CryptoQuant’s Bitcoin Bull Rating Index has jumped from 20 to 50 in simply 4 days, suggesting a swift shift out of bearish territory for the asset.

Bitcoin Bull Rating Index Is Again In Impartial Area

In a brand new submit on X, CryptoQuant head of analysis Julio Moreno has talked concerning the newest development within the analytics agency’s Bull Rating Index. This indicator principally tells us about which section of the market Bitcoin is in proper now.

The index combines the information of a number of key on-chain metrics to find out its worth. A few of these indicators embrace the Market Worth to Realized Cap (MVRV) Ratio, protecting monitor of common investor profitability on the community, and the Stablecoin Liquidity, measuring the quantity of capital saved within the type of fiat-tied tokens.

When the Bull Rating Index has a worth of 60 or larger, it means the vast majority of the underlying metrics are presently giving a bullish sign. However, the metric’s worth being 40 or decrease implies BTC is in a bear section in keeping with its indicators.

Now, right here is the chart shared by Moreno that exhibits the development within the Bitcoin Bull Rating Index over the previous yr:

As is seen within the above graph, the Bitcoin Bull Rating Index was sitting at a low of simply 20 4 days in the past, however since then, its worth has witnessed a pointy climb to the 50 stage. Which means on-chain metrics are signaling impartial market circumstances for the asset now.

This shift comes simply because the Federal Open Market Committee (FOMC) kicks off its two-day assembly on Tuesday. BTC worth itself has taken to sideways motion forward of it, indicating that the market is split concerning the occasion’s consequence.

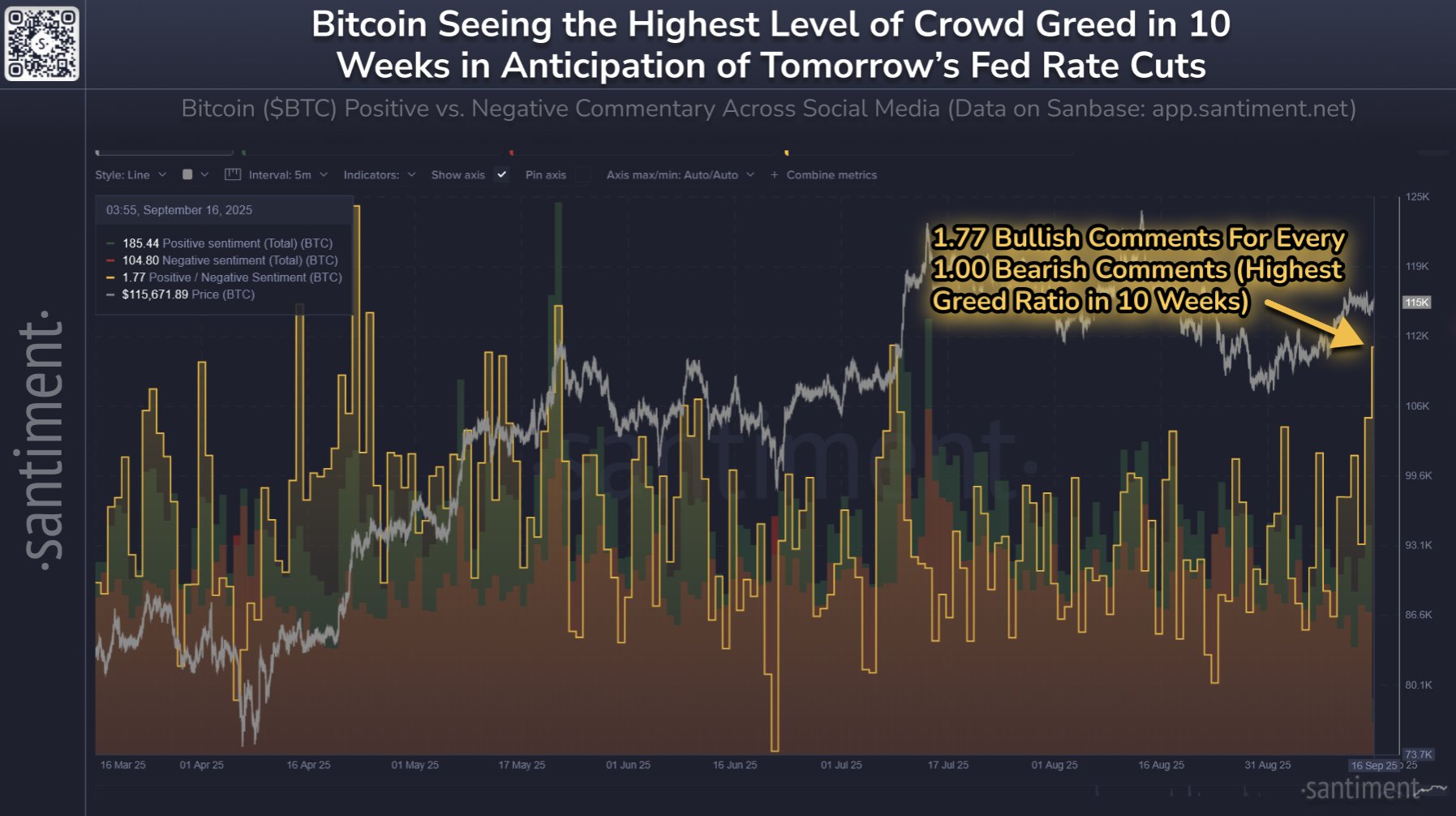

Analytics agency Santiment has shared in an X submit about how social media customers are reacting to the assembly.

Within the chart, Santiment has connected the information of the “Constructive/Unfavourable Sentiment,” an indicator that compares the bullish and bearish posts associated to Bitcoin which can be showing on the most important social media platforms.

This metric has surged not too long ago and hit the 1.77 mark, suggesting that there are 1.77 constructive feedback being made for each damaging remark associated to the cryptocurrency. That is essentially the most bullish that retail merchants have been on social media in round 10 weeks.

Whereas some pleasure might be regular, an extra of it isn’t normally a constructive signal. Because the analytics agency explains, “traditionally, markets transfer in the wrong way of retail’s expectations.”

BTC Value

On the time of writing, Bitcoin is buying and selling round $115,700, up greater than 2.5% over the past week.