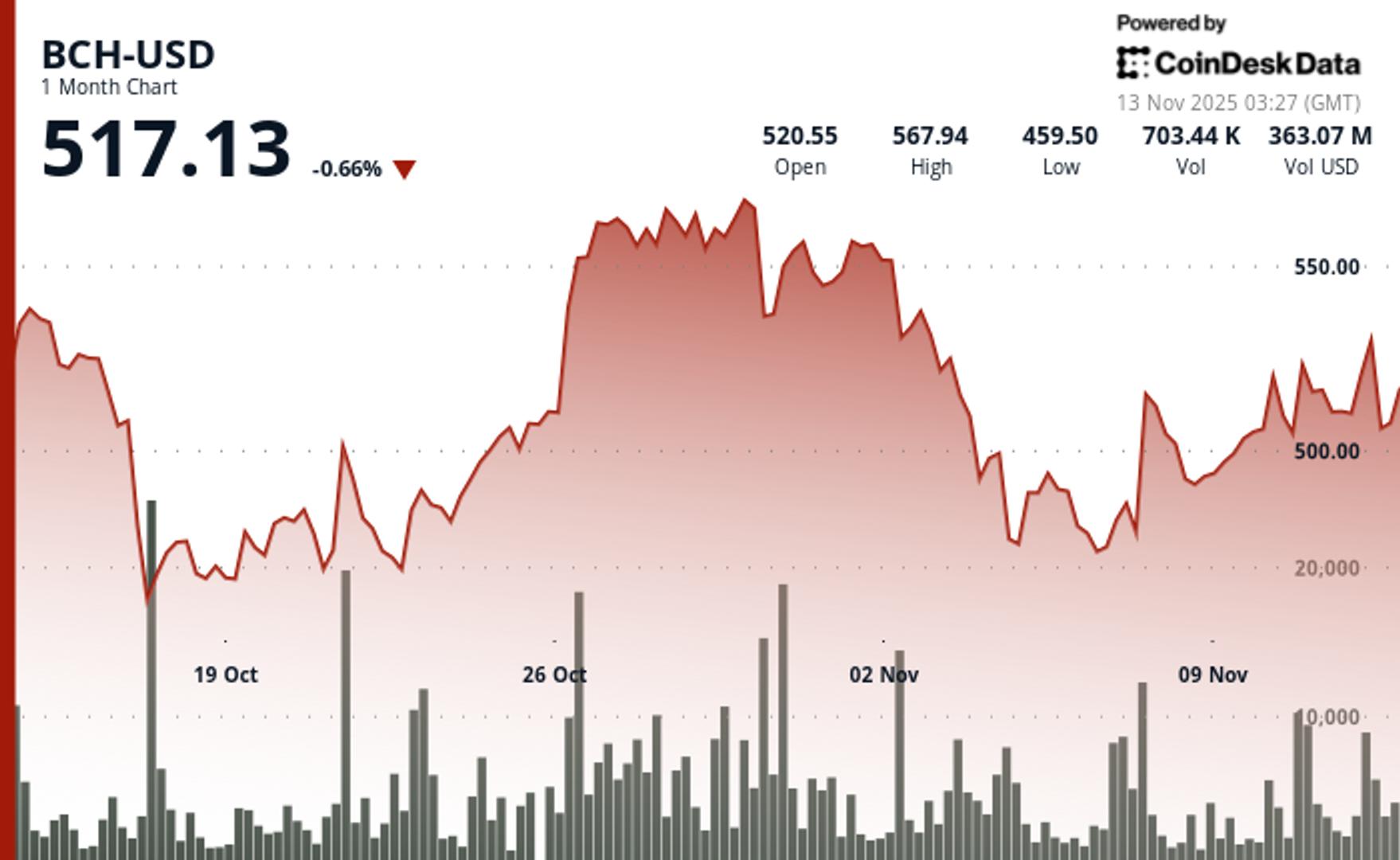

In line with CoinDesk Analysis’s technical evaluation knowledge mannequin, posted strong positive aspects throughout Wednesday’s session, advancing 1.9% from $508.32 to $518.01 amid heightened volatility throughout crypto markets. The transfer established clear bullish momentum inside a $32.78 buying and selling vary, representing 6.4% intraday volatility as BCH outperformed whereas most altcoins stumbled at key resistance zones.

The decisive break got here at 13:00 UTC on Wednesday when BCH pierced resistance at $530.00 on distinctive quantity of 39.3K items — 158% above the 24-hour shifting common. After touching $532.16, the token consolidated in a descending channel with declining quantity whereas sustaining greater lows and cementing help at $515.00.

Latest 60-minute motion revealed a two-phase surge beginning at 02:35 UTC on Thursday, with BCH leaping from $516.34 to $521.66 on quantity of three,276 items earlier than pulling again towards $518.07. This sample examined resistance close to $521.50 earlier than establishing contemporary help round $518.00, reinforcing the broader bullish construction.

Technical momentum versus profit-taking

With no elementary catalysts driving BCH particularly, technical ranges dominated because the cryptocurrency navigated broader market chop. Whereas BTC confronted rejection close to $107,000 and most altcoins offered off from resistance, BCH’s maintain above $515.00 help steered accumulation by bigger gamers.

The post-breakout consolidation indicated wholesome worth discovery, with diminishing quantity throughout pullbacks displaying restricted promoting curiosity. Merchants now watch whether or not BCH maintains its technical edge as crypto markets work by way of overhead provide.

Key technical ranges sign continuation sample for BCH

Help/Resistance:

- Main help locked at $515.00 following profitable breakout sequence

- Secondary help zone between $499-503, examined twice on promoting waves

- Key resistance at $521.50 primarily based on latest 60-minute rejection patterns

- Higher goal stays $530-532 space from earlier session highs

Quantity Evaluation:

- Quantity surge to 39.3K items (158% above SMA) confirmed breakout validity

- Declining quantity throughout consolidation exhibits restricted distribution strain

- 60-minute quantity of three,276 items supported momentum testing greater

- Accumulation patterns evident above $515 help zone

Chart Patterns:

- Bullish pattern intact with greater lows maintained by way of consolidation

- Descending channel following breakout suggests managed profit-taking

- Two-phase motion exhibits continued institutional curiosity

- Help testing reinforces structural integrity of uptrend

Targets & Threat Administration:

- Speedy goal: $521.50 resistance retest with quantity affirmation

- Prolonged goal: Return to $530-532 breakout highs on follow-through

- Threat threshold: Break beneath $515.00 help alerts pattern failure

- Cease placement: Conservative exits beneath $499 help for swing trades

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.