On-chain information exhibits the Bitcoin NVT Golden Cross has nonetheless not breached into the territory that marked the tops of earlier cycles.

30-Day EMA Of Bitcoin NVT Golden Cross Is Nonetheless Under Overheated Zone

As identified by an analyst in a CryptoQuant Quicktake submit, the Bitcoin NVT Golden Cross is but to hit an excessive degree within the present cycle. The Community Worth to Transactions (NVT) Ratio is an on-chain indicator that measures the ratio between BTC’s market cap and transaction quantity.

When the worth of this metric is excessive, it means the worth of the community (as represented by the market cap) is excessive in comparison with its potential to transact cash (the amount). Such a pattern is usually a signal that the asset could also be overvalued. Then again, the indicator having a low worth can suggest the cryptocurrency’s worth may have room to develop as its market cap isn’t inflated towards its transaction quantity.

Within the context of the present dialogue, a modified type of the NVT Ratio known as the NVT Golden Cross is the indicator of curiosity. This metric is a Bollinger-band-like signaling indicator that compares the short-term pattern of the NVT Ratio (10-day transferring common) towards its long-term pattern (30-day MA) to find out whether or not the indicator is close to a prime or backside.

Now, here’s a chart that exhibits the pattern within the 30-day exponential transferring common (EMA) of the Bitcoin NVT Ratio over the previous decade:

As displayed within the above graph, the 30-day EMA Bitcoin NVT Golden Cross at the moment has a price of round zero, which suggests the market is in a impartial section in response to the NVT Ratio.

Within the chart, the quant has highlighted the zones the place tops and bottoms have traditionally tended to happen. It might seem {that a} extremely constructive worth usually alerts some type of prime for BTC, whereas a unfavourable one can result in a backside.

Within the present cycle to date, the indicator hasn’t seen any spike into the pink zone. Whether or not because of this this bull market is an exception, or that Bitcoin is but to achieve its prime, solely stays to be seen.

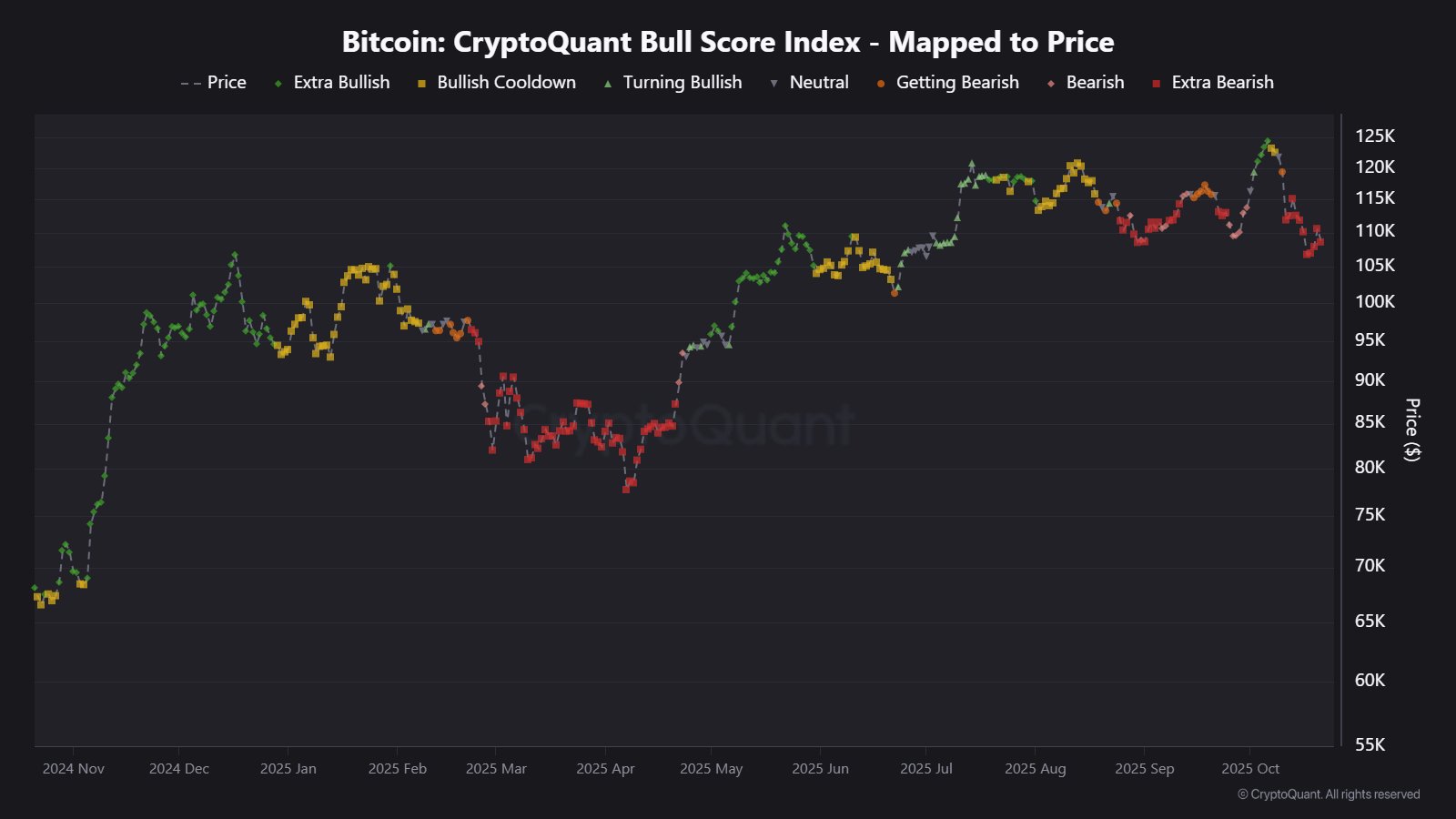

Whereas Bitcoin market situations are impartial from the attitude of the NVT Golden Cross, CryptoQuant’s Bull Rating Index is portray a special image. Because the analytics agency’s group analyst has famous in an X submit, this indicator, which mixes the info of a number of key on-chain metrics, is flashing a bear sign for the asset.

BTC Worth

Bitcoin surged towards $114,000 on Tuesday, however it could seem that the restoration was solely short-lived because the coin is already again at $108,000.