Bitcoin’s worth has struggled to keep up stability above $102,000 in latest days, and knowledge reveals this is because of an obvious imbalance between promoting stress and recent demand.

On-chain knowledge from CryptoQuant reveals that whereas long-term holders have been actively taking income, the market is exhibiting restricted capability to soak up their sell-offs. This can be a distinction to earlier phases of the bull run, the place rising demand was capable of offset elevated long-term holder exercise.

Associated Studying

Rising Lengthy-Time period Holder Promoting Strain Mirrors Previous Bull Cycles

Information from on-chain analytics platform CryptoQuant, which was initially shared by Julio Moreno, head of analysis at CryptoQuant, reveals an attention-grabbing change in dynamics amongst Bitcoin holder exercise that would form the cryptocurrency’s subsequent transfer.

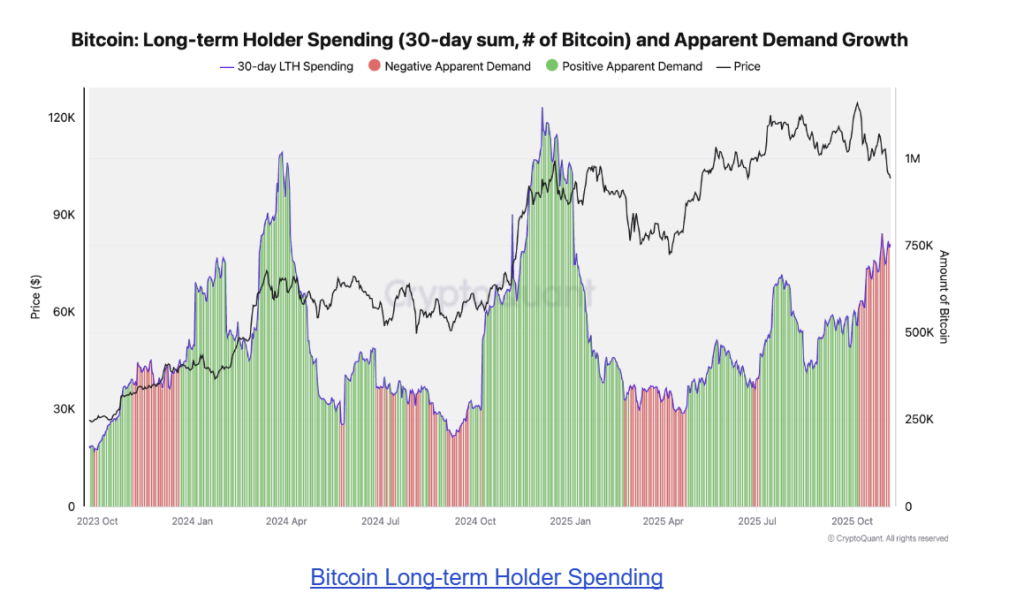

Julio Moreno defined that long-term holder (LTH) promoting is a traditional sample in bull markets as buyers take income when Bitcoin approaches or surpasses all-time highs. The CryptoQuant knowledge reveals that the 30-day sum of LTH spending, represented by the purple line within the chart picture beneath, has been growing since early October.

This conduct follows earlier bullish rally phases, similar to these seen in early and late 2024, when profit-taking coincided with increasing demand, and so Bitcoin pushed to new file costs.

The chart accompanying Moreno’s publish reveals inexperienced areas representing intervals of constructive obvious demand development and purple areas indicating contraction. Throughout January to March 2024 and November to December 2024, LTH selloffs occurred as demand expanded.

Bitcoin Lengthy-term Holder Spending

Since October 2025, nonetheless, that pattern has reversed. At the same time as LTH promoting elevated, demand has entered a purple zone, exhibiting that the market’s capability to soak up this promoting stress has weakened. This has coincided with Bitcoin’s battle to maintain its place above $102,000, suggesting that worth development is likely to be shedding momentum.

Sustained Weak Demand Might Delay Subsequent Rally

Moreno famous that the important issue to observe isn’t simply the amount of long-term holder sell-offs however whether or not demand development can maintain tempo.

When demand is powerful, the inflow of provide from long-term holders typically drives wholesome consolidation earlier than one other worth surge. In distinction, when demand falls behind, the outcome tends to be extended corrections or sideways motion.

A big portion of that demand now comes from Spot Bitcoin ETFs, which have seen a pointy slowdown in inflows. Information from SosoValue reveals that US-based Spot Bitcoin ETFs ended final week with internet outflows of $558.44 million on Friday, November 7, one of many largest single-day outflows in weeks.

Associated Studying

Until Bitcoin’s obvious demand begins to recuperate within the coming weeks and LTH sell-offs proceed, then this may proceed to weigh on worth motion and postpone the following leg of Bitcoin’s rally. On this case, we’d proceed to see Bitcoin consolidating between $101,000 and $103,000 for the remainder of November.

On the time of writing, Bitcoin is buying and selling at $101,655, down by 0.6% prior to now 24 hours.

Featured picture from Unsplash, chart from TradingView