Key Factors

- In accordance with crypto analyst PelinayPA, there’s a 55% chance that the Bitcoin (BTC) bull run will not be over but.

- The statement was substantiated by the inactivity of the long-term BTC holders regardless of the market crash.

- Not all agree with PelinayPA’s view; in keeping with them, the bullish run is already over and a dip to $102k is inevitable.

In accordance with crypto analyst PelinayPA, there’s a 55% chance that the Bitcoin (BTC) bull run will not be over but. The statement was substantiated by the inactivity from the long-term holders regardless of the market crash and the tumultuous instances that adopted.

Why Analysts Stay Optimistic a couple of Bullish Run?

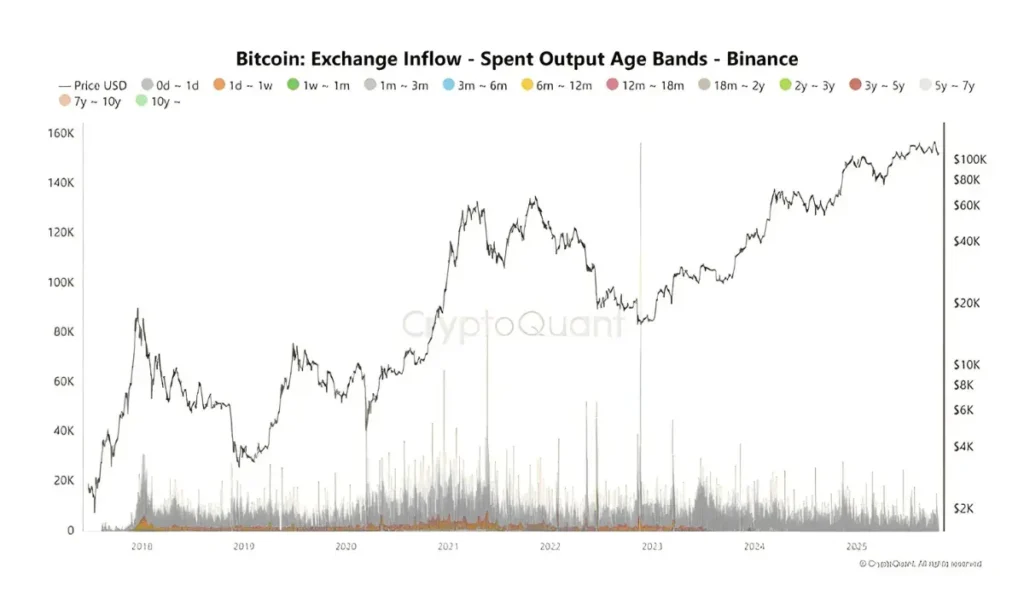

In accordance with PelinayPA, it’s the short-term sellers who’re taking income or transferring the BTCs to exchanges. The short-term sellers capitalize on small worth fluctuations. Whereas they switch the BTC to exchanges for quicker accessibility amid the unstable surroundings, the upper trade inflows flag promoting intention. However, it is probably not the all-encompassing view because the Bi switch is basically restricted to new entrants and short-term traders.

Supply: CryptoQuant

The long-term BTC holders, starting from 6 months to a long time, presently stay unwavering even with mounting macro stress, suggesting that their confidence within the flagship token stays fairly strong. Regardless of the optimism, the analyst will not be ruling out a near-term dip into $102K. In addition to, it’s price noting that there are some high-level whale actions being reported, as an example, a Satoshi-era whale moved $1.18B BTC to Kraken, elevating liquidation fears.

Furthermore, not all agree with PelinayPA’s view; in keeping with them, the bullish run is already over. Regardless of the blended views, many of the crypto analysts agree {that a} dip into $102k is inevitable within the quick time period.

How is BTC Faring Now?

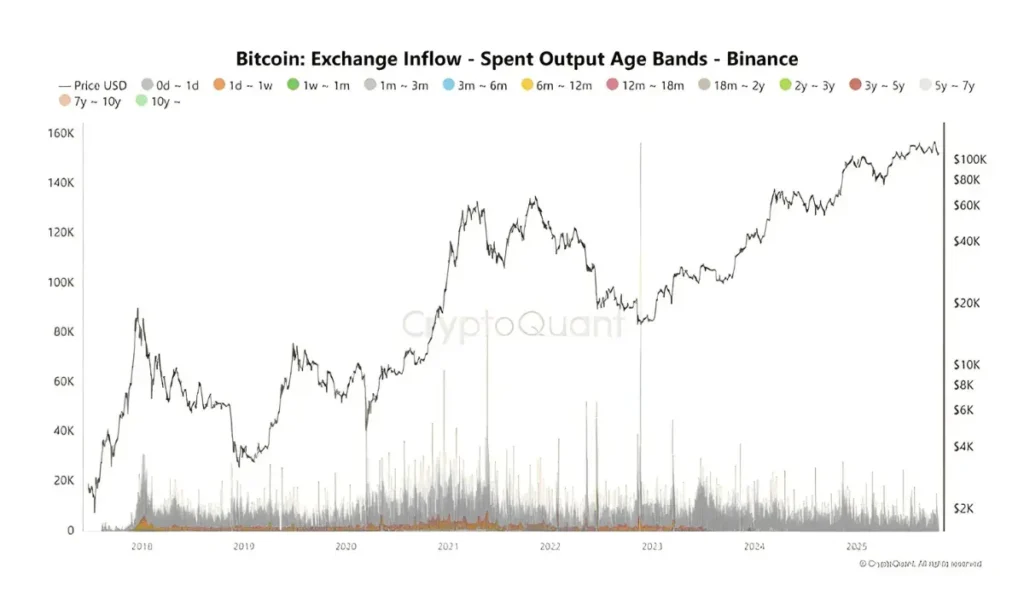

At press time, the bitcoin worth is round $108,693.41, with the value dropping by 0.78% inside a day’s framework.

Supply: TradingView

BTC had earlier failed to carry $113k assist stage, and the subsequent Fibannoci assist ranges out there are at $106k and $102k. Traders are carefully watching as the value is nearing key assist ranges.

On the technical aspect, each market oscillators and transferring averages are sending bearish alerts. Whereas the 14-day Relative Index stays impartial, the value is presently beneath the 10-day Easy Shifting Common. The Worry and Greed Index worth of 25 suggests excessive concern. Though the technical evaluation is unfolding a grim situation, the BTC has sturdy fundamentals, and the institutional actions stay strong, as indicated by the online ETF influx of $400.27 million on October 21.

Nonetheless, the whale exercise stays one other main reason behind concern. A high-profile dealer, Owen Gunden, reportedly moved 10,959 BTC ($1.18B) to Kraken on October 22, sparking fears of liquidation. On high of it, the gold worth crashed to document lows, dragging BTC’s costs as effectively.

The Backside Line: What’s the Street Forward?

The general market sentiment stays bearish because the macro uncertainties stay intact with the continued U.S authorities shutdown. Traders are really useful to observe a cautious method whereas making funding selections throughout unstable instances. Correct danger evaluation and danger minimization methods, resembling portfolio diversification, will help traders keep away from greater losses.