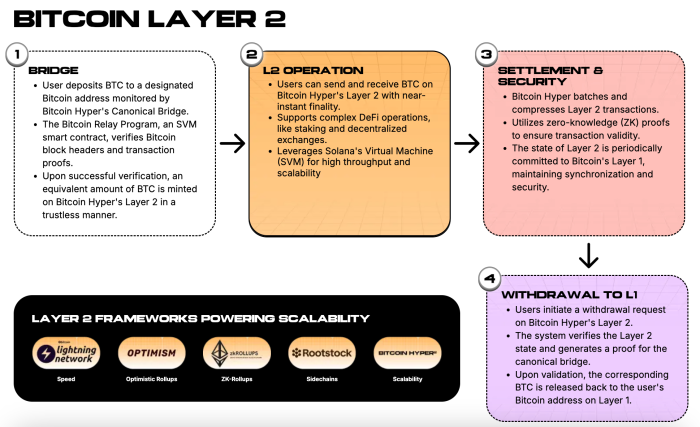

Bitcoin Hyper ($HYPER) proposes a Bitcoin Layer-2 that makes use of an SVM-based execution atmosphere, canonical bridging, and ZK proofs to maneuver $BTC at near-instant velocity with low charges.

The goal is to retain Bitcoin-grade safety whereas unlocking staking, DeFi, and on-chain apps for $BTC itself.

This strategy instantly addresses a ache level that lending alone can’t resolve: throughput and programmability on Bitcoin. If loans increase demand for $BTC as collateral, a performant L2 expands what that collateral can really do.

The stream is simple. Customers bridge $BTC, transact on Layer 2 with excessive throughput, then periodically settle again to Bitcoin L1 with cryptographic proofs.

In follow, which means cheaper funds, quicker markets, and room for dApps that depend on programmability with out compromising the belief folks anticipate from Bitcoin.

The extra companies reference $BTC, just like the newly launched loans, the extra a generalized execution layer turns into helpful for builders preferring to remain throughout the Bitcoin ecosystem moderately than porting worth elsewhere.

Utility additionally wants clear developer pathways. The $HYPER whitepaper emphasizes developer expertise, observability, and infrastructure, enabling groups to ship rapidly.

If the challenge could make constructing on $BTC really feel acquainted to groups used to fashionable VM stacks, it lowers switching prices and accelerates innovation.

That’s the form of narrative establishments perceive: quicker rails, safer settlement, and broader use circumstances.

Get on the $HYPER practice earlier than it’s too late.

Presale Momentum Meets A $BTC Lending Tailwind

Momentum is actual. The Bitcoin Hyper presale has reached $26.9M, and you may purchase $HYPER proper now for simply $0.013265.

That’s a strong present of demand for a $BTC-first L2 at a time when Bitcoin’s financialization is visibly accelerating. If lending adoption widens the $BTC gateway, $BTC-native infrastructure stands to profit instantly.

On-chain exercise provides one other datapoint. A current transaction despatched about 63.8 ETH, roughly $226K, into the presale contract, leading to a switch of 16.8M HYPER.

Whereas one whale doesn’t outline a market, massive patrons normally do their homework and infrequently act as early liquidity. That matches the sample of rising presale participation and the broader rotation towards $BTC-aligned narratives.

A 2026 situation at $0.08625 can be about 6.51x if the DAO and incentive packages mature as deliberate.

As Bitcoin-backed lending marks a brand new part in $BTC’s monetary integration, Bitcoin Hyper stands out because the infrastructure constructed to help that momentum.

With its Layer 2 strategy and rising presale, $HYPER might play a key function in turning the newest Bitcoin lending headlines into lasting on-chain utility.

This text is for informational functions solely and doesn’t represent monetary recommendation. At all times do your personal analysis (DYOR) earlier than investing in crypto.

Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/information/bitcoin-loans-usher-in-a-new-btc-era-bitcoin-hyper-tipped-as-the-next-1000x-crypto