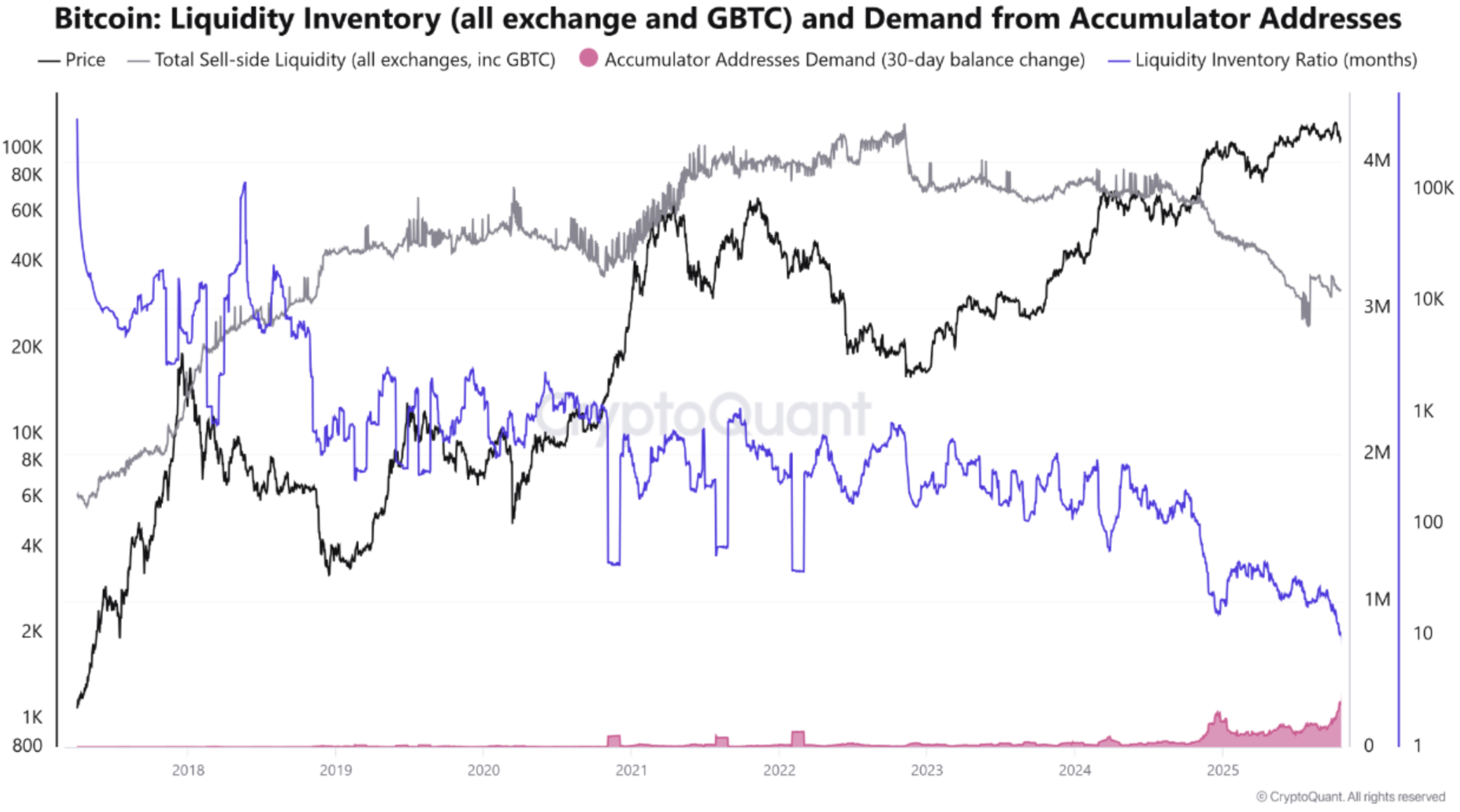

Bitcoin (BTC) liquidity is drying up quick, because the metric lately hit a seven-year low, reaching round 3.12 million BTC, the bottom stage since 2018. This occurred as BTC continued to commerce beneath the 99-day Shifting Common (MA), positioned round $112,086.

Bitcoin Liquidity Dries Up Amid Excessive Demand

In accordance with a CryptoQuant Quicktake put up by contributor Arab Chain, Bitcoin’s sell-side liquidity is drying up at a fast tempo, lately hitting a seven-year low at 3.12 million BTC.

Associated Studying

As BTC’s provide tumbles sharply, the cryptocurrency is buying and selling within the low $110,000 vary, indicating a fragile stability between falling energetic circulating provide and rising institutional demand.

Newest on-chain knowledge reveals that demand for BTC from long-term holders’ addresses has been steadily rising. Over the previous 30 days, long-term traders have amassed 373,700 BTC.

Lengthy-term traders accumulating BTC in the course of the newest dip reveals that there’s adequate market demand for the flagship cryptocurrency regardless of a unstable crypto market. Arab Chain remarked that the market is presently in a “quiet accumulation” part forward of a possible breakout.

The CryptoQuant analyst emphasised that the Liquidity Stock Ratio (LIR) has crashed to round 8.3 months, suggesting that present market liquidity covers lower than 9 months’ price of demand – confirming the fast depletion in BTC’s sellable provide.

For the uninitiated, the LIR measures the stability between out there liquidity and energetic buying and selling demand out there, exhibiting whether or not market makers are offering adequate depth relative to latest commerce quantity. A excessive LIR suggests ample liquidity and secure value motion, whereas a low LIR signifies thinner order books and better vulnerability to volatility or slippage.

The medium-term outlook for BTC seems to be bullish, because of a mixture of declining liquidity and rising demand from institutional and long-term traders. Arab Chain added:

If this pattern continues via the top of the fourth quarter, Bitcoin’s value may surpass $115,000, particularly if accompanied by rising shopping for flows from US funding funds and ETFs, supporting the continuation of the present bullish pattern.

BTC Prime Not In But

Whereas some analysts predict that BTC might have already peaked this market cycle, others are assured that the highest cryptocurrency is but to hit its cycle excessive. Current on-chain knowledge signifies that BTC NVT Golden Cross is but to enter the territory that marked earlier cycle tops.

Associated Studying

Equally, fellow CryptoQuant analyst PelinayPA predicted that there’s a 55% likelihood that Bitcoin has not but topped for the present market cycle. At press time, BTC trades at $111,295, up 2.1% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com