With the Bitcoin value rallying, one analyst has taken to X, highlighting the present state of bullish affairs. In a publish, the analyst thinks the world’s most useful coin is approaching “escape velocity,” with value motion deviating from candlestick preparations up to now. That is normally the case, particularly when costs are approaching all-time highs.

Will Bitcoin Rip Previous $70,000 In Coming Days?

The analyst notes {that a} regular BTC cycle would, at present costs and contemplating how the coin has been rallying up to now few weeks, usually have seen a pullback. The correction would then be adopted by an prolonged interval of consolidation, usually stretching a minimum of six months.

Nevertheless, since there’s a clear deviation, taking a look at value motion within the month-to-month chart, the analyst is satisfied that Bitcoin is about to elevate off. The ensuing rally could be at “escape velocity,” the coin would simply prolong positive factors, easing previous all-time highs.

Bitcoin is firmly in an uptrend at spot charges, taking a look at occasions within the day by day chart. Particularly, Bitcoin trades above $57,200 when writing, registering new 2024 highs. Over the previous day, the coin has damaged above key resistance ranges, simply breaking $53,000 and later $55,000 in a purchase pattern continuation formation.

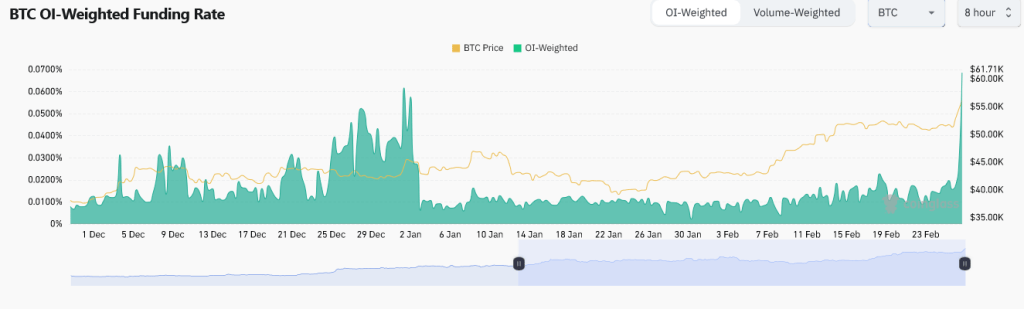

Rising Funding Charges And Open Curiosity As Establishments Double Down

With hovering curiosity, trade knowledge reveals that there was a spike in annualized funding charges and open curiosity throughout a number of platforms, enabling the buying and selling of Bitcoin perpetual futures. Knowledge from Coinglass reveals that the funding price in Binance is now at over 0.0686%. The identical has been noticed with open curiosity, which now stands at over $6.2 billion on Binance.

Modifications in open curiosity and funding charges are main indicators that can be utilized to gauge market sentiment. Often, rising open curiosity and funding charges counsel growing bullish sentiment, particularly amongst leverage merchants. On this situation, the opportunity of costs sustaining the uptrend stays excessive.

Confidence amongst merchants is exceptionally excessive. It’s fueled by current institutional developments, macro components, and the expectations forward of the incoming halving occasion. For context, the ten accredited spot Bitcoin exchange-traded funds (ETFs) in america have since obtained billions.

Observers now fear that at this tempo, and forward of the Bitcoin halving occasion, there could be a provide shock disaster. The priority is that after April, the variety of cash launched can be approach lower than these being wolfed by establishments. BTC costs will probably rally out of this, which can be out of attain for peculiar of us.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site fully at your individual threat.