Andy Burnham says it is time for the UK to cease being in hock to the bond markets. The Metropolis is in uproar, however who actually calls the photographs in Britain—the federal government we elect, or unelected financiers? On this video, I unpack Burnham’s problem, the myths about debt and borrowing, and why democracy—not markets—should resolve our future.

That is the audio model:

That is the transcript:

Andy Burnham has advised the media that it is time that the UK received past being in hock to the bond market. And he is proper, in fact, that’s clearly true, however let’s simply put all of this in context.

Andy Burnham was a Labour cupboard minister in Gordon Brown’s authorities in 2009 and onwards, and he was effectively revolutionary on the time, however no person who stood out from the gang.

A number of years in the past, he determined to go away Parliament. He turned the mayor of Manchester. He is been elected for his third time period now, and folks assume he is been fairly profitable in an space which stays hardcore Labour all through. However, and exactly as a result of he has been profitable in Manchester, some Labour members on the supposed left of the occasion are actually viewing him as a successor to Keir Starmer, and what he says is subsequently being picked up within the media.

I wish to contextualise this. I watched Burnham stand towards Jeremy Corbyn in 2015, and his arguments on economics had been, to be well mannered, fairly weak. I believe he is come a good distance since then as a result of what he is now mentioned reveals a a lot deeper understanding of each the wants of society and the wants of the financial system.

However let’s return to that time. Do we have to cease being in hock to the bond markets, as a result of the very fact is, the Metropolis is panicking about his feedback. They’re saying that they need to improve the worth of presidency borrowing now in case Andy Burnham does, by some means or different, and I very a lot stress that by some means or different, when he is not even a Labour MP, develop into chief of the Labour Get together and Prime Minister in substitute to Keir Starmer. And others are accusing Andy Burnham of getting a cavalier angle in the direction of the wants of the Metropolis of London.

So, let’s simply unpack all of this.

To begin with, the possibilities of Andy Burnham changing into chief of the Labour Get together anytime quickly are exceptionally distant. So all of this can be a little bit hypothetical. However from the sidelines, Andy Burnham can nonetheless affect debate, and in that sense, that is necessary. What he is saying is that bond markets shouldn’t be operating the UK financial system, and this authorities clearly thinks that the bond markets do run the UK financial system.

Rachel Reeves says she should hold them comfortable.

Keir Starmer says he has to maintain them comfortable, or we can have a Liz Truss second, one thing I’ll come again to in a couple of minutes.

Markets nod sagely in settlement, as do all of the market commentators who imagine that the markets rule, and naturally, Rachel Reeves has put in place fiscal guidelines that affirm all of this.

Any suggestion of a problem to this establishment conference results in market tantrums, and that is precisely what Andy Burnham is creating. And what markets wish to assume is that they maintain a veto over democracy, and he is having the temerity to face up and say possibly they do not.

Let’s take a look at what Andy Burnham truly advised.

He advised an enormous council home constructing programme. As someone answerable for native authorities, it is hardly stunning that he is aware of that that is essential.

As someone answerable for what goes on in Manchester, once more, it is hardly stunning that he sees the necessity for this. We’ve got a fully vital scarcity of social housing within the UK, and council housing, most of all, and subsequently what he is proposing is just not solely essential, however it’s elementary to making sure that we head off the risk from the fascist right-wing.

Andy Burnham can also be speaking in regards to the nationalisation of utilities, beginning, clearly, with water, the place we have now a transparent failure of all the things that has occurred since privatisation, and he is aware of that the price of that is comparatively low as a result of, to start with, the bonds are simply merely issued; no person has to lift any cash to really pay the worth of shopping for these utilities. And secondly, the worth that can be paid will take into accounts the buying and selling of those corporations and in most of the utilities that he needs to nationalise, frankly, issues are wanting fairly commercially poor, and subsequently, the worth to be supplied is low.

And he needs to attain these two core targets which precisely match with the desires of Reform voters, let me stress, by taxing the well-off extra, which is, in fact, simply doable as I present in my Taxing Wealth Report, and he means that we’d want to lift possibly £40 billion of extra borrowing, or roughly in proportion to the £2,800 billion of presidency debt presently in concern, about 1.4% of the whole.

In different phrases, what he is saying is nothing very tough to think about, and it is fully potential to imagine it might be utterly politically widespread.

It is also, in fact, orthodox social democracy. That is what Labour is all about. What he is saying is true to the core Labour coverage.

They did create many of the UK’s social housing. Some, in fact, occurred earlier than World Struggle II, and it was not Labour’s duty. Liberals had an enormous function in that in some components of the nation as effectively. However funding in housing and infrastructure is Labour core coverage, and it creates property for the nation, vital property for the nation. It improves our wealth.

These items usually are not a burden. These items usually are not a legal responsibility. The associated fee – the curiosity paid – and that is it – is tiny compared to the advantages offered.

And what’s extra, nationalisation can scale back long-term prices, for instance, with regard to the advantages paid on housing alone. We might, in reality, pay the prices of recent social housing by making certain that housing profit was successfully no value to the federal government, as a result of folks can be residing in government-owned homes.

However nonetheless, the Metropolis is claiming that this danger is spooking markets. They declare that rates of interest should rise. They declare that at current, the 4.7% rate of interest payable on 10-year authorities bonds can be too low.

However let’s only for a second, take into consideration that price of 4.7%. 4% of it’s mainly decided by the truth that the Financial institution of England says its financial institution base price is 4%, and subsequently, why would the gilt price be lower than that? What’s extra, as we all know, the Financial institution of England is promoting £70 billion price of bonds into monetary markets within the subsequent yr – a determine method in extra, by the best way, of the quantity that Andy Burnham needs to promote into monetary markets for social functions – and the one motive the Financial institution of England needs to try this is to easily take liquidity out of monetary markets to drive the rate of interest on authorities borrowing greater, which is exactly what its coverage is. So the determine of 4.7%, which it prices at current to borrow if you’re the UK authorities, is precisely what the Financial institution of England has set, and has nothing to do with what markets have determined.

Andy Burnham is not spooking markets. He is making probably the most marginal change to one thing which, frankly, is being set by the Financial institution of England, and which may very well be minimize by them as effectively.

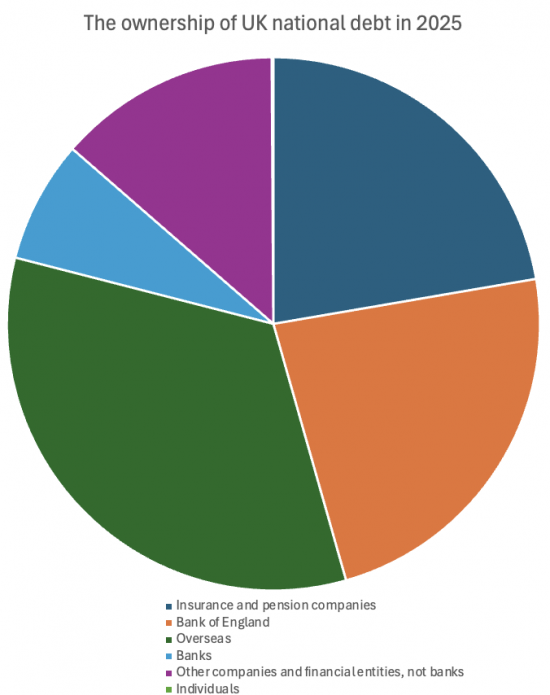

However simply to grasp this, let’s perceive who’s being spooked, as a result of let’s have a fast have a look at who owns the UK nationwide debt.

And this chart reveals the figures, however I am going to run via them simply in case.

Insurance coverage and pension corporations personal 22.3% of UK nationwide debt, slightly below 1 / 4, in different phrases.

Just below one other quarter is owned by the Financial institution of England. In different phrases, that debt would not even exist. Let’s be clear about it. If the federal government owns its personal debt, this is not a difficulty we have now to fret about.

So when market commentators – I heard Helia Ebrahimi say this on Channel 4 the opposite night time – say that the UK’s debt excellent is £2.8 trillion or £2,800 billion, she was speaking whole nonsense. The precise determine is just simply over £2 trillion as a result of the determine owned by the Financial institution of England is not actually debt in any respect, and but they do not wish to acknowledge that.

33.4% – or nearly precisely one third of UK nationwide debt – is owned by abroad buyers. Now, let’s be clear who they’re. A big a part of that sum is owned by international governments who maintain UK sterling balances within the possession of gilts as a result of they wish to personal sterling as a result of it’s nonetheless a world reserve foreign money, and commerce with the UK does, of their opinion, require that they maintain sterling, and to steadiness their total portfolios of international foreign money holdings, particularly at a time when the greenback is wanting decidedly doubtful as to worth, they should maintain sterling.

So most of that steadiness is international central banks , simply by the best way, as we personal balances in different currencies as effectively, as a result of that is a part of our abroad holdings. So there’s nothing uncommon about this abroad holding. A number of the relaxation, by the best way, is individuals who run commerce surpluses mainly with the UK: they promote extra into the UK than we purchase from them, and that is the steadiness left over, they usually go away that in deposits as effectively. However there’s nothing horrifying about that determine, regardless of all the things that individuals say.

Our banks solely personal 7.4% of UK authorities debt, a surprisingly low determine, however you do to some extent have to mix that with that determine for different monetary establishments and huge corporations who personal 13.5%, as a result of between the 2, relying on the time of the day, round 20% is owned for the needs of what’s referred to as the repo market, which is the in a single day London deposit market with regard to borrowing, which doesn’t depend on the deposit of money, however relies upon upon giant corporations shopping for bonds from banks, which they maintain in a single day and promote again to them the next morning. I do know it sounds daft- it sounds crazy- and it’s – however that is as a result of they do not belief the banks to go bust in a single day. In order that they wish to personal these property for the sake of that market.

So 20% of all authorities bonds are mainly owned for the needs of constructing certain that our giant monetary establishments within the UK can truly deposit cash in a single day after they aren’t utilizing it.

And on the backside of that listing, there’s simply 0.1% of all UK authorities bonds are owned by people, which is sort of extraordinary.

So who needs to panic if we have a look at these market sectors?

Insurance coverage and pension corporations do not, as a result of they wish to maintain bonds for the long run.

The Financial institution of England would not as a result of it’s the authorities.

Abroad buyers aren’t apprehensive by this. They’re getting a greater price of curiosity within the UK than they’re elsewhere. They are not going to be going wherever if a minor change within the degree of borrowing takes place.

And the opposite gamers mainly want this cash for purely sensible functions. So all of this discuss markets panicking is full and utter nonsense.

However two issues I stress. This discuss the truth that markets are, not directly, the people who find themselves driving the method is just not true. Markets aren’t driving this course of.

The markets, the folks behind, the monetary establishments within the Metropolis of London, the individuals who entrust cash to their care, usually are not panicking.

What we’re listening to is political speak by some people who find themselves claiming that taxpayers are going to be taken for a journey by folks like Andy Burnham. However all of that’s false. The people who find themselves speaking are those that wish to defend the elite privileges of those that commerce in bonds within the Metropolis of London and who see nice benefit by creating market turmoil as a result of they have an inclination to make some huge cash out of it, and, who imagine, they act within the pursuits of the wealthier a part of the British public, as a result of, in fact, they do dominate the possession of pensions and life assurance funds behind the scenes.

However, these bond merchants who’re sending out these messages about how horrible Andy Burnham is usually are not elected. They’re making an attempt to say a veto over energy. They could oppose social housing and the nationalisation of utilities, and the enlargement of public funding. They is likely to be fearful about the truth that Andy Burnham may wish to scale back their speculative revenue alternatives, however they’re solely involved about themselves. They are not involved about society.

And the explanation why they’re spooked is that there is a politician on the horizon who’s calling them out.

Now, let’s be clear, markets can transfer in surprising methods. We did see that with Liz Truss in 2022, however that was a posh story, way more advanced than I’ve received time to elucidate now. And many of the response to what Liz Truss did was due to the simultaneous motion of the Financial institution of England to announce that it was going to massively develop its bond gross sales, and that is what brought about the crash, Liz Truss did not. I am not letting her off on the grounds of competence or the rest; she was clearly absurd, hopelessly out of her depth; her funds with Kwasi Kwarteng was completely incoherent, and markets did react adversely. However all I am saying is that they reacted adversely to the Financial institution of England simply as a lot as they reacted adversely to her.

But when someone explains what they’re doing, and that was the elemental drawback of what occurred in September 2022, when Truss was round, as a result of she did not clarify what she was doing – if someone does clarify they’re utilizing borrowing to fund property and that this isn’t a tax giveaway, then there’s little or no prospect of an actual unhealthy market response, due to course, monetary markets are completely used to folks borrowing to fund asset funding. That is what they’re meant to be doing on a regular basis, day in, day trip. So actually, the Metropolis is speaking nonsense now, and if this truly occurred, there can be no market response.

In different phrases, Andy Burnham is true. The UK should transfer past being in hock to monetary markets, and it may transfer past being in hock to monetary markets.

The very fact is that, as fashionable financial principle reveals, we do not even must borrow as an issuer of our personal sovereign foreign money. We concern bonds as a result of the Metropolis of London, and pension funds, and life assurance funds, and abroad governments, and abroad people, or extra probably establishments who wish to save within the UK, want these to facilitate their very own monetary portfolios, however not as a result of the federal government does, as a result of it may by no means run out of cash, and it may all the time borrow from the Financial institution of England.

And the very fact is that that is proven by that 0.1% of bonds which might be in particular person possession. There is no such thing as a motive for the federal government to concern bonds. It does so as a result of the Metropolis – however nobody else – wants them.

So Labour should select: is it going to be the Metropolis’s messenger? Or is it going to advertise a politics of care, which is what Andy Burnham appears to be speaking about to me?

The politics of care calls for truth-telling. That requires that we are saying the state has the facility to speculate responsibly. It’s got the facility to fund its personal actions if it needs. It’s got the choice of cooperating with the Metropolis if the Metropolis needs to put funds with it, which we name borrowing, however which is de facto deposit-taking. And the reality is, bond markets are a risk to democracy in the best way we deal with them now, they usually must be put of their place.

It is time to cease bowing to the Metropolis of London.

It is time to declare that democracy should win.

It is time to declare that persons are the precedence and financiers aren’t.

That is what Andy Burnham is doing. What do you assume?

We have got a ballot beneath.

Do you assume that the Metropolis of London must be put again in its field?

Do you assume that the federal government ought to deal with it as somebody who deposits funds with it relatively than somebody it borrows from?

Do you assume the priorities of individuals ought to come first?

Tell us.

Ballot

Taking additional motion

If you wish to write a letter to your MP on the problems raised on this weblog submit, there’s a ChatGPT immediate to help you in doing so, with full directions, right here.

One phrase of warning, although: please guarantee you might have the right MP. ChatGPT can get it flawed.

Feedback

When commenting, please pay attention to this weblog’s remark coverage, which is offered right here. Contravening this coverage will end in feedback being deleted earlier than or after preliminary publication on the editor’s sole discretion and with out rationalization being required or supplied.

Thanks for studying this submit.

You possibly can share this submit on social media of your alternative by clicking these icons:

There are hyperlinks to this weblog’s glossary within the above submit that specify technical phrases utilized in it. Comply with them for extra explanations.

You possibly can subscribe to this weblog’s every day electronic mail right here.

And if you want to assist this weblog you’ll be able to, right here: