As a taxpayer, you’ve undoubtedly heard about adjusted gross earnings, or AGI, which performs a pivotal function in your taxes. Let’s take a deep dive into what AGI is and why it’s so essential.

Word: The One Huge Lovely Invoice (OBBB) is now being referred to by lawmakers because the Working Households Tax Cuts. You may even see one or each names used on this article, however they check with the identical set of tax adjustments.

At a look:

- AGI is your gross earnings minus particular changes, which the IRS makes use of to find out your taxable earnings.

- Calculate your AGI by subtracting changes out of your gross earnings.

- Your AGI can decide your eligibility for sure tax breaks.

What’s adjusted gross earnings (AGI)?

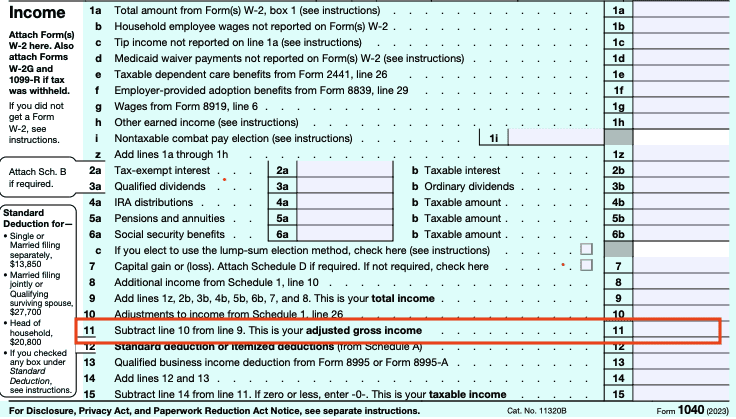

Basically, your AGI is your gross earnings minus any changes. The Inside Income Service (IRS) makes use of your AGI to find out how a lot tax you owe, and it may affect which tax deductions and credit you’ll be able to take. It’s famous on line 11 of IRS Type 1040:

Understanding gross earnings

To know AGI, we first must outline gross earnings. Gross earnings is the whole earnings you earn in a yr earlier than any taxes or different deductions are taken out.

Frequent kinds of gross earnings

Different kinds of gross earnings

- Alimony acquired: Funds acquired from a former partner (just for divorces finalized earlier than 2019).

- Royalties: Earnings from mental property similar to patents, emblems, or books.

- Playing winnings: Any cash you win from playing actions, together with lotteries, casinos, and betting swimming pools.

Changes to earnings

You will need to make sure changes to your gross annual earnings to calculate your AGI. Is sensible, proper? These changes are particular bills that the IRS permits you to subtract out of your gross earnings. They’re additionally typically referred to as above-the-line deductions — “the road” refers to your calculated AGI in your federal earnings tax return (Type 1040).

The deductions you can also make rely in your private tax state of affairs. We’ll spotlight some frequent earnings changes under, however don’t fear an excessive amount of about them. Should you use TaxAct®’s DIY tax preparation software program, we’ll ask you detailed questions to find out what particular deductions you qualify for and information you thru the tax submitting course of.

Frequent changes to earnings (as of tax yr 2025)

- Educator bills: Academics can deduct as much as $300 of out-of-pocket prices for classroom provides like books and tools.

- Pupil mortgage curiosity: Eligible college students could deduct as much as $2,500 of curiosity paid on scholar loans.

- IRA contributions: Contributions to a conventional IRA could also be deductible relying in your earnings.

- Well being financial savings account (HSA) contributions: You probably have a high-deductible well being plan, contributions to an HSA are deductible.

- No tax on ideas deduction: This new tax break helps you to deduct certified tip earnings. This deduction was launched by the Working Households Tax Cuts.

- No tax on extra time deduction: Additionally a part of the Working Households Tax Cuts, this tax profit helps you to deduct certified extra time compensation.

- Automobile mortgage curiosity: One other new tax break for curiosity paid on a certified passenger car mortgage.

Different changes to earnings

- Self-employment tax: Self-employed people can deduct half of their self-employment tax.

- Self-employed medical insurance: Should you’re self-employed, you’ll be able to deduct the price of your medical insurance premiums.

- Transferring bills for navy: Lively-duty Armed Forces members can deduct navy shifting bills if the transfer is because of a navy order.

- Penalty on early withdrawal of financial savings: Should you withdrew cash early from a CD or one other time-deposit financial savings account, you would possibly be capable of deduct the penalty.

- Sure enterprise bills: Some professionals can deduct particular work-related bills.

- Contributions to SEP, SIMPLE, and certified plans: Self-employed people can deduct contributions to sure retirement accounts.

- Alimony paid: For divorces finalized earlier than 2019, alimony funds are deductible.

Methods to calculate adjusted gross earnings defined

Calculating your AGI is simple if you happen to observe these steps:

- Begin along with your gross earnings: This consists of all of your earnings from wages, investments, and different sources mentioned above.

- Subtract changes to earnings: Deduct the allowed changes similar to educator bills, scholar mortgage curiosity, and HSA or IRA contributions.

Need assistance? Check out TaxAct’s easy-to-use AGI calculator.

Instance AGI calculation

Let’s assessment a extra detailed instance for instance the way to calculate AGI with a number of kinds of earnings and changes.

Think about your whole gross earnings for the yr as a single taxpayer consists of:

- Wages: $50,000

- Rental earnings: $10,000

- Dividends: $2,000

- Enterprise earnings: $8,000

- Playing winnings: $500

Including all these collectively, your whole gross earnings can be $70,500.

Subsequent, let’s say you had the next changes:

- Pupil mortgage curiosity: $2,000

- IRA contributions: $3,000

- Well being financial savings account contributions: $1,000

- Self-employment tax deduction: $565 (half of $1,130)

- Self-employed medical insurance: $2,500

Including these collectively, your whole changes can be $9,065.

Lastly, subtract your changes out of your gross earnings to seek out your AGI: $70,500 (gross earnings) – $9,065 (changes) = $61,435 AGI.

FAQs about AGI

The underside line

Understanding your AGI is crucial for tax planning functions. By making the most of tax advantages and changes, you’ll be able to doubtlessly decrease your taxable earnings and general tax invoice. And don’t neglect, TaxAct may also help you declare useful tax deductions and simplify tax submitting once you use our DIY tax prep software program.

For extra in-depth studying, you’ll be able to go to the IRS web site on AGI.

This text is for informational functions solely and never authorized or monetary recommendation.

All TaxAct provides, services are topic to relevant phrases and situations.