Bitcoin (BTC) is holding close to $117,500, up about 6.1% over the previous two weeks. Nevertheless, current information from Binance exhibits that BTC’s present worth motion is basically supported by retail buyers, whereas whales have been noticeably absent.

Bitcoin Holds $117,500 Amid Excessive Retail Inflows

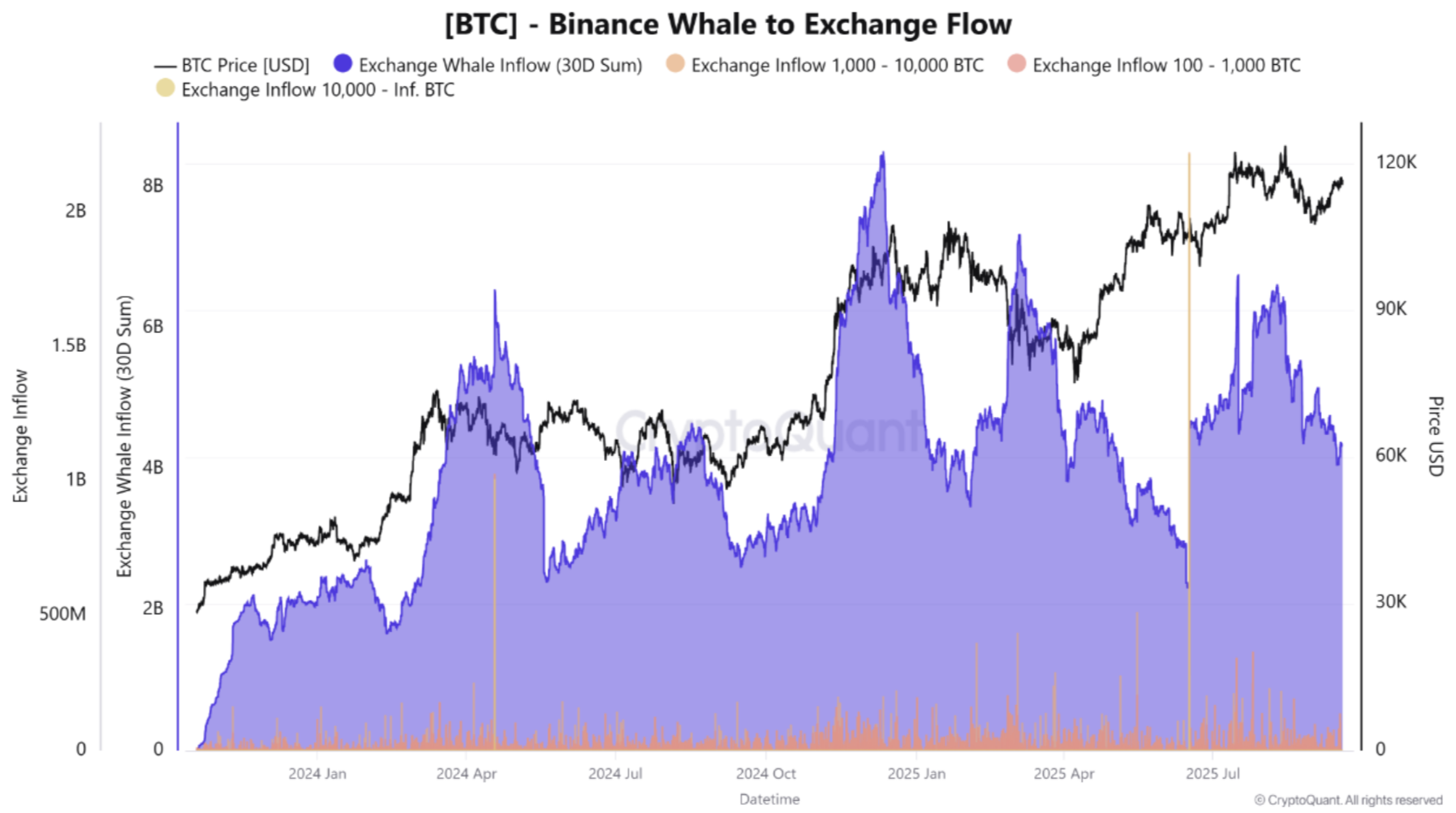

In keeping with a CryptoQuant Quicktake put up by contributor Arab Chain, Bitcoin is hovering across the $117,500 worth degree, supported by lively inflows from retail buyers. Notably, massive whale inflows have been utterly absent, indicating that the present market is being pushed by people greater than by massive wallets.

Associated Studying

Inflows starting from 0 to 0.001 BTC recorded roughly 97,000 BTC. Equally, inflows from the 0.001 to 0.01 BTC section totaled almost 719,000 BTC.

The distribution above means that Bitcoin’s present rally is basically pushed by retail buyers. These buyers conduct quite a few however small-volume transactions, confirming that particular person buyers are shaping the market dynamics. Arab Chain added:

The figures reveal that the majority of inflows are concentrated in small and medium-sized transactions, reflecting the dominance of retail exercise in Bitcoin buying and selling. This liquidity, regardless of its restricted scale, has helped maintain the market balanced at present ranges.

It’s price emphasizing that there was nearly no whale stress through the present market rally. Particularly, no important surges in inflows of greater than 100 BTC have been noticed, mitigating the probability of a pointy short-term worth correction.

To conclude, the present market state of affairs exhibits that Bitcoin is experiencing a state of equilibrium, largely attributable to heightened retail investor participation. Such a situation offers the market a chance to steadily surge towards the essential $120,000 resistance degree.

That stated, it might be sensible to control any whale exercise, because it might shortly alter the market’s path. Any sudden entry of whale inflows might set off a fast worth correction, just like earlier market tops.

Specialists Divided On BTC Worth Motion

As Bitcoin trades about 5.4% under its all-time excessive (ATH), there are indicators that the highest cryptocurrency by market cap could also be on the cusp of a contemporary rally. As an example, BTC not too long ago broke above the mid-term holder breakeven, lowering the probability of a right away sell-off.

Associated Studying

Current constructive developments – such because the US Federal Reserve (Fed) lowering rates of interest by 25 foundation factors – might reinvigorate the crypto market. Towards that backdrop, crypto entrepreneur Arthur Hayes not too long ago reiterated his formidable $1 million BTC prediction.

That stated, gold bug Peter Schiff opines that BTC has doubtless already peaked for this market cycle. At press time, BTC trades at $117,523, up 1.8% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com