There are two most important colleges of thought in the case of dividend investing. The primary is yield-at-all-costs, whereby buyers chase the best payouts doable, usually on the expense of stability. The second is dividend development, which doesn’t all the time supply the most important headline yield however focuses on corporations that enhance their dividends yr after yr with out interruption.

I lean towards the latter camp as a result of dividend development indicators robust stability sheets, sustainable money flows, and administration confidence. One Canadian ETF designed particularly for this method is the Hamilton CHAMPIONS™ Canadian Dividend Index ETF (TSX:CMVP). Right here’s why I prefer it as a core holding in a tax-free financial savings account (TFSA).

How CMVP works

CMVP tracks the Solactive Canada Dividend Elite Champions Index, which screens for corporations with no less than six consecutive years of dividend will increase and no cuts. This leads to a median annual dividend development price of 10%. The result’s a blue-chip tilt, with holdings averaging a $73 billion market capitalization.

In follow, this implies you’re getting Canada’s most established dividend payers – banks, insurers, utilities, railways, and pipelines – names many buyers already belief as core holdings.

By demanding each dividend development and stability, the index avoids yield traps, the place a excessive dividend in the present day masks underlying enterprise threat. As a substitute, it emphasizes corporations with sturdy money flows and stability sheet energy that may maintain elevating payouts yr after yr.

CMVP outperformance

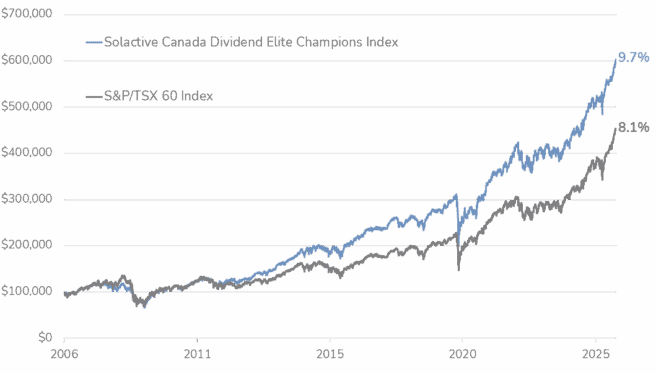

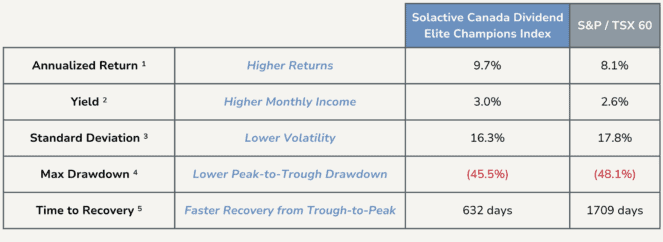

Efficiency isn’t nearly returns, but additionally how easily these returns are delivered. In Hamilton’s backtested knowledge, CMVP’s benchmark not solely outpaced the S&P/TSX 60 over the long run, nevertheless it did so with much less volatility.

Meaning it captured stronger compounding with out as many gut-wrenching drawdowns. The index additionally delivered a better yield than the TSX 60, which is smart given the dividend-focused display. Maybe extra importantly, when markets did stumble, the index recovered quicker.

That mixture – greater returns, much less threat, faster restoration – is strictly what long-term dividend buyers need. It means that CMVP’s methodology rewards endurance by sticking with corporations that not solely pay dividends, however steadily develop them, reinforcing shareholder worth by means of each money stream and resilience.

The Silly takeaway

CMVP’s 2% yield isn’t the most important, however this ETF isn’t about chasing yield. It’s about proudly owning a portfolio of dividend champions that mix development, high quality, and stability, all of that are components that matter way more in a TFSA the place compounding is tax-free.

On high of that, CMVP is presently fee-free till January 31, 2026. After that, the administration price is simply 0.19%, nonetheless effectively beneath the price of most managed dividend ETFs in Canada.