The worth efficiency of Bitcoin over the previous two weeks has been a significant supply of concern, because the coin’s worth continues to float away (about 15% down now) from its all-time excessive. Because the flagship cryptocurrency slows down, the most recent on-chain information suggests {that a} group of buyers is exiting the market en masse.

Extra Quick-Time period Holders Are Giving Up Their Holdings

In an October 18 publish on the X platform, on-chain analyst Darkfost revealed {that a} important variety of Bitcoin’s short-term buyers have began to shut their positions and understand their losses.

Associated Studying

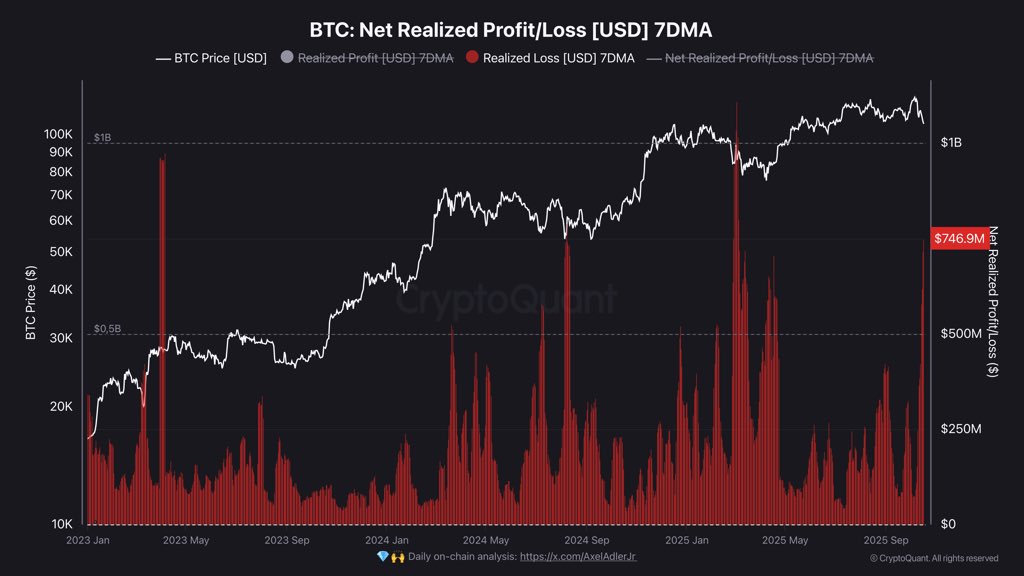

Darkfost’s evaluation was hinged on the Internet Realized Revenue/Loss metric, which tracks the online quantity (in USD) of income or losses which are realized on-chain. This metric measures the online revenue or loss every day, averaged, on this case, over seven days. It offers perception into whether or not extra buyers are promoting at losses or with their heads nonetheless above water..

In accordance with the crypto pundit, the realized losses of BTC buyers have surged to an approximate degree as excessive as $750 million per day, one of many highest ranges this present cycle has seen. Curiously, Darkfost defined that the magnitude of those capitulation occasions stands simply similar to these seen throughout the 2024 summer season correction.

What’s price noting about this capitulation section is what could doubtless observe. In accordance with the analyst, occasions like this normally precede native bottoms. What this implies is that after short-term holders (often called the “weak palms”) have surrendered their holdings to the more-confident long-term holders (the “diamond palms”), the cryptocurrency stands an opportunity of seeing a value rebound — an expectation in congruence with historic traits.

Nevertheless, on the extra cautious facet, Darkfost supplied a delicate warning that the dreary reverse is also the case in a state of affairs the place the market stands at an early bearish section.

Bitcoin Whales Would possibly Be Accumulating Once more

Supporting the constructive redistribution concept, a Quicktake publish on the CryptoQuant platform by Abramchart provides a glimmer of hope for Bitcoin market members. Referencing the Inflows To Accumulation Addresses (Dynamic Cohort) metric, the analyst highlighted a big influx of greater than 26,500 BTC into whale accumulation wallets.

When massive quantities of Bitcoin — similar to this magnitude — are moved, it normally alerts an underlying institutional or whale accumulation, as cash are usually transferred from exchanges to those wallets for long-term holding.

Associated Studying

Following historic patterns, it is rather doubtless that this accumulation occasion will precede a continued bullish growth of the flagship cryptocurrency. As Abramchart defined, this development all serves as a touch that good cash is “quietly shopping for the dip.”

As of this writing, Bitcoin holds a valuation of about $106,870, with no important motion seen over the previous 24 hours.

Featured picture from iStock, chart from TradingView