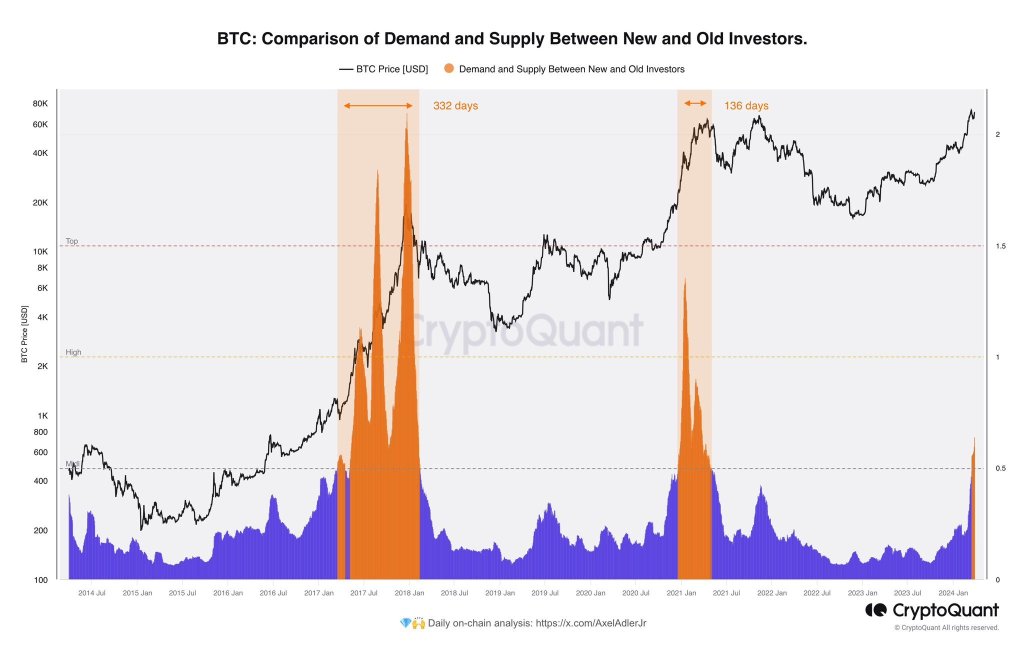

Ki Younger Ju, the founding father of CryptoQuant, a blockchain analytics agency, has observed a curious development. In a publish on X, the founder shared a snapshot suggesting that Bitcoin “outdated whales” is perhaps shifting their holdings to “new whales,” primarily conventional finance heavyweights like Constancy and BlackRock.

The USA Securities and Alternate Fee (SEC) not too long ago authorized these new whales to record spot Bitcoin exchange-traded funds (ETFs) for all traders.

“Outdated Whales” Shifting Cash: Promoting Or Danger Mitigation?

Whereas a definitive sell-off isn’t confirmed, commentators replying to the founder’s publish imagine these “outdated whales” may very well be mitigating danger. Of their evaluation, transferring their Bitcoin stash from self-custody to a regulated funding automobile like spot Bitcoin ETFs is a greater measure of protecting sudden eventualities.

If that is the strategy, then it might show strategic. Bitcoin holders can transact with out relying on a 3rd celebration. Notably, this growth coincides with a major drop in BTC stock on main exchanges like Coinbase and Binance, in addition to at GBTC.

The decline has accelerated for the reason that introduction of spot Bitcoin ETFs, hinting at a possible departure from exchanges. In the meantime, the operators of GBTC are unwinding the product and changing it to a spot Bitcoin ETF following a courtroom choice.

Will Spot BTC ETFs Achieve Traction?

Even so, that “outdated whales” are transferring their cash to centralized merchandise like ETFs contradicts the core philosophy of BTC as a instrument for monetary self-sovereignty. Whether or not extra customers, primarily retailers, will select to personal spot Bitcoin ETF shares relatively than the underlying cash immediately stays to be seen.

Establishments is perhaps obliged by regulation to make use of a regulated product in the event that they should be uncovered to BTC. Nonetheless, retailers can select to purchase immediately from exchanges or mine. This freedom may result in extra retailers opting to purchase BTC.

This development emerges forward of the extremely anticipated Bitcoin halving. This occasion is about for mid-April 2024 and can additional cut back BTC’s circulating provide, probably driving larger costs. Earlier than then, BTC costs are agency, regular above $70,000 on the time of writing.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site totally at your individual danger.