Ethereum has formally damaged under key assist ranges, and market sentiment is quickly deteriorating as main property throughout the crypto panorama proceed to slip. Analysts are more and more calling for the arrival of a brand new bear market, noting that each Bitcoin and the main altcoins have misplaced vital technical zones that beforehand held the broader construction collectively. ETH, now buying and selling at multi-month lows, is feeling the total weight of cascading liquidations, robust sell-side quantity, and evaporating investor confidence.

Associated Studying

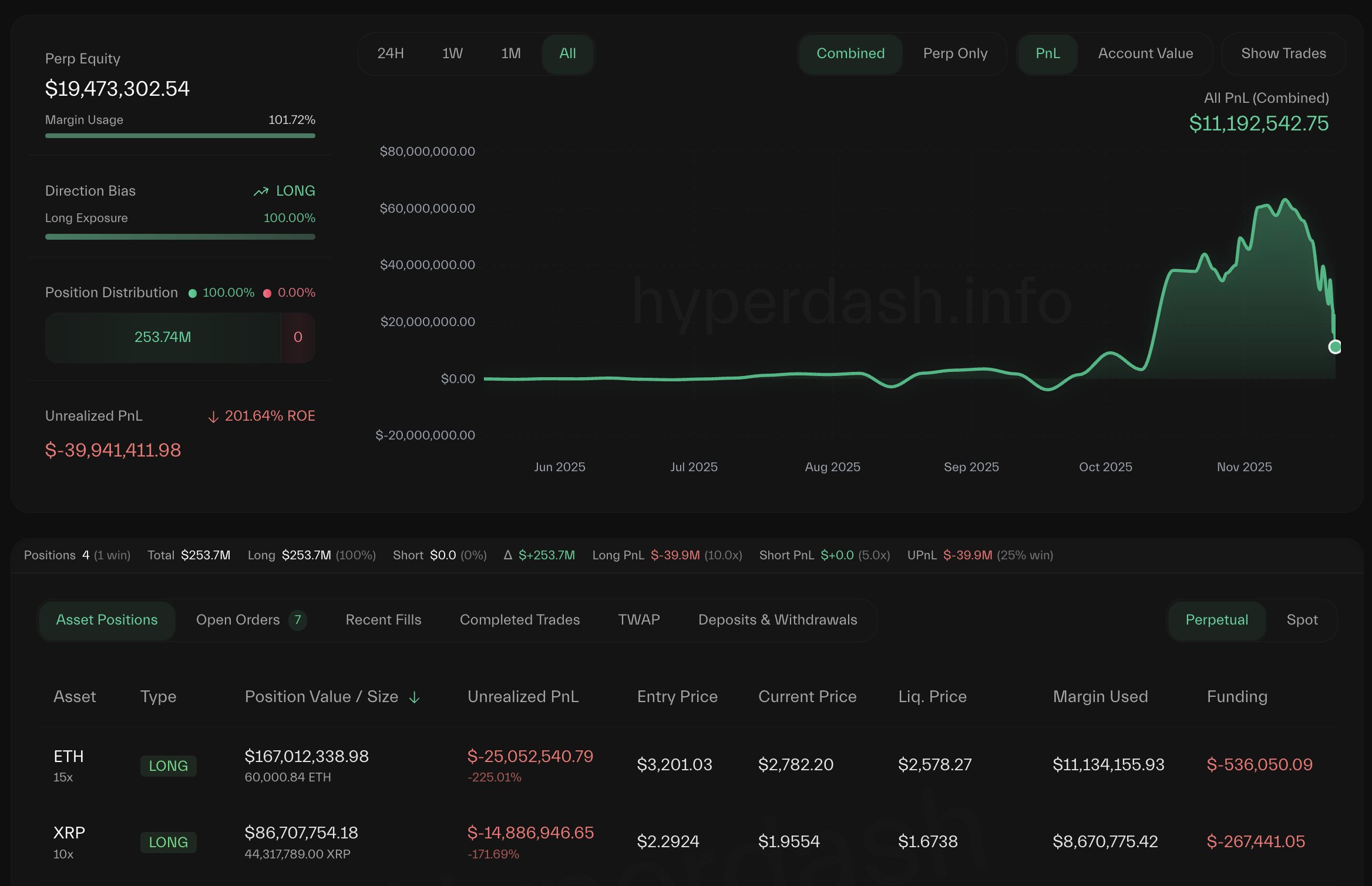

Including to the rising uncertainty, Lookonchain stories a placing growth: in simply 10 days, greater than $61 million in revenue has disappeared for a widely known market participant sometimes called the Anti-CZ Whale.

This dealer beforehand gained consideration for aggressively opening shorts instantly after CZ bought ASTER — a transfer that paid off handsomely till the current violent downturn reversed his fortunes.

The Anti-CZ Whale’s Unrealized Revenue Collapse Provides Stress

In keeping with Lookonchain, the dealer referred to as the Anti-CZ Whale has taken a large hit throughout the newest market downturn — and Ethereum sits on the heart of the injury. Simply 10 days in the past, this whale had amassed practically $100 million in complete revenue on Hyperliquid, largely fueled by aggressive positions constructed during times of excessive volatility.

Nevertheless, because the crypto market sharply corrected, his outsized ETH and XRP longs turned in opposition to him. The end result has been a brutal drawdown: his complete revenue has now fallen to simply $38.4 million, wiping out greater than 60% of beneficial properties in lower than two weeks.

This dramatic reversal displays multiple dealer’s misfortune — it indicators the extent of the stress weighing on Ethereum. As ETH continues to say no and investor sentiment deteriorates, even essentially the most seasoned actors are struggling to navigate the volatility. The whale’s fast revenue erosion highlights how shortly bullish conviction can shift when key assist ranges fail.

For Ethereum, holding the present zone is essential. Value motion has already inflicted important ache throughout longs, short-term holders, and leveraged gamers. If ETH loses this assist decisively, the subsequent wave of compelled promoting might deepen losses and speed up the broader market capitulation.

Associated Studying

ETH Value Evaluation: Testing a Main Weekly Assist Zone

Ethereum has entered a vital part on the weekly timeframe, with worth pulling again sharply towards the $2,680 area — a degree that now acts because the final significant assist earlier than a deeper market breakdown. The chart exhibits a powerful rejection from the $4,500 zone earlier this quarter, adopted by a sustained collection of decrease highs and decrease lows, confirming a medium-term downtrend.

The 50-week shifting common has been misplaced decisively, and ETH is now sitting instantly on high of the 100-week MA, a degree that has traditionally acted as a key pivot throughout main market corrections.

Quantity has expanded throughout the current drop, highlighting an atmosphere pushed by worry and compelled promoting relatively than managed profit-taking. This aligns with broader market situations, the place liquidity is skinny and volatility stays elevated throughout majors. A clear break under $2,650 would open the door for a retest of the $2,300–$2,400 zone, which served as robust accumulation throughout earlier cycles.

Associated Studying

Nevertheless, the weekly chart additionally exhibits that ETH is getting into a traditionally oversold space, just like mid-2022 and late-2023, the place reversals ultimately shaped after weeks of compression. For now, Ethereum should maintain above this weekly assist to keep away from a deeper retrace and protect the construction wanted for a possible restoration.

Featured picture from ChatGPT, chart from TradingView.com