Affirm offered earnings (PDF Complement right here) after the bell immediately and so they produced a formidable report, exceeding analysts’ expectations with stable progress in all areas of the enterprise.

The BNPL pioneer reported a Gross Merchandise Quantity (GMV) enhance of 32% year-over-year, reaching $7.5 billion, alongside a notable income surge of 48% to $591 million.

The variety of lively shoppers grew by 16% to 17.1 million, with transactions per lively shopper additionally on the rise. The expansion in lively retailers by 15% to 279,000 reveals growth in its enterprise community. Nevertheless, the earnings presentation additionally hints at challenges in managing working bills, emphasizing strategic changes to take care of profitability amidst fast progress.

Partnerships have performed a pivotal position in Affirm’s progress, with the corporate establishing relationships throughout a variety of classes. This diversification technique not solely expands Affirm’s market presence but additionally mitigates dangers related to dependence on a restricted variety of sectors. The notable progress in lively retailers by 15% year-over-year to 279,000 additional demonstrates Affirm’s increasing ecosystem and its attraction to companies searching for to supply versatile fee options.

Affirm’s monetary well being can also be highlighted by its income much less transaction prices, which noticed a year-over-year enhance of 68%. This enchancment in profitability metrics signifies efficient price administration and operational effectivity. Furthermore, the corporate’s strategic changes in working bills and the continued give attention to know-how and knowledge analytics are pivotal in supporting its progress trajectory whereas sustaining a lean operational mannequin.

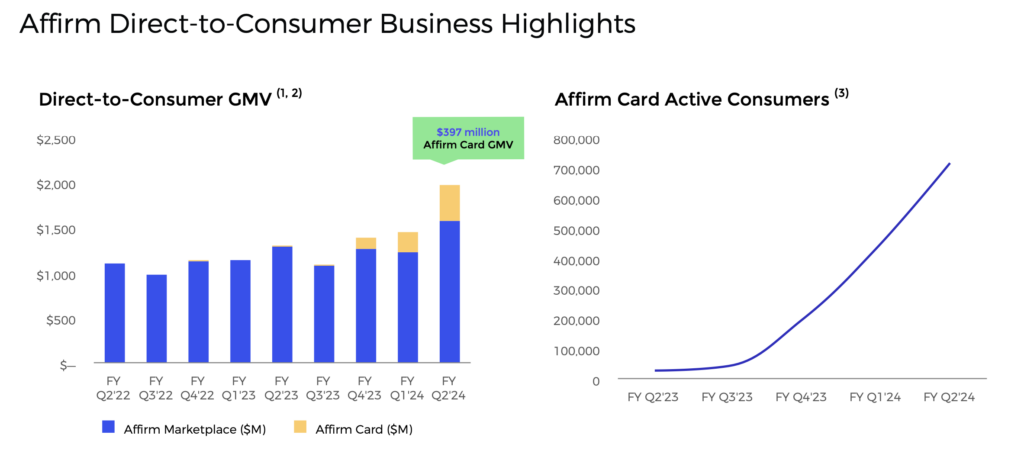

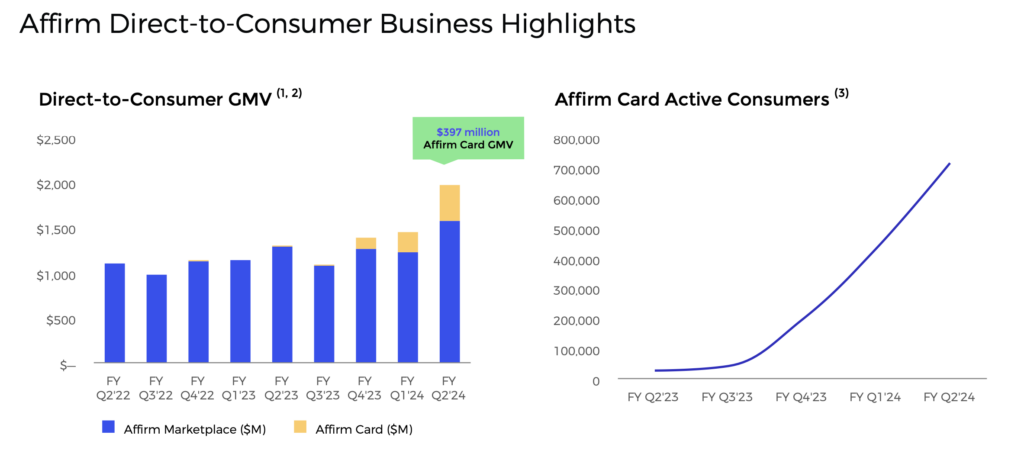

Affirm launched the Affirm Card in 2021 however within the final 12 months utilization has considerably picked up. There are actually greater than 700,000 shoppers with the debit card that may used to show any buy right into a “pay over time” buy. Virtually $400 million in purchases had been made on the Affirm card within the final quarter.

What was interested in this earnings name is that there was no ready assertion. CEO Max Levchin merely stated, “As is our customized, the higher the outcomes, the less phrases we use to touch upon them. This time round, I really feel adequate to go on to the Q&A.”

So, the Q&A piece was your entire earnings name and the massive group of analysts peppered Levchin and CFO Michael Linford with questions. They mentioned the combination and efficiency of their BNPL providers with main retailers, strategic strikes to navigate the evolving regulatory panorama, and plans for worldwide growth. There was additionally a give attention to technological developments to enhance underwriting and fraud detection and insights into how shopper conduct traits are shaping product choices. Moreover, Affirm’s method to managing credit score danger and its affect on future profitability was a spotlight.

Buyers weren’t that happy, regardless of the stable outcomes. Affirm’s inventory has had a terrific final six months, it’s up over 200%. And although the corporate beat expectations it was not adequate for traders and the inventory value was down greater than 12% in after-hours buying and selling.