On-chain analytics agency CryptoQuant has revealed how promoting from US Bitcoin traders has dominated throughout the current market downturn.

Bitcoin Coinbase Premium Hole Factors To US Selloff

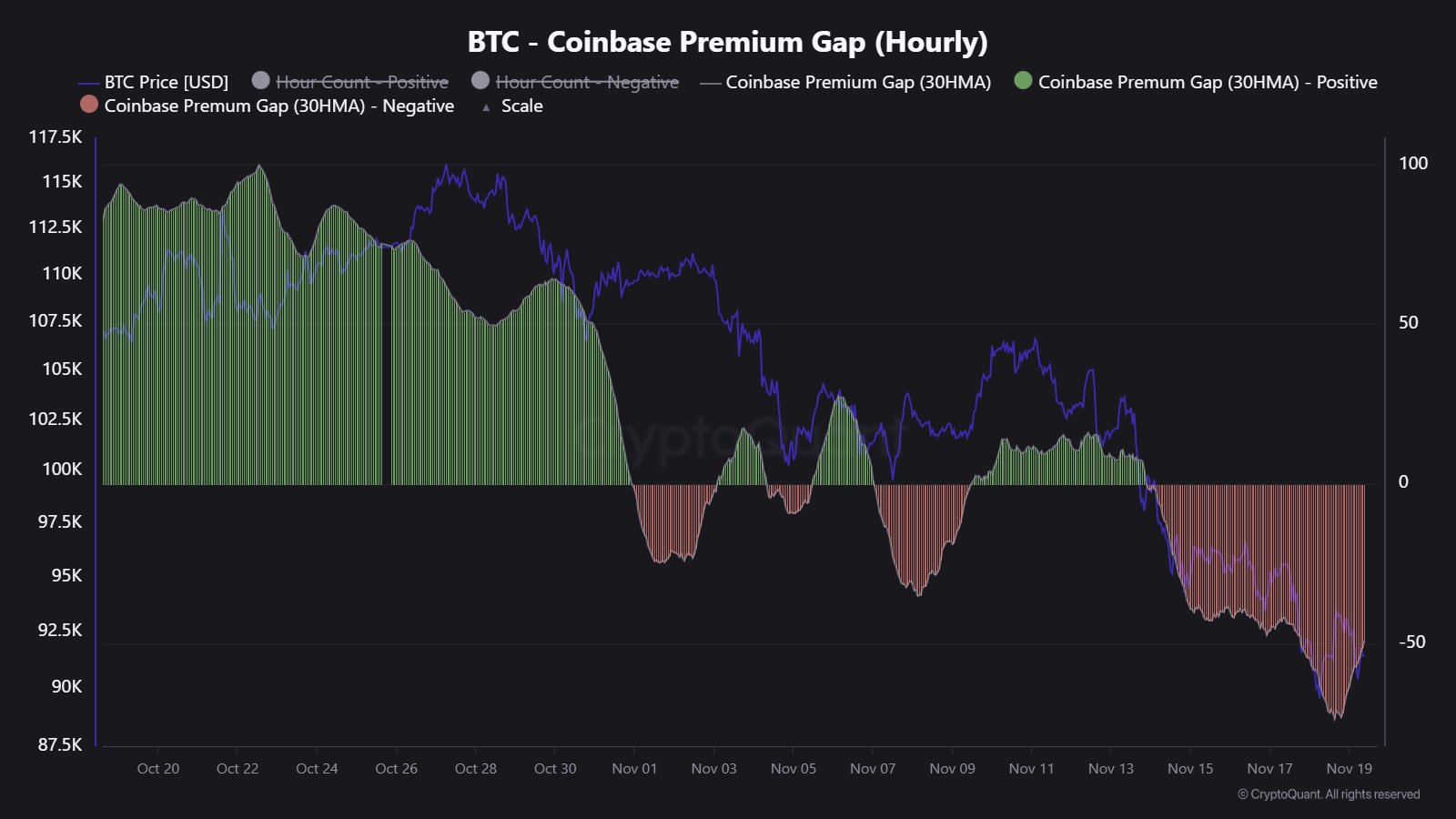

In a brand new thread on X, CryptoQuant has talked about some key items of information associated to the US-dominated Bitcoin selloff. The primary indicator that CryptoQuant has shared is the “Coinbase Premium Hole,” which retains observe of the distinction between the BTC worth listed on Coinbase (USD pair) and that on Binance (USDT pair).

Because the beneath chart exhibits, the 30-hour shifting common (MA) worth of this metric has plummeted into the pink territory just lately.

A unfavourable worth on the Coinbase Premium Hole signifies that the asset is buying and selling at a worth decrease on Coinbase as in comparison with Binance. The previous change is the popular platform of the American traders, particularly giant institutional entities, whereas the latter one hosts a world visitors. As such, a pink premium could be a signal that US-based whales are promoting greater than world traders.

“The Coinbase Premium Hole dropped as little as -$90, which is an indication of sturdy U.S. promoting strain,” defined the analytics agency. One other metric that factors towards extraordinary promoting strain from the American merchants throughout the current worth decline is the cumulative return for the totally different buying and selling classes.

From the above chart, it’s seen that each European and Asia-Pacific buying and selling hours have seen an nearly impartial return in Bitcoin over the previous month. The American session, however, has witnessed a deep unfavourable worth.

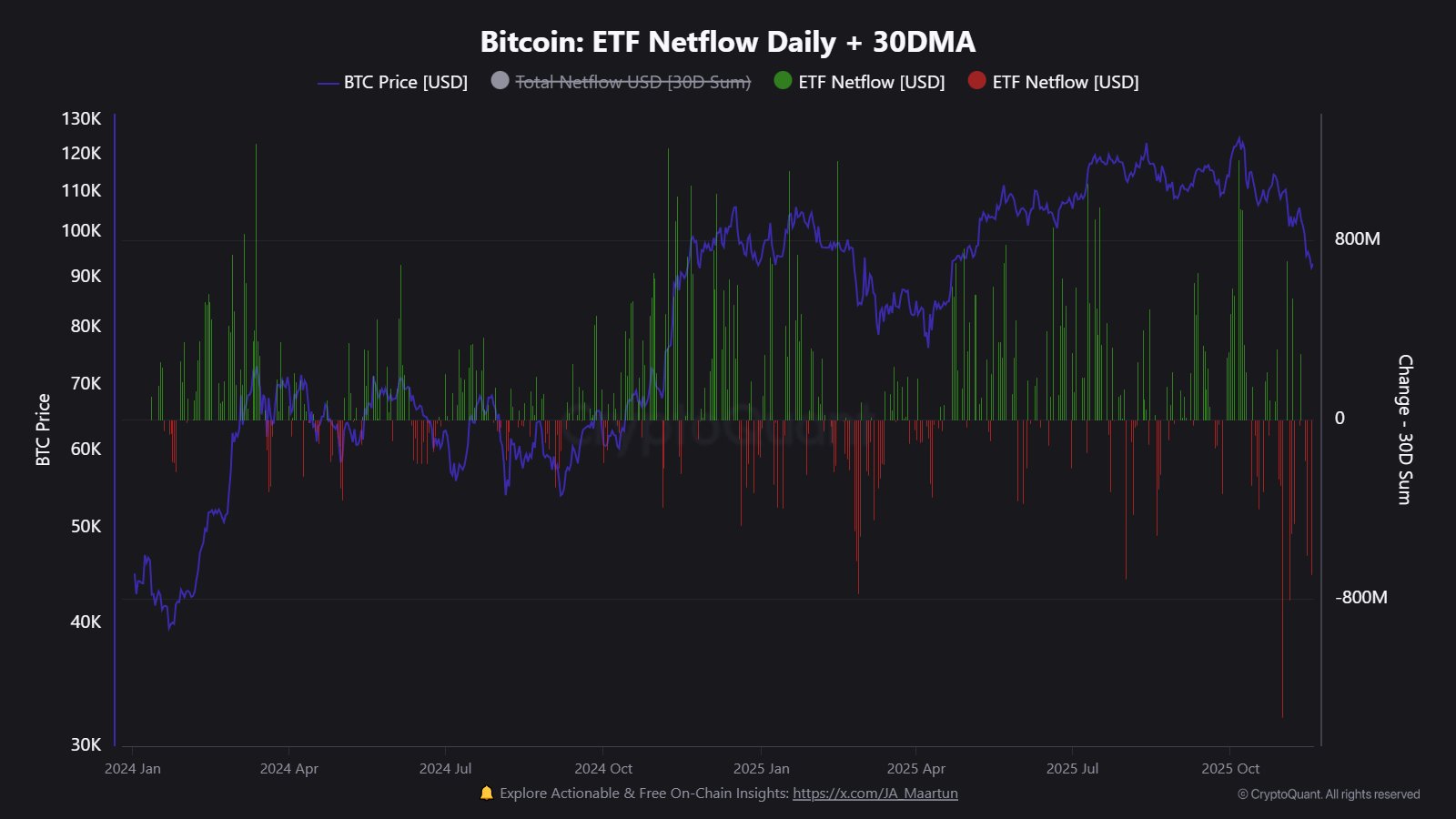

One other main method institutional entities spend money on Bitcoin is thru the spot exchange-traded funds (ETFs), funding autos that maintain BTC on behalf of their traders, and permit them to realize off-chain publicity to the coin’s worth actions.

These funds have additionally witnessed outflows throughout the selloff in the previous few weeks.

ETFs have seen internet outflows for 3 straight weeks now, which is a departure from final yr’s This autumn pattern, the place 194,000 BTC flowed into the wallets linked with these funds, however in This autumn 2025 thus far, 8,000 BTC has flowed out as an alternative. “ETF outflows proceed to weigh on the BTC spot market,” famous CryptoQuant.

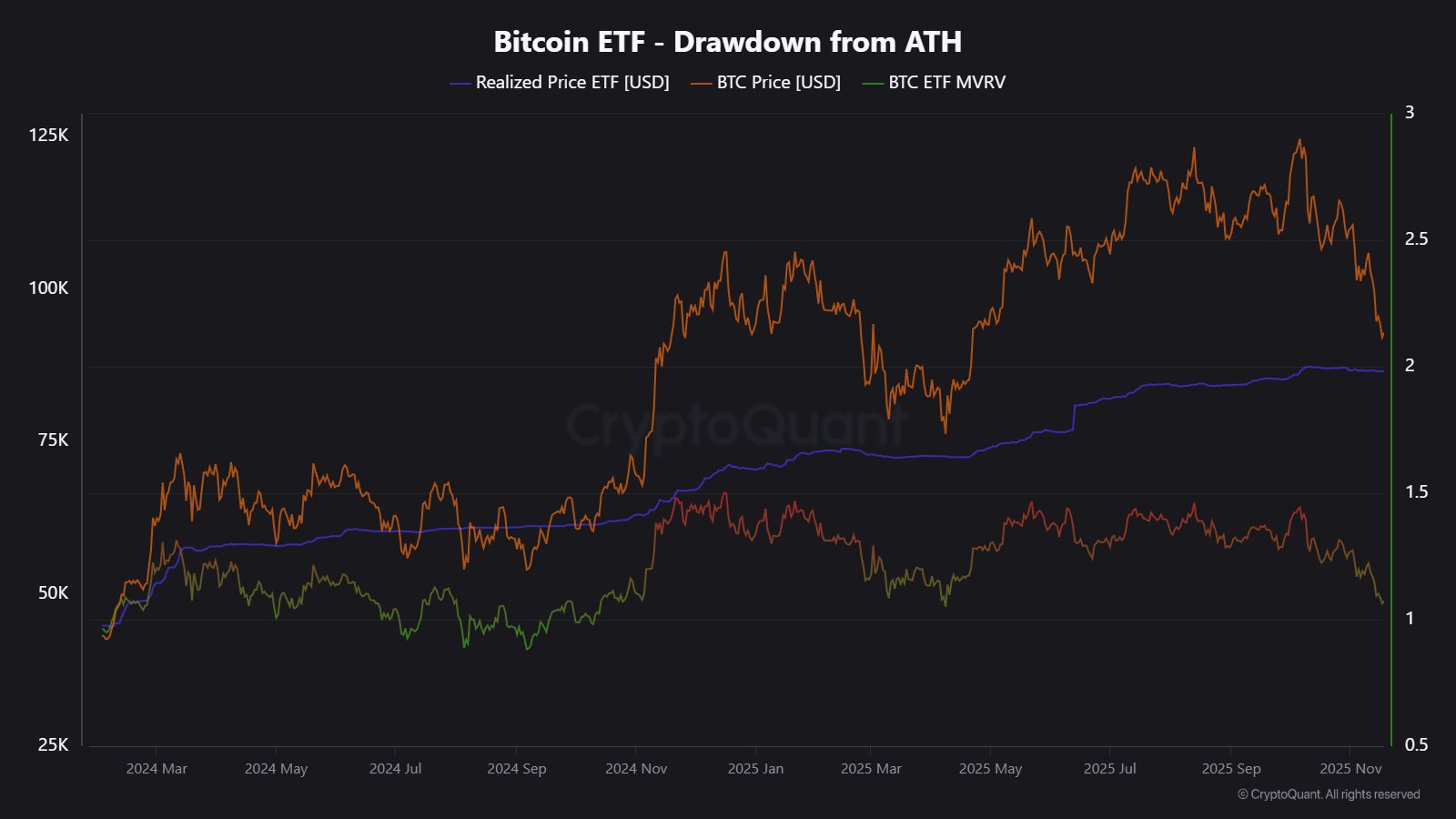

As for what might be subsequent for Bitcoin, the value foundation of the spot ETFs could also be value looking forward to, which is situated at $86,566. If the cryptocurrency breaches beneath this mark, holdings of the spot ETFs will go underwater.

BTC Worth

On the time of writing, Bitcoin is floating round $92,000, down greater than 10% during the last seven days.