In response to experiences, Dogecoin confronted a pullback this week at the same time as indicators of shopping for curiosity appeared on charts and in company coffers.

Associated Studying

DOGE traded at $0.251 on the time of reporting, down 4.8% over the previous 24 hours however up 2.5% for the final seven days.

The coin opened the week close to $0.27 and slipped below $0.25 as sellers pressured the market.

CleanCore Expands Dogecoin Treasury

Stories have disclosed that CleanCore Options has been including to its Dogecoin holdings and now holds greater than 710 million DOGE as a part of a plan to succeed in a one-billion coin goal.

The corporate’s treasury reveals over $20 million in unrealized positive factors. CleanCore mentioned the buildup follows a $175 million non-public placement accomplished on September 5, 2025, and that Bitstamp by Robinhood is its chosen buying and selling venue for the purchases.

The Dogecoin Basis and Home of Doge are listed as companions within the broader initiative.

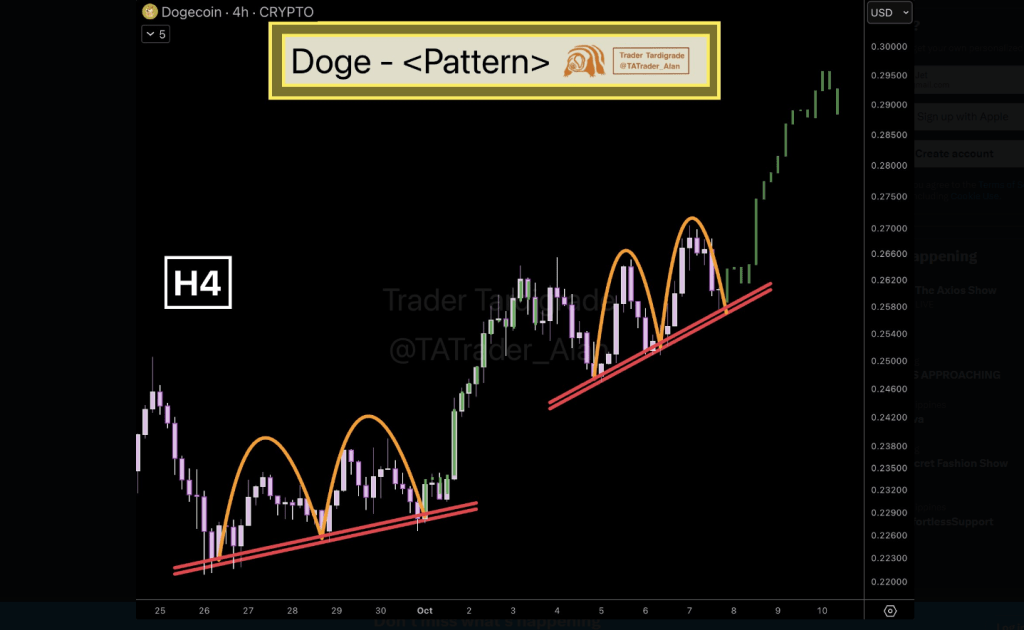

$Doge/4-hour

A pleasant sample was caught on the #Dogecoin chart 🔥 pic.twitter.com/JqZkx3S7bd— Dealer Tardigrade (@TATrader_Alan) October 7, 2025

Dealer Spots Repeating Setup On 4-Hour Chart

In response to an X put up by analyst Dealer Tardigrade, the four-hour chart reveals a “good” sample that has appeared greater than as soon as this month.

The arrange includes two failed rally makes an attempt the place value climbed towards resistance however fell again, every time discovering help on a rising trendline.

The latest sample started round October 4 after DOGE slid from about $0.26. Bulls pushed costs above $0.27 on October 6, however the transfer didn’t maintain and the token once more returned to trendline help.

A Sample With Earlier Echoes

Primarily based on experiences, the identical sequence confirmed up in late September. That episode began close to $0.22 on September 26, the place an preliminary rally stalled at about $0.234 after which retreated to help by September 28.

A second strive ended simply above $0.235 on September 29. Worth then discovered footing close to the trendline and climbed from roughly $0.22 on September 30 to about $0.26 by October 3.

The repeated failure to interrupt help in each stretches is being learn by some as proof of regular bids at these ranges.

Outlook And What To Watch

Market watchers say the important thing traces to comply with are the rising help line recognized by Tardigrade and the resistance zone close to $0.27.

A sustained transfer above that stage can be seen as bullish by merchants who use the four-hour timeframe. Conversely, a break beneath the trendline would take away a short-term flooring that has held throughout the two prior episodes.

Associated Studying

CleanCore’s ongoing accumulation is being tracked by observers who be aware that enormous patrons can change market dynamics once they purchase on dips.

Taken collectively, the chart sample and the company shopping for give buyers two methods to learn the market: one is technical and favors a potential repeat of late-September power; the opposite is structural and appears at regular accumulation by an institutional treasury.

For now, DOGE’s blended each day numbers present that momentum is fragile, regardless that each the chart and the reported treasury strikes level to persistent demand at sure value ranges.

Featured picture from OlesyaNickolaeva/Shutterstock.com, chart from TradingView