In case you bought medical insurance protection via the Well being Insurance coverage Market, you may have to file IRS Kind 8962 along with your federal earnings tax return. This type helps decide should you’re eligible for the Premium Tax Credit score (PTC) and whether or not you might want to repay any extra credit score or declare extra credit score as a tax refund.

Don’t fear — we’re right here that will help you perceive this essential doc and file Kind 8962 with out the effort once you’re prepared. Right here’s what you might want to know.

At a look:

- Kind 8962 helps reconcile your Premium Tax Credit score (PTC) with any Advance Premium Tax Credit score (APTC) acquired.

- In case you obtained an excessive amount of APTC, chances are you’ll have to repay extra APTC. In case you qualify for extra PTC, it may improve your tax refund.

- TaxAct simplifies submitting Kind 8962 to make sure you declare the appropriate medical insurance tax credit.

What’s IRS Kind 8962?

Kind 8962 helps you establish should you acquired the correct amount of Premium Tax Credit score (PTC) in your Market medical insurance protection in a professional well being plan. In case you acquired Advance Premium Tax Credit score (APTC) funds to assist decrease your month-to-month premiums, this type makes positive you’re reconciling tax credit accurately once you file your federal earnings tax return.

In plain discuss, it helps the Inner Income Service (IRS) decide whether or not you acquired the appropriate credit score quantity based mostly in your family earnings and different components. You might need to repay a few of the credit score should you acquired an excessive amount of. In case you didn’t obtain sufficient, chances are you’ll get an even bigger tax refund.

What’s the premium tax credit score?

The PTC is a tax credit score designed to assist eligible people and households afford medical insurance protection bought via the Well being Insurance coverage Market. The quantity of PTC you qualify for relies on your family earnings, tax household dimension, and the price of your space’s Second Lowest Value Silver Plan (SLCSP).

You may also select to take advance fee of Premium Tax Credit score (APTC). Market might also refer to those funds as a subsidy. The APTC is a portion of the PTC paid on to your medical insurance supplier all year long, lowering your month-to-month premium prices. Principally, you obtain the tax credit score upfront all year long as an alternative of ready to assert the total credit score once you file your tax return.

Nonetheless, the APTC relies on estimated family earnings, that means you will need to reconcile it once you file your tax return utilizing Kind 8962. In case your precise earnings is greater than you estimated, chances are you’ll have to repay extra advance PTC funds. Whether it is decrease, chances are you’ll be eligible for extra PTC, which may improve your tax refund.

PTC eligibility necessities

- You have been enrolled in medical insurance protection via the Market for a minimum of one month of the calendar yr.

- You didn’t qualify for an employer-sponsored plan thought-about inexpensive in your earnings stage.

- You weren’t eligible to enroll in a authorities program corresponding to Medicare, Medicaid, or CHIP.

- You fall inside sure family earnings limits.

- Nobody else can declare you as a dependent on their tax return.

- Your submitting standing isn’t married submitting individually.

- Notice: There are exceptions for some victims of home abuse and spousal abandonment — the IRS addresses these eventualities on its PTC FAQ web page.

Widespread phrases defined

- Premium Tax Credit score (PTC): A tax credit score that helps decrease medical insurance premiums for eligible taxpayers.

- Advance Premium Tax Credit score (APTC): Parts of the PTC paid upfront to assist cowl medical insurance plan prices all year long.

- Second Lowest Value Silver Plan (SLCSP): The benchmark plan used to calculate your PTC quantity, based mostly on plans out there in your Market protection space.

- Federal poverty line (FPL): A measure of earnings used to find out eligibility standards for particular packages and advantages, together with the PTC. See the FPL chart on healthcare.gov.

- Family earnings: The overall earnings for all relations in your tax return, used to find out your PTC eligibility.

Why is tax Kind 8962 essential?

Kind 8962 ensures that taxpayers obtain the right amount of PTC and account for any variations between their estimated and precise family earnings for the yr. In case your family earnings was greater than you estimated, you might need to repay extra APTC. However should you earned lower than anticipated, you might qualify for further PTC, which may imply the next tax refund. Both means, Kind 8962 helps make sure you get the correct amount of tax credit for medical insurance and keep according to IRS guidelines.

In brief, submitting Kind 8962 ensures you:

- Reconcile advance funds of the Premium Tax Credit score (APTC).

- Declare the right amount of PTC should you’re eligible for extra credit score.

- Keep compliant with IRS tax submitting necessities associated to the Inexpensive Care Act.

Who must file Kind 8962?

You should use Kind 8962 if:

- You bought medical insurance via the Well being Insurance coverage Market.

- You or a member of the family in your tax family acquired the APTC.

- You need to declare the Premium Tax Credit score (PTC) once you didn’t obtain an advance fee.

You gained’t want this type should you didn’t get insurance coverage via the Market.

Kind 8962 instance

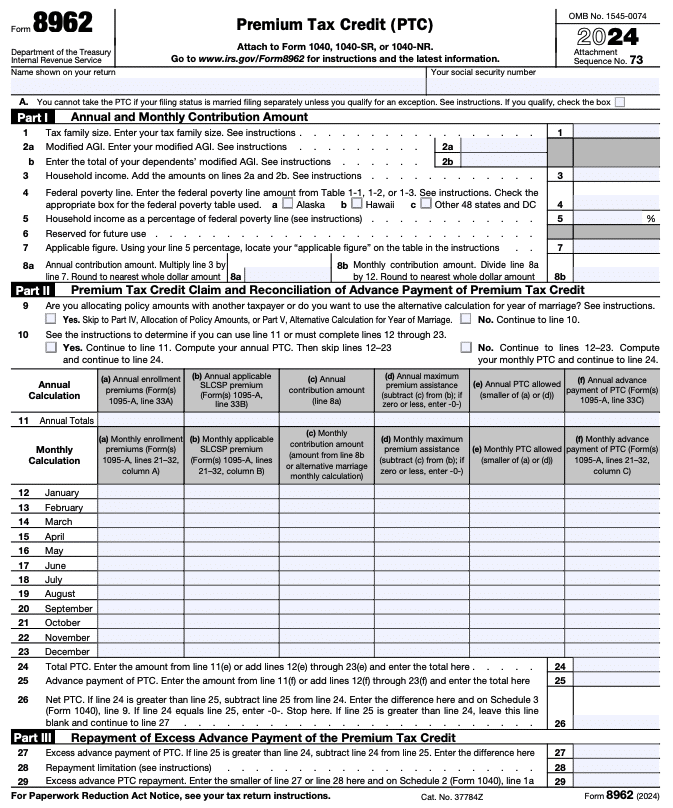

IRS Kind 8962 (web page 1) appears to be like like this:

Instance eventualities: Reconciling the PTC

- Underestimated earnings: When making use of for Market protection, Juan underestimated his family earnings by $10,000. Based mostly on his estimate, his household acquired $2,400 in APTC ($200 per thirty days). Nonetheless, together with his precise earnings, he was solely eligible for $1,200 in PTC. When he recordsdata his federal earnings tax return, he should repay the surplus APTC of $1,200, which is able to cut back his tax refund or improve the quantity he owes, relying on his tax scenario.

- Overestimated earnings: As a result of a job loss, Sarah overestimated her family earnings by $15,000 throughout the well being protection enrollment course of. She was initially granted solely $800 in APTC for the yr ($67 per thirty days), however along with her precise earnings, she qualifies for $2,000 in PTC. Since she acquired too little APTC, she will declare a further $1,200 as a tax refund when she recordsdata Kind 8962 along with her federal earnings tax return.

Kind 8962 directions: How one can fill out Kind 8962

To fill out Kind 8962, you want Kind 1095-A (Well being Insurance coverage Market Assertion), which gives particulars about your insurance coverage protection.

Right here’s a step-by-step information for once you’re able to file. (Or, if you wish to make issues simple, simply let our tax preparation software program stroll you thru the Kind 8962 submitting course of.)

Half I: Annual and Month-to-month Contribution Quantities

First, write your title and Social Safety quantity (SSN) on the high of the shape.

- Enter your family earnings, tax household dimension, and modified adjusted gross earnings (MAGI) out of your Kind 1040.

- Calculate your family earnings as a share of the federal poverty line (FPL) utilizing the IRS directions.

- Decide the annual and month-to-month contribution quantities you’re anticipated to pay towards your medical insurance premiums.

Half II: Premium Tax Credit score Declare and Reconciliation of Advance Premium Tax Credit score

This part helps you calculate the PTC you qualify for and examine it in opposition to any APTC you acquired.

- In case you had Market protection for the entire yr, enter your annual totals on Line 11.

- In case your protection modified all year long, use the month-to-month breakdown supplied.

- By the top of Half II, you’ll decide three key quantities:

- Line 24: Your whole PTC.

- Line 25: The APTC you acquired.

- Line 26: Your web PTC. If Line 24 is larger than Line 25, you get a tax credit score; if Line 25 is larger, depart this line clean and proceed to Half III. If the quantities are equal, enter zero and cease there.

Half III: Compensation of Extra APTC

In case you acquired extra APTC than you have been eligible for, you may have to repay extra APTC. That is the place Half III is available in.

- Line 27: Subtract Line 24 from Line 25 to seek out any extra APTC.

- Line 28: Enter the reimbursement limitation (test Desk 5 within the irs.gov directions to see if a reimbursement cap applies based mostly on earnings).

- Line 29: Enter the smaller of Line 27 or Line 28 — that is the quantity you might want to repay in your Kind 1040.

Half IV: Shared Coverage Allocations

In case you shared a medical insurance coverage with somebody exterior your tax household (e.g., you bought a divorce throughout the tax yr), chances are you’ll have to allocate the Premium Tax Credit score between tax filers. This part permits you to break up coverage quantities pretty based mostly on agreed percentages. You’ll have to seek the advice of with the opposite tax household to find out how you’ll break up reconciling any APTC repayments if wanted.

Half V: Different Calculation for Marriage

This part is simply for individuals who obtained married throughout the tax yr. It determines whether or not you need to use the choice calculation for the yr of marriage to cut back your extra APTC reimbursement.

Kind 8962 FAQs

How one can file Kind 8962 with TaxAct

TaxAct will help you simply file Kind 8962 once you e-file with us. To get began, seize your Kind 1095-A and comply with these steps to enter your info:

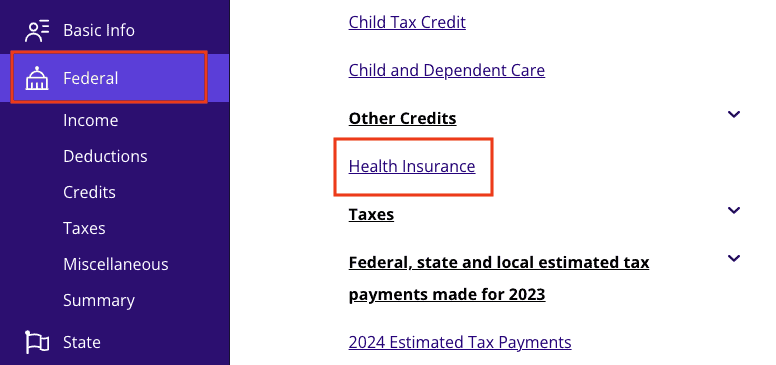

- From inside your TaxAct return (On-line or Desktop), click on Federal. (On smaller units, click on within the high left nook of your display screen, then click on Federal).

- Click on Well being Insurance coverage as proven beneath.

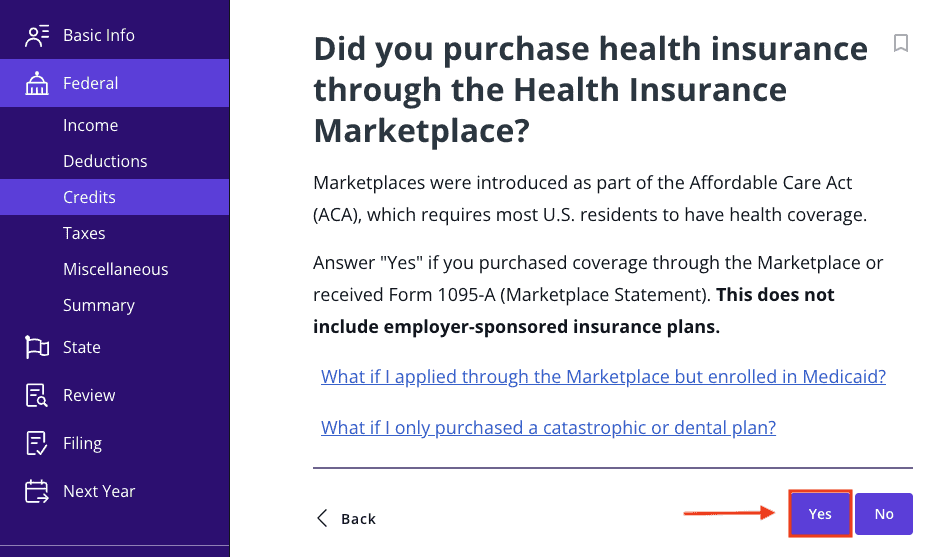

3. Click on Sure, as proven beneath, after which click on Proceed.

4. Proceed with the interview course of to enter your info. TaxAct will use your solutions to fill out Kind 8962 for you.

The underside line

Submitting Kind 8962 ensures you’re accurately reconciling tax credit in your medical insurance premiums. Whether or not you might want to repay extra APTC or declare extra Premium Tax Credit score, TaxAct will help you file with confidence.

This text is for informational functions solely and never authorized or monetary recommendation.

All TaxAct provides, services are topic to relevant phrases and situations.