Key Findings

- The TaxA tax is a compulsory fee or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of normal authorities companies, items, and actions.

Cuts and Jobs Act of 2017 (TCJA) reformed the U.S. system for taxing worldwide company earnings. Understanding the affect of TCJA’s worldwide provisions to date may also help lawmakers contemplate the best way to method worldwide tax coverage within the coming years. - Worldwide tax coverage should steadiness competing aims, resembling maximizing income and progress whereas minimizing revenue shiftingRevenue shifting is when multinational corporations scale back their tax burden by transferring the situation of their earnings from high-tax international locations to low-tax jurisdictions and tax havens.

and complexity. - The TCJA’s worldwide adjustments—a transition to a territorial system with worldwide components, and a few anti-base-erosion measures—have been an try and steadiness these competing aims.

- The TCJA’s worldwide system’s “world minimal tax,” often called GILTI, raises substantial income, however it might lose a lot of its income as international locations work to adjust to Pillar Two.

- The TCJA’s incentive to maintain extremely cell earnings within the U.S., often called FDII, has been considerably profitable in curbing revenue shifting.

- A rule often called BEAT, which disallows the overuse of cross-border tax deductions generally related to revenue shifting as measured by accounting information, will not be as efficient as projected.

- Reformers ought to construct on what these provisions bought proper and modify them the place they fail or the place they turn out to be incompatible with worldwide tax developments.

Introduction

In 2017, Congress handed the Tax Cuts and Jobs Act, a broad tax legislation that included important adjustments to the U.S. worldwide company tax system. The TCJA decreased the headline company earnings taxA company earnings tax (CIT) is levied by federal and state governments on enterprise earnings. Many corporations will not be topic to the CIT as a result of they’re taxed as pass-through companies, with earnings reportable underneath the particular person earnings tax.

price from 35 p.c to 21 p.c, whereas reforming the taxation of earnings earned overseas by U.S. multinational enterprises (MNEs).

The pre-2017 system could possibly be referred to as a worldwide system with deferral. That’s, U.S. MNEs nominally owed the complete U.S. company earnings tax price on earnings earned overseas, however solely when the earnings have been “repatriated.” The post-2017 system could possibly be referred to as a territorial system with base erosion measures. The U.S. now not lays declare to all worldwide company earnings, however it has guidelines supposed to forestall companies from avoiding U.S. tax by attributing their earnings to low-tax jurisdictions (i.e., revenue shifting). The TCJA worldwide system improved upon its predecessor, however it, too, has flaws and can doubtless want revision earlier than the top of 2026.

Tax coverage around the globe has modified since 2017 and can proceed to vary within the subsequent few years. A world tax settlement often called Pillar Two, brokered by the Organisation for Financial Co-operation and Growth (OECD), begins to enter impact this 12 months and intends to determine a world minimal price of 15 p.c. TCJA’s worldwide provisions resemble some Pillar Two guidelines, however TCJA and Pillar Two conflict on some particular particulars. Pillar Two features a secure harbor provision that may successfully insulate the U.S. from main issues by December 31, 2026. Nevertheless, past that date, a mismatch between U.S. guidelines and Pillar Two guidelines could also be expensive by way of compliance efforts and tax liabilities.

The 119th Congress will doubtless be concerned with addressing Pillar Two in 2025 or 2026, maybe in laws that additionally addresses the scheduled expiration of lots of TCJA’s particular person earnings taxA person earnings tax (or private earnings tax) is levied on the wages, salaries, investments, or different types of earnings a person or family earns. The U.S. imposes a progressive earnings tax the place charges enhance with earnings. The Federal Revenue Tax was established in 1913 with the ratification of the sixteenth Modification. Although barely 100 years outdated, particular person earnings taxes are the largest supply of tax income within the U.S.

provisions. In doing so, it’s prone to revamp a few of TCJA’s worldwide provisions—the bottom erosion measures talked about above.

Under is a overview of three main worldwide provisions of the TCJA, often called world intangible low-taxed earnings (GILTI), foreign-derived intangible earnings (FDII), and base erosion and anti-abuse tax (BEAT). A robust understanding of their rationale, affect, and almost definitely interactions with Pillar Two will probably be useful in designing future modifications to the system.

Defining Goals in Worldwide Tax Coverage

To guage TCJA’s worldwide insurance policies in opposition to its predecessors or successors, one should contemplate the aims of worldwide company tax coverage. What targets may policymakers hope to perform? There are a number of to remember, and so they usually battle with one another, forcing us to think about trade-offs between them.

Elevate Income

The principal objective of tax coverage is to lift income. Each tax has flaws, and people flaws are inclined to turn out to be unwieldy at larger charges. However the perfect one can do is choose the taxes with essentially the most manageable flaws for a given income goal.

U.S. worldwide provisions may generate revenues in two methods. First, they might tax earnings genuinely earned overseas by U.S. companies. Second, and extra importantly, they’ll defend the home tax baseThe tax base is the entire quantity of earnings, property, belongings, consumption, transactions, or different financial exercise topic to taxation by a tax authority. A slender tax base is non-neutral and inefficient. A broad tax base reduces tax administration prices and permits extra income to be raised at decrease charges.

—that’s, forestall MNEs from avoiding U.S. taxes by revenue shifting.

The second objective is extra necessary, at the least for the U.S., as a result of the U.S. home market is so massive, and since U.S. companies are disproportionately concentrated in it, even after accounting for its measurement.

Make the U.S. an Engaging Place for Funding

Tax coverage must also make the U.S. a sexy vacation spot for funding, each by U.S. companies and by international ones. Capital investments—together with bodily capital like buildings or tools, and much more summary types of funding like organizational know-how—are complementary to employees’ efforts and abilities, elevating their productiveness. On the nationwide degree, higher capital funding makes for larger gross home product (GDP) and better residing requirements.

Make U.S. Companies Globally Aggressive

It is usually within the U.S.’s curiosity to facilitate the success of U.S. companies overseas. If a U.S. agency and a international agency are competing to achieve a 3rd market, Individuals ought to typically want that the U.S. agency win a higher market share. This will likely embrace investing overseas, hiring overseas, and incomes revenues and earnings overseas. On common, these actions are helpful for U.S. residents, regardless that they occur elsewhere.

One easy cause this could be the case is that Individuals are disproportionately prone to be shareholders of American MNEs, and so they earn higher dividends or capital beneficial properties on their holdings. Extra subtly, some jobs situated in U.S. company headquarters are successfully world in perform. Success overseas might imply extra and higher jobs within the MNE’s dwelling metropolis. Even Individuals who don’t maintain a type of jobs profit from having deeper-pocketed prospects round them. Lastly, the U.S. advantages from enterprise exercise flowing by the U.S. monetary system, moderately than European or Asian currencies and inventory exchanges. Such exercise is extra prone to enhance demand for the U.S. greenback, entrenching it as the worldwide reserve forex, and extra prone to enhance demand for U.S. monetary companies of all types. All in all, international success by U.S. companies is complementary to success at dwelling.

In a number of instances, politics might concentrate on examples the place international exercise appears to be an alternative to home exercise as a substitute—for instance, two international locations might compete over the manufacturing of a tradable good to be used in each markets. However these instances are extra the exception than the rule. In sectors like retail, transportation companies, useful resource extraction, hospitality, or well being care, funding in a single place doesn’t come on the expense of one other place. Empirical analysis tends to indicate that international funding is related to higher home funding, lending extra credibility to the notion that these are complementary.[1]

As many international locations want to let their MNEs compete globally with out disadvantages, they usually assess comparatively little or no tax on international earnings, a design often called a “territorial” system. Nevertheless, territorial methods are weak to revenue shifting and customarily require measures to defend their tax bases.[2]

Cut back Compliance Prices

Lastly, a world tax code ought to keep away from being overly complicated or cluttered. Individuals might dislike complexity for quite a lot of causes, however crucial is that worldwide tax compliance occupies the time and efforts of clever, productive individuals who could be fairly beneficial elsewhere. As worldwide tax compliance absorbs these folks, the remainder of the financial system loses out on their efforts.

Naturally, these targets battle with one another. Enterprise competitiveness targets are at odds with revenue-raising targets. Stopping revenue shifting requires guidelines about which earnings belong the place, which is extraordinarily complicated when earnings are earned by “intangible” belongings or over the web, and not using a clear bodily location. The job of worldwide tax policymakers is to muddle by as finest they’ll, recognizing they should compromise on all of those aims.

Defining the Flaws of the Pre-2017 System

In 2017, the TCJA’s architects hoped to deal with the U.S. company tax system’s appreciable flaws. The U.S. had a company earnings tax price of 35 p.c, which utilized to each home earnings and repatriated earnings earned overseas. Nevertheless, the tax on earnings overseas would subtract a credit score for any international earnings taxes paid, and, much more importantly, MNEs may defer repatriationTax repatriation is the method by which multinational corporations carry abroad earnings again to the house nation. Previous to the 2017 Tax Cuts and Jobs Act (TCJA), the U.S. tax code created main disincentives for U.S. corporations to repatriate their earnings. Modifications from the TCJA get rid of these disincentives.

for years and even many years.

This method was out of step with the remainder of the world’s practices, and it was functioning poorly. The U.S. price was the very best company tax price amongst all OECD international locations in 2017 and among the many highest on this planet.[3] Moreover, all however six OECD international locations had deserted worldwide methods in favor of territorial methods by 2017.[4] Immediately, that quantity has declined to 4.[5]

This method created two main distortions. The primary distortion was that it inspired companies to delay repatriation so long as doable. The farther into the long run the tax is assessed, the higher.

The incentives governing company earnings held overseas have been just like these of a retirement saver holding cash in a conventional particular person retirement account (IRA): no tax owed till withdrawal. IRAs are also known as “tax-advantaged” relative to peculiar brokerage or saving accounts as a result of they permit compounding earlier than tax is due. Against this, an account topic to annual earnings tax must forgo some compound returns on the tax cash.

In the identical method that retirement savers attempt to maximize their use of IRAs, companies earlier than 2017 tried to maximise earnings reported and held overseas.

Whereas the worldwide deferral system didn’t make a lot income or a lot sense, it didn’t essentially hold funding capital out of the U.S.; extremely worthwhile world companies may discover different routes to elevating home capital once they wanted to.

The second distortion created by the pre-TCJA worldwide system was corporations successfully renouncing their U.S. citizenship. Amongst these corporations that might not protect themselves from U.S. worldwide taxation, the system inspired them to “invert”—that’s, transfer their authorized headquarters exterior of the U.S. in order that they’d now not be topic to U.S. taxes on non-U.S. earnings.

Along with these two distortions, the pre-2017 U.S. tax system was weak to revenue shifting, an issue from which no company tax system is totally immune. Although U.S. MNEs nominally owed a 35 p.c tax price on any earnings, home or worldwide, they have been finest served by attributing earnings to worldwide jurisdictions with low tax charges, to pay a small burden when the earnings have been earned and delay the remainder of the 35 p.c till a lot later.

Though many earnings could possibly be deferred or shifted, there have been some limitations to those practices. Underneath a provision referred to as Subpart F, passive earnings resembling curiosity, dividends, rents, and royalties have been taxed worldwide with out deferral. This is able to forestall a number of the most evident schemes for finding subsidiaries with beneficial intangible belongings in low-tax international locations as a way to make deductible funds that depend in opposition to U.S. taxable earningsTaxable earnings is the quantity of earnings topic to tax, after deductions and exemptions. For each people and companies, taxable earnings differs from—and is lower than—gross earnings.

, “stripping” U.S. earnings to low-tax international locations. Nevertheless, many MNEs have been able to extra subtle schemes that will keep away from Subpart F and nonetheless scale back U.S. taxable earnings.

TCJA’s Strategy

TCJA addressed these points by decreasing the company earnings tax price and transferring towards a territorial system—successfully relinquishing many U.S. claims on international earnings of U.S. MNEs—whereas including extra base erosion measures to curb revenue shifting.

The primary merchandise—the decrease 21 p.c home company earnings tax price—is related to worldwide tax coverage in that it’s simpler to “defend” from revenue shifting. The decrease the home price, the much less incentive companies should reclassify home earnings. Sadly, the decrease price got here at a considerable value to revenues, requiring different revenue-raising provisions to “pay for” it. In some instances, this got here out to a helpful commerce—for instance, decrease charges on company earnings coupled with decreased deductibility of curiosity ameliorated the tax code’s debt-equity bias.[6] Nevertheless, different revenue-raising provisions, like analysis and improvement amortization, have been much less worthwhile.[7]

Subsequent, TCJA included a participation exemption, that means that international earnings of U.S. corporations could be exempt from U.S. tax underneath sure situations involving holding durations, possession stakes, and taxes paid to international jurisdictions. A participation exemption is the core of a territorial system, and it was the worldwide norm by the point TCJA was enacted.

The participation exemption put U.S. MNEs on an equal footing when doing enterprise overseas, as they now not needed to pay an additional layer of tax. For instance, if a British MNE and an American MNE underneath the U.S. worldwide system competed in opposition to one another in Germany, the British agency would solely pay taxes to Germany, whereas the American agency would anticipate further U.S. taxes. After TCJA, the U.S. agency would pay solely German taxes on its German operations, similar to its British counterpart.

A disadvantage of participation exemptions, nevertheless, is that they’ll make a system extra weak to revenue shifting. To defend in opposition to revenue shifting, TCJA included base erosion measures. These are typical of nations with territorial methods. And so they usually partially stroll again the territoriality of the tax system, successfully together with components of a worldwide system—in any case, they concern themselves with earnings a agency wish to label as international.[8] Nevertheless, although TCJA incorporates some components of a worldwide system, it doesn’t have a lot in frequent with the actual U.S. system that it changed. TCJA’s worldwide system is constructed round low tax charges with out deferral—successfully, the alternative of the excessive price and beneficiant deferral system the U.S. had previous to 2017.

The three most vital base erosion provisions are GILTI, FDII, and BEAT. GILTI is a class of international earnings added again into taxable earnings for U.S. companies, however it’s partially deductible, decreasing the efficient price paid on that earnings, and it comprises a partial international tax credit scoreA tax credit score is a provision that reduces a taxpayer’s last tax invoice, dollar-for-dollar. A tax credit score differs from deductions and exemptions, which scale back taxable earnings, moderately than the taxpayer’s tax invoice straight.

. FDII is a counterpart to GILTI, a time period for intangible and world earnings that the MNE attributes to the U.S. FDII can also be taxed at a low price, successfully rewarding corporations for selecting the U.S. as the situation for his or her extremely cell earnings. Lastly, BEAT is a particular minimal tax that applies to companies with too many “base erosion” funds—that’s, bills paid to associated companies overseas in classes usually related to revenue shifting. The minimal tax disallows deductions for base erosion funds, successfully nullifying extreme earnings stripping.

World Intangible Low-Taxed Revenue

The tax on GILTI is considerably complicated, and Tax Basis has offered extra detailed instance calculations elsewhere.[9] However most of its essential dynamics will be understood by 4 essential components of the calculation.

The primary factor of the calculation is the sum of earnings of international associates, often called web examined earnings. Notably, the GILTI calculation is “blended,” that means it sums all international locations collectively; it isn’t, underneath present legislation, a country-by-country calculation.

Second, the MNE might subtract what is named the certified enterprise asset funding (QBAI) exemption. The QBAI exemption is an imputed 10 p.c return on depreciable international belongings. Successfully, companies incomes returns from massive, substantive investments overseas can count on a big discount of their GILTI tax base, putting extra of the burden of GILTI on companies incomes excessive margins with intangible belongings and markups. After subtracting QBAI, the MNE has its GILTI tax base.

Third, the MNE deducts 50 p.c of its GILTI. This successfully implies that GILTI is taxed at solely half of the traditional company earnings tax price (10.5 p.c as a substitute of 21 p.c). This deduction is scheduled to fall to 37.5 p.c on the finish of 2025, that means that GILTI will probably be taxed at 5/8 of the traditional company earnings tax price.

Fourth, the MNE is credited for international taxes paid, however solely at 80 p.c of the worth, and to not exceed whole GILTI legal responsibility.

Figuring out these design components may also help an observer perceive each GILTI’s intent and results.

Geared toward Supernormal Returns and Revenue Shifting, not Regular Exercise

The QBAI exemption in GILTI might seem arbitrary, and its rationale will not be apparent at first look. However it’s arguably an try at approximating one thing necessary: a distinction between two sorts of company earnings. Some company earnings is characterised extra by modest returns on tangible investments. And a few company earnings is characterised by high-margin returns on intangible investments. By exempting a ten p.c return on some belongings, QBAI shifts the burden of GILTI in the direction of returns which can be inframarginal and indicative of extremely cell markups derived from beneficial intangibles.

There are two factors to be made right here. First, and most significantly within the realm of worldwide taxes, excessive margins usually point out {that a} agency is benefiting from some summary, non-physical issue of manufacturing, like an concept, that provides it a aggressive benefit. And naturally, a U.S.-headquartered MNE’s finest concepts and intangible belongings are prone to be most attributable to U.S. efforts.

A mix of excessive margins and low international tax charges, then, is circumstantial proof {that a} agency has benefited from intangibles primarily developed within the U.S. however has then taken benefit of intangibles’ non-physical nature to allocate returns to low-tax jurisdictions.

GILTI, regardless of its homonym, shouldn’t be a definitive indicator of guilt. Nevertheless, its drafters understood {that a} sure tax profile is usually in step with revenue shifting and selected to allocate tax burdens extra closely in the direction of MNEs with that profile.

Along with this essential rationale, a extra normal precept of tax coverage, not unique to the worldwide realm, justifies the QBAI exemption: ideally, taxes ought to fall on investments so beneficial that they’d have been made anyway. A heavy tax burden on a generic capital funding with a modest return—a marginal funding—may disincentivize folks from investing in that asset within the first place. Against this, a tax burden on a wildly worthwhile capital funding’s returns, an inframarginal funding, wouldn’t dissuade the agency from making that funding. The construction of QBAI helps the GILTI system tax inframarginal investments extra, and marginal investments much less.

Lower than Half Worldwide

Whereas GILTI is, in lots of respects, a worldwide tax systemA worldwide tax system for firms, versus a territorial tax system, consists of foreign-earned earnings within the home tax base. As a part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation in the direction of territorial taxation.

, the formulation’s components display why the U.S. is considerably nearer to territorial than worldwide as an entire. Solely half of GILTI counts in the direction of the company earnings tax, or 5/8 even after the formulation tightens on the finish of 2025. Moreover, GILTI enjoys each the QBAI exemption and a international tax credit score. The result’s a system that’s significantly lower than half the U.S. home price.

That is roughly in step with different international locations which have territorial methods. Lots of them have a participation exemption, excusing most international earnings from tax, but in addition some type of managed international company (CFC) guidelines, bringing again in sure lessons of international earnings almost definitely to be shifted earnings.

All in all, GILTI is more durable on taxpayers than a typical CFC regime, or the proposed Pillar Two earnings inclusion rule (IIR). On quite a lot of technical particulars, like substance carveouts, expense allocation, and carryforwards, GILTI is much less beneficiant than a few of its counterparts. In actual fact, Tax Basis modeling reveals that GILTI raises extra income than a Pillar Two IIR would elevate.[10]

Goldilocks Precept of International Taxes

The international tax credit score design totally incentivizes MNEs to buy decrease taxes, up to a degree. If a agency will get its world tax price down from 20 p.c to 19 p.c, it retains the cash. GILTI legal responsibility is totally zeroed out already by international tax credit. Any further international tax credit going from 19 p.c to twenty p.c are successfully wasted. Nevertheless, as soon as they get into the vary by which they’ve GILTI legal responsibility—for instance, an 8 p.c price—the U.S. claws again many of the cash from further tax avoidance.

The result’s a type of Goldilocks precept. If a agency reduces its tax burden amongst international governments by a little bit bit, the U.S. lets it hold its rewards. If a agency reduces its tax burden on international earnings by quite a bit, that’s suspicious, and maybe indicative of revenue shifting.

Notably, this Goldilocks imply the place it lumps all different international locations right into a “remainder of world” class reveals it’s primarily about U.S. pursuits vis-à-vis the remainder of the world, with little or no concern for dynamics among the many remainder of the world’s international locations. The GILTI calculation successfully asks whether or not an MNE with earnings overseas is paying low tax charges generally, not whether or not it’s paying low charges in particular international locations. A average quantity of earnings in low tax international locations shouldn’t be punished, and certainly, it may be rewarded underneath sure circumstances. Some earnings in a low-tax nation can offset earnings in high-tax international locations and obtain a average price general, permitting the agency to make use of international tax credit that will in any other case be wasted.

GILTI’s formulation, then, shouldn’t be totally oriented towards a challenge of eliminating low-tax international locations. As an alternative, it merely disincentivizes the overuse of low-tax jurisdictions by U.S. MNEs.

This contrasts with Pillar Two, which is certainly a challenge designed to fight low-tax international locations extra straight. Pillar Two’s equal of GILTI, the IIR, makes use of country-by-country calculations, penalizing low taxes on the nation degree even when a blended system like GILTI would present excessive taxes paid elsewhere.

Double TaxationDouble taxation is when taxes are paid twice on the identical greenback of earnings, no matter whether or not that’s company or particular person earnings.

Issues in GILTI Design

Although GILTI was supposed to extend the tax burden solely on international earnings taxed at low charges, some quirks of its expense allocation guidelines resulted in double taxation of even high-taxed earnings, opposite to GILTI’s identify and acknowledged targets. As acknowledged above, the expense allocation guidelines are one cause GILTI could also be much less taxpayer-friendly than an IIR; GILTI can in some instances act as a surtaxA surtax is a further tax levied on prime of an already current enterprise or particular person tax and might have a flat or progressive price construction. Surtaxes are sometimes enacted to fund a selected program or initiative, whereas income from broader-based taxes, just like the particular person earnings tax, sometimes cowl a mess of applications and companies.

on earnings that was already taxed comparatively extremely.[11] In 2020, the IRS launched steerage to partially repair the issue by regulatory statement.[12] Nevertheless, the expense allocation in GILTI deserves a extra complete repair from Congress.[13]

The Income Workhorse of TCJA’s Worldwide Reforms

GILTI is essentially the most important persistent revenue-raising factor of TCJA. (A one-time transition tax, which closed out the excellent deferred earnings overseas from the earlier tax system by taxing them at a low price, additionally raised important income, however is not going to proceed to lift income sooner or later.)

TCJA’s worldwide reforms have been roughly income impartial, permitting the company earnings tax parts of the legislation to be made everlasting, even underneath funds reconciliation guidelines. Nevertheless, the preliminary Joint Committee on Taxation (JCT) projections doubtless underestimated GILTI revenues and overestimated BEAT revenues. The committee’s preliminary 10-year estimates on the time TCJA was handed held that BEAT would elevate $149.6 billion to GILTI’s $112.4 billion.[14]

By 2021, nevertheless, actual company earnings tax return information confirmed a a lot completely different story. JCT collected a pattern of 81 massive C companies in 2018 and confirmed that these companies paid $6.3 billion of GILTI tax legal responsibility after international tax credit, however simply $0.07 billion of BEAT legal responsibility.[15] (This quantification of BEAT wouldn’t embrace larger peculiar company tax funds induced by MNEs strategizing to keep away from BEAT.)

Exact estimates for GILTI income are troublesome, as company earnings tax income is usually unstable, and particularly so when it interacts with international jurisdictions that will change their very own legal guidelines or multinational companies that will change their conduct. Nevertheless, Tax Basis has estimated that GILTI will elevate $19.1 billion in 2024 and $37.0 billion in 2028.[16] A comparable estimate from Tax Coverage Middle reveals $14.8 billion in 2024 and $26.3 billion in 2028.[17] These numbers are small relative to the company earnings tax as an entire, and even smaller relative to the person earnings tax as an entire—however worldwide company revenues have at all times been small. Many company earnings are totally home, and for these which can be worldwide, the U.S. will get the second chew on the apple, not the primary.

The quick rise in projected revenues from GILTI is essentially a consequence of the scheduled lower within the GILTI deduction to 37.5 p.c.

Measuring Tax Parity Appropriately

The differential between U.S. home charges and GILTI charges might lead an observer to check them straight and conclude that exercise abroad receives higher tax remedy. Nevertheless, it is very important word that GILTI is a secondary top-up price that could be assessed along with a jurisdiction’s home tax. It’s geared toward boosting tax charges the place on-paper revenue shifting appears doubtless. It’s not decreasing the tax charges on actual investments in massive markets which have their very own company tax charges.

Equally, one notable critique of QBAI has been that it incentivizes abroad investments, maybe on the expense of home investments. It definitely protects investments overseas from a further layer of tax, incentivizing them to a point. However investments overseas are sometimes enhances, not substitutes, to home investments.[18] And extra importantly, the primary function of QBAI is to be a backward-looking “substance take a look at” for earnings situated abroad, not a potential incentive.

International-Derived Intangible Revenue

International-derived intangible earnings is a brand new class of earnings outlined as a type of U.S.-based counterpart to GILTI. Very like GILTI, it’s structured round an extra return over QBAI and partially (37.5 p.c) excluded from taxable earnings to get a a lot decrease price than the headline company earnings tax price. On the whole, over the long term, FDII and GILTI charges will probably be roughly equal for corporations selecting the place to find intangible belongings.

The aim of FDII, then, is to incentivize MNEs to find their mental property within the U.S. by providing a reduction to earnings that will in any other case be significantly simple and remunerative to shift overseas. Revenue related to intangibles is simple to shift, and that’s significantly true when the purchasers are already situated exterior of the U.S., so FDII, recognizing the excessive tax elasticity of this type of earnings, provides a aggressive price.

FDII is on this respect a competitor to so-called “patent fieldA patent field—additionally known as mental property (IP) regime—taxes enterprise earnings earned from IP at a price under the statutory company earnings tax price, aiming to encourage native analysis and improvement. Many patent bins around the globe have undergone substantial reforms as a result of revenue shifting considerations.

” regimes in Europe, lots of which additionally supply low charges for types of earnings considered extremely cell.[19]

FDII as an Attractor of Inbound Revenue Shifting

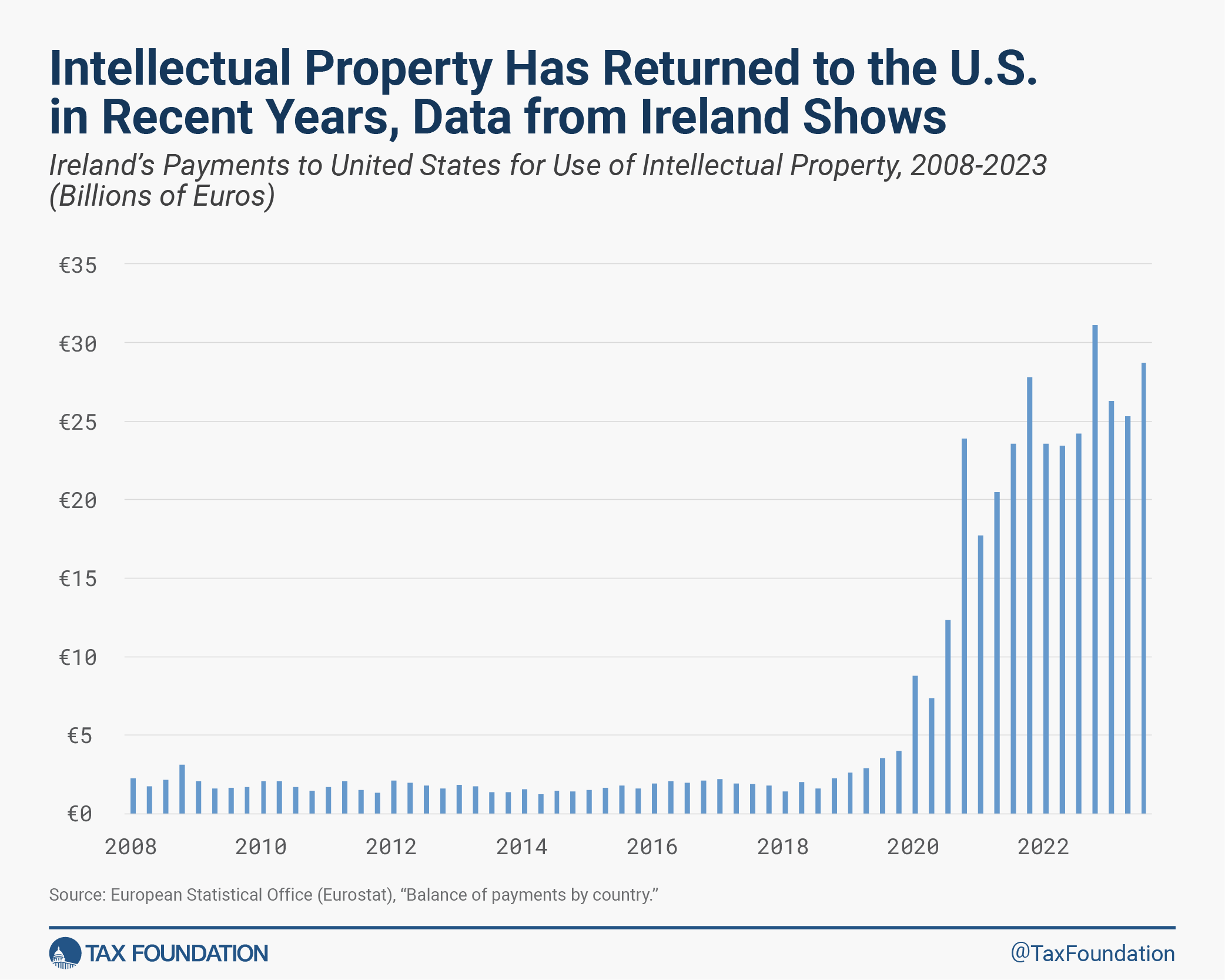

Irish steadiness of funds information reveals that FDII has been considerably efficient in its supposed position, driving mental property again towards the United States. As Eire is a world hub for reported company earnings, its import and export information continuously reveal truths about company tax planning, moderately than the precise buying and selling proclivities of Irish residents.

In a development first famous by Irish economist Seamus Coffey in 2021, Irish funds to the US for mental property hovered round €2 billion per quarter for many of the financial enlargement of the 2010s. Nevertheless, TCJA took impact firstly of 2018, and by the final quarter of 2019, the funds rose previous €4 billion for the primary time. By the final quarter of 2020, they skyrocketed to just about €24 billion.

Coffey additional reveals that the general quantity of Irish funds for mental property didn’t change a lot. As an alternative, merely the vacation spot modified. Funds that beforehand went to different elements of the Eurozone or offshore monetary facilities had modified locations to the US.

An prolonged information collection exhibiting the continued trajectory of this indicator will be present in Determine 1:

Coffey attributed the development, which has solely continued to higher heights, to a mixture of the OECD’s challenge on earnings shifting, adjustments to Irish company tax legislation, and the TCJA. “A case examine of US MNCs within the info and communication know-how (ICT) sector reveals that underneath the revised buildings the usage of know-how in worldwide markets is now not licensed from jurisdictions resembling Bermuda and the Cayman Islands however as a substitute is licensed straight from the US,” Coffey concludes. “That is in step with the financial footprint of those corporations and aligns the reporting of their earnings with the situation of their substance.”[20]

“Caught” Earnings

Although FDII could also be an affordable incentive to not shift future earnings away, and even to return some intangibles to the U.S., it isn’t almost enough to repair all profit-shifting ills. One of many largest issues with the present tax system, from the U.S. perspective, is that some older tax buildings that predate the OECD’s challenge or the TCJA will probably be onerous to unwind. The longer term inventory of intangibles could also be allotted in a fashion extra pleasant to the U.S., however many high-value intangibles owned by U.S. MNE teams at present might stay domiciled in jurisdictions that have been tax-friendly within the 2010s, regardless that that’s misaligned with their substance. Future reforms might need to contemplate prospects for returning current belongings to the U.S. for tax functions.

General, stasis, moderately than a discount in revenue shifting, appears to be the result of U.S. and OECD efforts to date. The European Union Tax Observatory, a company that typically characterizes revenue shifting as a major drawback, reveals in its World Tax Evasion Report 2024 that world company tax income losses to tax havens rose dramatically all through the Nineteen Nineties, 2000s, and 2010s, however have since “stagnated at about 10 p.c” of whole company revenues, because the beginnings of the OECD’s challenge and the passage of TCJA.[21] Whether or not this counts as a failure or a hit is within the eye of the beholder.

On the whole, economists who’ve advocated measures to include revenue shifting have proven of their tutorial work that TCJA ought to be anticipated to curb revenue shifting, however maybe to not the diploma that they want.[22]

FDII as an Export Subsidy

One critique of FDII, made shortly after the TCJA handed Congress, is that it provides a decrease price to revenues derived from exports than the U.S. tax system provides to revenues derived from home gross sales. This, the argument goes, will draw a problem from the World Commerce Group or another discussion board and be declared an unlawful export subsidy, forcing the U.S. to desert it.[23]

In simultaneous negotiations with Congress and the OECD in recent times, the Biden administration proposed eliminating FDII, however Congress finally didn’t achieve this. Nonetheless, the OECD’s June 2023 record of “dangerous tax practices” included FDII and famous it was “within the technique of being eradicated”—one thing that the Biden administration couldn’t totally promise with out Congress’s cooperation.[24]

Whether or not FDII finally ends up being accepted or not in worldwide legislation stays to be seen. Nevertheless, a provision resembling FDII that provides a decreased price to extremely cell earnings could also be an necessary element of the U.S. tax panorama going ahead.

Base Erosion and Anti-Abuse Tax

The bottom erosion and anti-abuse tax is the final main base erosion factor of TCJA. It disallows the deductibility of sure “base erosion funds” for companies that use too lots of them. Very like GILTI, it’s an try to make use of formulation to determine companies that could be revenue shifting, and apply a tax to them. However in contrast to GILTI, it has raised comparatively little income.[25] In actual fact, JCT notes that regardless of a scheduled enhance doubling the BEAT tax price, the BEAT raised about as little income in 2020 at a ten p.c price ($1.9 billion) because it did in 2018 at a 5 p.c price ($1.8 billion). JCT notes that the common base erosion proportion has declined from 8.4 p.c to 2.9 p.c, hollowing out the BEAT base. It is a tough metric that divides base erosion funds by whole deductions and determines whether or not a taxpayer should pay BEAT.[26]

A pure follow-up line of inquiry on BEAT is why the income stays so low. Evidently, companies are structuring themselves in ways in which keep away from paying BEAT. Are they, for instance, merely eschewing base erosion funds and giving up on them as a way of earnings stripping completely?

The perfect evaluation and empirical proof counsel not. Relatively, companies could also be relabeling and recategorizing funds in ways in which keep away from BEAT legal responsibility with out essentially paying any extra tax.

Shortly after TCJA handed, tax students within the Minnesota Regulation Assessment recommended quite a lot of ways in which TCJA provisions could possibly be exploited, together with BEAT. “Importantly, base erosion funds typically don’t embrace funds for value of products bought,” they word. “If a international affiliate incorporates the international mental property right into a product after which sells the product again to a U.S. affiliate, the price of the products bought doesn’t fall inside BEAT.”[27] In different phrases, they counsel laundering base erosion deductions, which might be disallowed underneath BEAT, as value of products bought (COGS) deductions. A U.S. agency might not be capable of make base erosion funds straight, however it could possibly make value of products bought funds to a international affiliate, which in flip makes base erosion funds to a different international affiliate, sidestepping BEAT by finishing base erosion funds earlier than an entity in scope for BEAT touches the availability chain.

Although information on the internal workings of MNEs are restricted, a gaggle of accounting students examined information from related-party funds and concluded that “outcomes counsel that companies reclassify under the road related-party funds to COGS to keep away from the BEAT.”[28]

Provided that BEAT’s drawback is a fast-declining base, not its price, the scheduled enhance in BEAT to 12.5 p.c beginning in 2026 is unlikely to vary its trajectory.

How Pillar Two Could Change the Impacts of GILTI, FDII, and BEAT

As many international jurisdictions change their tax codes to adjust to Pillar Two, the impacts of GILTI, FDII, and BEAT will even change.

Most critically, GILTI—which provides comparatively beneficiant tax credit for tax charges as much as concerning the mid-teens—will discover its income sources drying up. As Tax Basis and JCT modeling workout routines have proven, rising international taxes will considerably scale back the revenues of U.S. taxes on international earnings by entitling MNEs to bigger international tax credit.[29] This disadvantage of Pillar Two would even be doubtless underneath some other system with international tax credit. As world charges go up, there may be merely much less revenue left for U.S. shareholders and the U.S. treasury to separate.

GILTI shouldn’t be completely consonant with Pillar Two’s IIR however is in lots of respects stricter. Nevertheless, it’s much less strict in that it permits mixing throughout international locations, moderately than requiring country-by-country reporting. This makes it not fairly as efficient as an IIR at sniffing out and punishing low-tax international locations, however considerably simpler to adjust to. Some MNEs can have dozens of subsidiaries in many alternative tax jurisdictions. These subsidiaries could also be current in dozens of nations, making country-by-country reporting onerous.

For FDII, Pillar Two will signify each a possibility and a menace. As international tax charges rise, the U.S. might turn out to be a comparatively extra enticing vacation spot for revenue shifting, making up a substantial quantity of the income misplaced to higher international tax credit.[30]

A agency with a considerable FDII deduction would have a tax price near Pillar Two’s 15 p.c minimal, even earlier than different doable tax credit are thought of. If a agency has tax legal responsibility under 15 p.c underneath Pillar Two’s guidelines, it might be assessed a tax penalty often called the undertaxed earnings rule.

On the whole, a profitable Pillar Two implementation will scale back the dispersion of tax charges amongst jurisdictions, making all base erosion measures considerably much less helpful. Nevertheless, they’re unlikely to turn out to be completely out of date; international locations will nonetheless compete on charges as much as the 15 p.c mark, and on incentives not offset by the Pillar Two regime’s minimal tax. If tax competitors stays, then so too will revenue shifting, and base erosion measures can nonetheless justify their existence.

In reforming GILTI, FDII, and BEAT within the coming years, lawmakers ought to contemplate what they bought proper: comparatively beneficiant phrases for financial substance, comparatively beneficiant phrases for intangibles retained domestically, and CFC guidelines for high-intangible earnings held overseas. Nevertheless, lawmakers ought to take a second take a look at issues with the present system, discover methods to cut back litter, and avert conflicts with worldwide tax and commerce agreements, together with Pillar Two.

Keep knowledgeable on the tax insurance policies impacting you.

Subscribe to get insights from our trusted consultants delivered straight to your inbox.

[1] Mihir Desai, C. Fritz Foley, and James R. Hines, “Home Results of the International Actions of U.S. Multinationals,” American Financial Journal (February 2009), https://www.aeaweb.org/articles?id=10.1257/pol.1.1.181.

[2] Daniel Bunn, Alan Cole, Alex Mengden, “Anti-Avoidance Insurance policies in a Pillar Two World,” Tax Basis, Oct. 17, 2023, https://taxfoundation.org/analysis/all/world/base-erosion-profit-shifting-pillar-two/.

[3] Kari Jahnsen and Kyle Pomerleau, “Company Revenue Tax Charges across the World, 2017,” Tax Basis, Sep. 7, 2017, https://taxfoundation.org/information/all/world/corporate-income-tax-rates-around-the-world-2017/.

[4] Kari Jahnsen and Kyle Pomerleau, “Designing a Territorial Tax SystemA territorial tax system for firms, versus a worldwide tax system, excludes earnings multinational corporations earn in international international locations from their home tax base. As a part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation in the direction of territorial taxation.

: A Assessment of OECD Programs,” Tax Basis, Aug. 1, 2017, https://taxfoundation.org/analysis/all/eu/territorial-tax-system-oecd-review/.

[5] Tax Basis, “Worldwide Tax System,” https://taxfoundation.org/tax-basics/worldwide-taxation/.

[6] Alan Cole, “Curiosity Deductibility – Points and Reforms,” Tax Basis, Could 4, 2017, https://taxfoundation.org/analysis/all/federal/interest-deductibility/.

[7] Alex Muresianu, “R&D Amortization Hurts Financial Progress, Progress Industries, and Small Companies,” Tax Basis, Jun. 1, 2023, https://taxfoundation.org/weblog/rd-amortization-impact/.

[8] Daniel Bunn, Alan Cole, and Alex Mengden, “Anti-Avoidance Insurance policies in a Pillar Two World,” Tax Basis, Oct. 17, 2023, https://taxfoundation.org/analysis/all/world/base-erosion-profit-shifting-pillar-two/.

[9] Daniel Bunn, “U.S. Cross-border Tax Reform and the Cautionary Story of GILTI,” Tax Basis, Feb. 17, 2021, https://taxfoundation.org/analysis/all/federal/gilti-us-cross-border-tax-reform/.

[10] Alan Cole and Cody Kallen, “Dangers to the U.S. Tax Base from Pillar Two,” Tax Basis, Aug. 30, 2023, https://taxfoundation.org/analysis/all/federal/global-minimum-tax-us-tax-base/.

[11] Cody Kallen, “Expense Allocation: A Hidden Tax on Home Actions and International Earnings,” Tax Basis, Aug. 26, 2021, https://taxfoundation.org/weblog/expense-allocation-rules-hidden-tax-foreign-profits/.

[12] Inner Income Service, “Steerage Underneath Sections 951A and 954 Relating to Revenue Topic to a Excessive Fee of International Tax,” https://www.federalregister.gov/paperwork/2020/07/23/2020-15351/guidance-under-sections-951a-and-954-regarding-income-subject-to-a-high-rate-of-foreign-tax.

[13] Daniel Bunn, “U.S. Cross-border Tax Reform and the Cautionary Story of GILTI,” Tax Basis, Feb. 17, 2021, https://taxfoundation.org/analysis/all/federal/gilti-us-cross-border-tax-reform/.

[14] Joint Committee on Taxation, “Estimated Price range Results of the Convention Settlement for H.R. 1, the Tax Cuts and Jobs Act,” Dec. 18, 2017, https://www.jct.gov/publications/2017/jcx-67-17/.

[15] Joint Committee on Taxation, “U.S. Worldwide Tax Coverage: Overview and Evaluation,” Mar. 19, 2021, https://www.jct.gov/getattachment/a7e1e4e1-f225-434e-a58b-072208f11cff/x-16-21.pdf.

[16] Daniel Bunn, Alan Cole, William McBride, and Garrett Watson, “How the Moore Supreme Courtroom Case May Reshape Taxation of Unrealized Revenue,” Tax Basis, Aug. 30, 2023, https://taxfoundation.org/analysis/all/federal/moore-v-united-states-tax-unrealized-income/.

[17] Eric Toder, “The Potential Financial Penalties of Disallowing the Taxation of Unrealized Revenue,” Tax Coverage Middle, Oct. 11, 2023, https://www.taxpolicycenter.org/publications/potential-economic-consequences-disallowing-taxation-unrealized-income/full.

[18] Mihir Desai, C. Fritz Foley, and James R. Hines, “Home Results of the International Actions of U.S. Multinationals,” American Financial Journal (February 2009), https://www.aeaweb.org/articles?id=10.1257/pol.1.1.181.

[19] Alex Mengden, “Patent Field Regimes in Europe, 2023,” Tax Basis, Aug. 8, 2023, https://taxfoundation.org/information/all/eu/patent-box-regimes-europe-2023/.

[20] Seamus Coffey, “The altering nature of outbound royalties from Eire and their affect on the taxation of the earnings of US multinationals – Could 2021,” Eire Division of Finance, Jun. 14, 2021, https://www.gov.ie/en/publication/fbe28-the-changing-nature-of-outbound-royalties-from-ireland-and-their-impact-on-the-taxation-of-the-profits-of-us-multinationals-may-2021/.

[21] EU Tax Observatory, “World Tax Evasion Report 2024,” https://www.taxobservatory.eu//www-site/uploads/2023/10/global_tax_evasion_report_24.pdf.

[22] Kimberly Clausing, “Revenue Shifting Earlier than and After the Tax Cuts and Jobs Act,” Nationwide Tax Journal 73:4 (November 2018): 1233-1266, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3274827; Javier Garcia-Bernardo, Petr Janský, and Gabriel Zucman, “Did the Tax Cuts and Jobs Act Cut back Revenue Shifting by US Multinational Corporations?,” Nationwide Bureau of Financial Analysis, Could 2022, https://www.nber.org/system/information/working_papers/w30086/w30086.pdf.

[23] Reuven Avi-Yonah and Martin Vallespinos, “The Elephant At all times Forgets: US Tax Reform and the WTO,” College of Michigan Regulation & Econ Analysis Paper, Jan. 28, 2018, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3113059.

[24] OECD, “Dangerous Tax Practices – Peer Assessment Outcomes,” June 2023, https://www.oecd.org/tax/beps/harmful-tax-practices-consolidated-peer-review-results-on-preferential-regimes.pdf.

[25] Joint Committee on Taxation, “U.S. Worldwide Tax Coverage: Overview and Evaluation,” Mar. 19, 2021, https://www.jct.gov/getattachment/a7e1e4e1-f225-434e-a58b-072208f11cff/x-16-21.pdf.

[26] Joint Committee on Taxation, “Background and Evaluation of the Taxation of earnings Earned by Multinational Enterprises,” https://www.jct.gov/publications/2023/jcx-35r-23/

[27] David Kamin, David Gamage, Ari Glogower, Rebecca Kysar, Darien Shanske, Reuven AviYonah, Lily Batchelder, J. Clifton Fleming, Daniel Hemel, Mitchell Kane, David Miller, Daniel Shaviro, and Manoj Viswanathan, “The video games they are going to play: Tax video games, roadblocks, and glitches underneath the 2017 tax laws,” Minnesota Regulation Assessment 103 (2018): 1439–1521, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3089423.

[28] Stacy Kelley LaPlante et al., “Simply BEAT It: Do companies reclassify prices to keep away from the bottom erosion and anti-abuse tax (BEAT) of the TCJA?,” Singapore Administration College Faculty of Accountancy, Feb. 1, 2021, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3784739.

[29] Alan Cole and Cody Kallen, “Dangers to the U.S. Tax Base from Pillar Two,” Tax Basis, Aug. 30, 2023, https://taxfoundation.org/analysis/all/federal/global-minimum-tax-us-tax-base/.

[30] Alan Cole and Cody Kallen, “Dangers to the U.S. Tax Base from Pillar Two,” Tax Basis, Aug. 30, 2023, https://taxfoundation.org/analysis/all/federal/global-minimum-tax-us-tax-base/.

Share