Bitcoin, the most important cryptocurrency available in the market, skilled a worth restoration on Friday; nevertheless, trade consultants anticipate an extra take a look at of sub-$30,000 ranges within the close to time period.

The extended downtrend noticed over the previous fourteen days, coupled with mounting promoting stress, has raised considerations in regards to the sustainability of the latest rebound.

BTC’s Native Backside Predicted

Chris Burniske, co-founder of a New York-based enterprise crypto agency, highlights a number of components contributing to the anticipated downward motion of Bitcoin.

Burniske suggests that the consolidation part could prolong longer than anticipated because of many variables, together with crypto-market dynamics, macroeconomic situations, adoption tendencies, and new product developments.

Burniske presents his outlook on Bitcoin, stating {that a} native backside could possibly be reached within the $30,000 to $36,000 vary. Nevertheless, he wouldn’t be shocked if the cryptocurrency exams the mid-to-high $20,000 earlier than restoration happens, resulting in a renewed push towards earlier all-time highs.

Burniske cautions that the trail to such a restoration will possible be risky, marked by potential fakeouts, and will span a number of months.

The market professional advises traders to train persistence throughout this era of uncertainty. Burniske suggests that different cryptocurrencies could expertise extra vital share declines if his predictions maintain Bitcoin. Burniske additional said:

Earlier than you get mad with, “We’re simply getting this cycle began, Chris!!!” Largely agree, ~referred to as the cycle backside in Nov 2022 and proceed to imagine the long-term pattern stays strong. Have additionally seen plenty of crypto volatility over the past decade+…. not too long ago, I’ve particularly been discussing an area prime and native low, not a cycle-wide prime and low.

Purchase Sign For Bitcoin

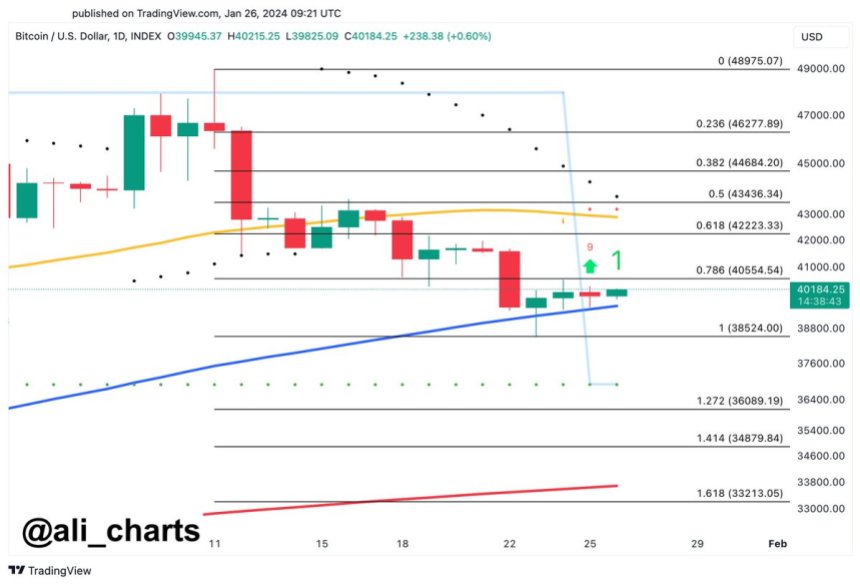

Crypto analyst Ali Martinez has offered insights into potential worth actions for Bitcoin in its newest evaluation performed on the social media platform X (previously Twitter).

Martinez’s evaluation signifies that the TD Sequential indicator not too long ago flashed a purchase sign on the every day chart, coinciding with Bitcoin’s present place above the 100-day Easy Transferring Common (SMA) at roughly the $40,000 degree.

In accordance with Martinez, if Bitcoin surpasses the $40,550 resistance degree, it could set off an upswing with a goal worth of $43,000. This bullish situation implies a possible worth rally for Bitcoin quickly.

Nevertheless, the analyst additionally highlights the significance of intently monitoring the 100SMA assist degree, as a breach of this degree might have vital implications for the cryptocurrency’s worth trajectory.

Martinez cautions that if the 100SMA assist degree is breached, it would end in Bitcoin experiencing a downward transfer towards the $33,300 degree. This potential draw back situation signifies a vital assist degree that, if damaged, might result in elevated promoting stress and a bearish sentiment available in the market.

On the time of writing, BTC’s worth has recovered 3.8% over the previous 24 hours, leading to a present buying and selling worth of $41,400.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site solely at your individual threat.