Optimizing buying and selling methods is one of the best function of MT5. It gives an clever parameter tuning algorithm, which – when utilized the good means – can discover good buying and selling methods.

Nonetheless, the core drawback of optimized methods is that they appear to carry out superior throughout the backtest and fail proper after they’re deployed.

Do you know that many optimized methods fail after they’re deployed?

This weblog article offers with the steps on how we will keep away from this problem. The article initially introduces the optimized parameters and reveals then how we will discover a technique which performs nicely in historical past and on future knowledge.

Step 1: Designing an entry sample

Everybody who begins with buying and selling, appears to be like at entry patterns first. Easy methods to acknowledge a state of affairs in the marketplace, after we can open a place which shall be a win?

There are such a lot of concepts in the marketplace and from my expertise 10x extra effort goes right into a recoverying technique for instances, when the entry sample leads us to a loosing state of affairs. Anyway, for this text I want to take a Value Motion sample with two consecutive higher-highs and two consecutive increased lows as an entry criterion.

As proven within the setup above, the bot is ready for 2 highs the place the second is increased than the primary (higher-high). Similar for the lows: we wait for 2 increased lows. As quickly as the worth breaks the extent of the higher-high, we open a place. That is it. No woodoo.

Subsequent let’s examine what to do with this commerce now.

Step 2: Commerce Administration and First Optimization

The query the place to exit this commerce just isn’t really easy to be answered. 10 Million Gurus will inform one thing like “bro, simply use the earlier lower-low because the Cease-Loss. And a few earlier fractal for take-Revenue”. It is a good thought. So let’ outline the next:

Take-Revenue is: entry worth + dTP the place dTP is the quantity of factors between the entry worth and the envisioned Take revenue stage (e.g. earlier Larger excessive).

Cease-Loss is: entry worth – dSL, the place dSL is the quantity of factors between the entry worth and the envisioned Cease Loss stage (e.g. final Decrease-Low).

Subsequent we inform the optimizer to attempt completely different values for dTP and dSL. Perhaps 0.5*dTP is one of the best TP worth or perhaps it is 5*dTP?

In my methods I often not simply scale the dTP and dSL ranges however do additionally set restrictions on the minimal and most required distances between two Highs or two Lows. The optimizer can deal with all of those parameters.

Step3: Preventing Overfitting

I suppose you too have met an overfitted buying and selling technique, which was performing 100% per thirty days within the backtest however blew up all accounts after 4 weeks of buying and selling. We wish to keep away from that!

Individuals who begin studying machine studying, run of their first days into the so known as overfitting drawback. This implies, that the learner finds an answer which works just for the coaching dataset.

Think about following analogue state of affairs:

Everytime you drive along with your automobile previous a site visitors gentle, you notice the time and if the sunshine is inexperienced or purple. Now you accumulate 20 data and a pair of inexperienced data are on a Monday. Now, for those who let some fancy AI be taught to foretell the site visitors gentle from the time, it would let you know

that for those who drive on Monday, the site visitors gentle is inexperienced. All the time!

In buying and selling, freshmen usualy assume: Nice! Let’s drive with max velocity. In AI we belief! 🌅

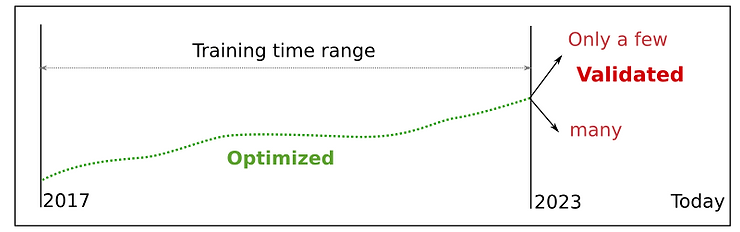

Easy methods to keep away from it? We optimize the EA parameters on knowledge earlier than 2023 and take a look at the efficiency on knowledge after Jan 2023. The take a look at after 2023 known as the forward-test.

So we count on the efficiency of the optimized EA to be related within the backtest and within the forward-test. However is it all the time the case?

Information Mining as Answer 🏆️

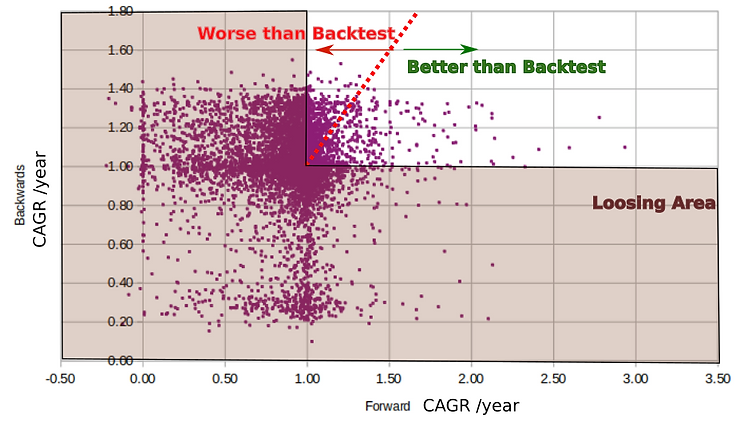

MetaTrader runs often greater than 10,000 assessments with completely different parameters. As talked about above we optimize the parameters on knowledge earlier than 2023 and take a look at them on knowledge after Jan 2023. This implies we make 20,000 runs in complete. Holding targeted with that quantity of information just isn’t straightforward. For that reason I developed this charting approach for my bot creation course of so you will not discover it defined wherever however right here. It’s price to take a number of seconds to take a loot at it. Is it necessary? YES! As a result of it reveals that the success of a buying and selling bot on future knowledge just isn’t a fortunate draw!

The vertical axis is the CAGR (e.g. 1.5 means 50% per yr income per yr on common) of the backtest and the horizontal axis is CAGR of the ahead take a look at. Every purple level represents a method with its distinctive parameters.

The purple dashed line reveals the place the CARG of the backtest was just like CAGR of the ahead take a look at. This implies, that

all methods alongside the purple dashed line have similar efficiency on backtest and on new validation knowledge!

This provides us a quantitative motive to count on similar income sooner or later! 🔥

Word, that many of the tremendous profitable backtest methods had been failing within the ahead take a look at. Which one will we choose for buying and selling? After all the one, which is on the purple dashed line and has the very best CAGR.

Easy methods to create such a Chart?

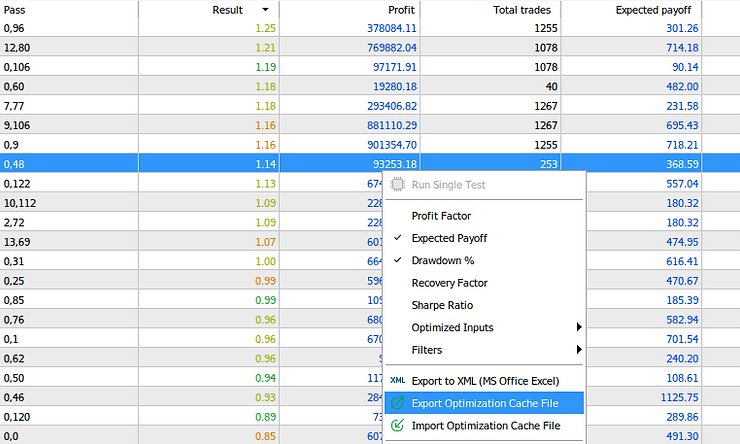

First, I exported the Backtest and Ahead take a look at outcomes to an Excel xml file like this:

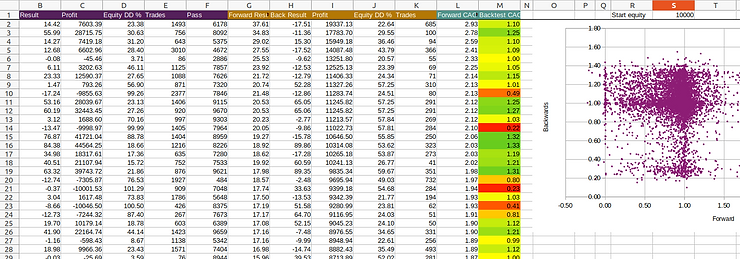

After that I copied some columns from the backtest and a few columns from the ahead take a look at xml file into the third Excel file, which computer systems the CAGR and plots the plot chart.

The third Excel file, which plots the imply yearly achieve for backtest and ahead take a look at exports.

Subsequent, I’d summarize the result of the charting hustle with a number of consequence examples.

Outcomes Earlier than:

After we merely choose one of the best backtest, we find yourself with this:

Outcomes After:

after we choose the greatest mixture backtest-to-forward take a look at as described on this article, we find yourself with a method which dlivers very related efficiency for backtest knowledge and the long run ahead take a look at knowledge. That is precisely what we wish.

Conclusion

I like to recommend to contemplate such analysis in each EA-development course of. In assume it’s so important, that truly everybody who’s constructing buying and selling bots ought to apply it. Why would not anybody publish such EA-analysison MQL5 market when providing a buying and selling bot there?

PS: After a number of months of digging into EA improvement, I’ll publish quickly extra articles and one other nice replace for AI for Gold. The time has come to attempt for the 400%++ income once more.