The Financial institution of Canada stored the in a single day rate of interest at 5.00%, as anticipated. As acknowledged, the BOC stays involved about dangers to the inflation outlook, notably with regard to the persistence of underlying inflation. The central financial institution continues to watch wage development, company pricing practices, inflation forecasts and the provision and demand stability of the inner economic system.

In line with the BOC’s evaluation, the economic system will enter a interval of stagnation, with first quarter GDP development more likely to stay near zero. Nonetheless, as a result of a lift in abroad demand, which is aiding the restoration in spending, in addition to an anticipated pick-up in exports and enterprise funding, development is predicted to strengthen step by step by mid-year.

Consistent with its October forecast, the BOC tasks GDP development of 0.8% by 2024. Trying forward, the financial institution expects development of two.4%, which is stronger. With a year-end inflation charge of three.4%, the BOC’s important concern is inflation. Housing spending stays a significant contributor to inflation overshooting the goal. The primary half of the yr will see the inflation charge maintain at round 3%, in accordance with the central financial institution’s prediction. After that, the speed will doubtless decline additional and attain the two% goal by 2025.

Though the GDP forecast for 2024 is basically optimistic, the Financial institution of Canada stays involved about continued inflation. That is according to the info recorded in December and highlights the central financial institution’s concern over the long-term nature of doable inflation. Though the speed hikes are virtually thought-about full, it’s unlikely that they’ll decrease charges except inflation continues to enhance. Concerning the 2025 projection, they probably anticipate a big upturn, after a section of sluggish development. This may occasionally contain low rates of interest till 2025, which in accordance with their mannequin might be an element supporting development.

Tiff Macklem, governor of the BOC, challenged market forecasts of an upcoming charge lower. He expressed his concern over inflation dangers, which can be higher than earlier than and mentioned that the present argument facilities on how lengthy they need to preserve the present 5% coverage charge.

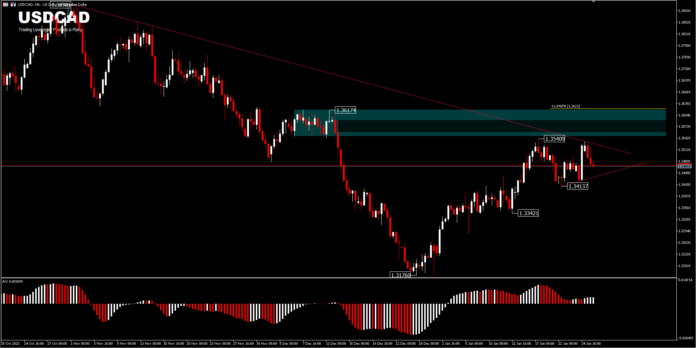

From a technical perspective, USDCAD held under 1.3540 regardless of a robust restoration in a single day, a lift from rising crude oil costs favoring the Canadian greenback as a commodity foreign money. Intraday bias stays impartial and extra consolidation might be seen. Nonetheless, additional rally is predicted so long as minor help at 1.3342 holds. The decline from 1.3898 ought to have accomplished at 1.3716. A break of the descending trendline and 1.3540 resistance may goal 1.3617 (61.8percentFR) value stage. Minor help of 1.3413 will attempt to include the draw back, earlier than touching 1.3342 help on the draw back.

In the meantime, USOIL crude oil costs proceed to enhance. Oil costs are on monitor to rise round 5% this week, as market fundamentals favor a bullish outlook. Official knowledge confirmed that US crude inventories plunged by 9.2 million barrels final week, surpassing market expectations and marking essentially the most important decline since August.

Knowledge additionally confirmed that the US economic system grew sooner than anticipated within the fourth quarter, whereas China introduced it might lower financial institution reserve ratios subsequent month and pledged to stabilize its capital market. On the provide facet, geopolitical tensions flared within the Center East this week, after US and UK forces launched extra strikes on armed group targets in Yemen, rising provide dangers within the oil-producing area.

In Friday’s buying and selling (Jan 26), USOil corrected under $77 per barrel, as China reportedly referred to as on Iran to assist include Houthi assaults on Crimson Sea transport or danger damaging enterprise relations with Beijing, serving to to ease market issues about provide disruptions.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is offered as a common advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.