Technical reversal indicators emerge amid excessive oversold circumstances following an aggressive institutional distribution wave.

Information Background

• Whale wallets dumped almost 200 million XRP (~$400M) over 48 hours, triggering acute provide strain

• Market-wide risk-off intensified as Bitcoin slipped beneath $90,000, pulling altcoins into deeper volatility

• Bitwise’s new XRP ETF posted $25.7M first-day quantity and $107.6M AUM, signaling sturdy institutional demand

• Sentiment throughout majors stays fragile, with whole crypto market cap nonetheless drifting beneath heavy outflows

Value Motion Abstract

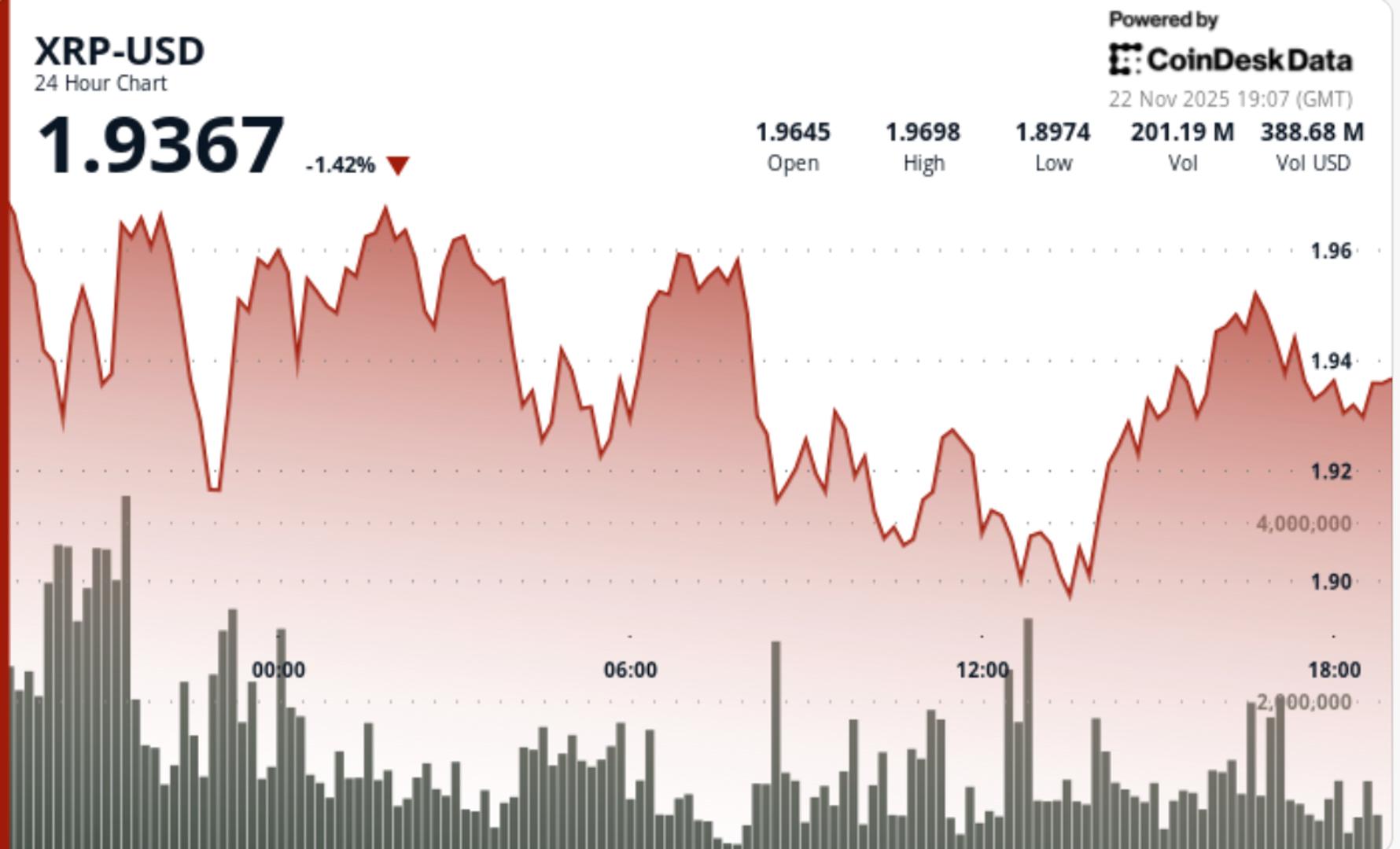

• XRP fell from $1.96 → $1.91, marking its lowest shut in three classes

• Quantity spiked 67% above common to 182.1M, confirming institutional promoting

• A descending channel dominated the session with 5.1% intraday volatility

• Capitulation backside fashioned at $1.895, adopted by a 0.5% late-session reversal

• Ultimate-hour quantity surged to 2.76M, breaking the sample of declining exercise

Technical Evaluation

XRP’s session mirrored a traditional distribution-driven decline adopted by early-stage reversal indicators. Whale promoting created sustained downward strain as main holders offloaded almost 200M tokens, overwhelming the $1.96 resistance band and pushing XRP right into a descending channel that continued by way of many of the session.

Assist at $1.90–$1.91 emerged as the important thing battleground. The psychological stage attracted aggressive shopping for after a capitulation occasion at $1.895, the place institutional inflows reversed the intraday pattern. Momentum indicators—together with RSI and short-term stochastic—flashed deep oversold circumstances, creating the primary bullish divergence since final week’s main breakdown.

The sturdy 2.76M-volume spike in the course of the bounce suggests early accumulation conduct, contradicting the prior multi-hour decline in participation. Nonetheless, the macro construction stays fragile. Bulls should power a clear break above $1.96 to invalidate the descending channel and try a pattern reversal. Failure to defend $1.90 would expose the chart to a quick extension towards $1.82, then $1.73.

What Merchants Ought to Watch

• $1.90 stays the road within the sand. An in depth beneath opens the trail towards October’s deep liquidity pockets

• Reclaiming $1.96 is important to neutralize the descending channel and restore short-term bullish momentum

• ETF flows—particularly Bitwise’s AUM trajectory—could present upside catalysts if quantity accelerates

• Divergences and oversold indicators favor near-term bounce makes an attempt, however whale distribution stays the dominant danger

• Market-wide worry ranges stay elevated; XRP will proceed to overreact to Bitcoin volatility