Since mid-January Bitcoin (BTC) has been dealing with mounting promoting strain from numerous market gamers. This contains asset supervisor Grayscale, bankrupt crypto change FTX, and now, the US authorities, which is about to public sale off a considerable quantity of Bitcoin seized from the notorious darkish internet market Silk Highway.

Sale Of Confiscated Silk Highway Bitcoin

The US authorities has filed a discover to promote roughly $130 million price of Bitcoin confiscated from Silk Highway. The submitting states that the US intends to get rid of the forfeited property as directed by the US Lawyer Normal.

People or entities, apart from the defendants within the case, claiming an curiosity within the forfeited property should file an ancillary petition inside 60 days of the preliminary publication of the discover.

As soon as all ancillary petitions have been addressed or the submitting interval has expired, the US will acquire clear title to the property, enabling them to warrant good title to subsequent purchasers or transferees.

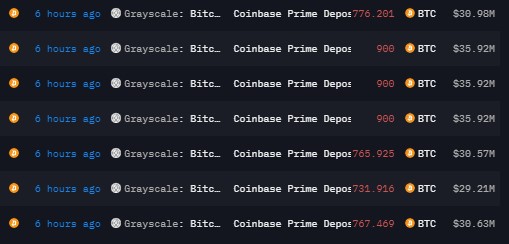

The continued promoting strain on BTC has resulted in a pointy 20% correction over the previous 10 days. This development is predicted to proceed and additional amplify the promoting strain. Including to the scenario, asset supervisor Grayscale, whereas slowing down its promoting actions, continues to switch a major quantity of Bitcoin to Coinbase.

In response to information from Arkham Intelligence, Grayscale not too long ago despatched an extra 10,000 BTC price $400 million to Coinbase.

Because the approval of the Bitcoin spot exchange-traded fund (ETF), Grayscale has deposited a complete of 103,134 BTC ($4.23 billion) to Coinbase Prime. Presently, Grayscale holds 510,682 BTC ($20.43 billion).

Best Shopping for Alternatives?

Adam Cochran, a outstanding market professional, has supplied insights into the latest value motion and the expectations of Bitcoin patrons. Cochran highlights that combination open curiosity (OI) for BTC has decreased by 17% from latest highs however stays round 20% larger than the averages noticed throughout extra steady market ranges.

Cochran notes that the market has seen makes an attempt to catch falling costs, suggesting a mixture of “subtle” and leveraged patrons.

Cochran additional observes that retail buyers are pushed by narratives surrounding the ETF and halving occasions, main them to purchase dips on leverage. Nonetheless, many buyers stay unconvinced concerning the market’s path and are ready for a transparent entry level, in response to Cochran’s evaluation.

Notably, Cochran highlights that the present funding charges don’t point out a bearish sentiment, even in choices buying and selling, suggesting an expectation of a backside formation shortly.

The market’s dynamics are influenced by feelings and possibilities, and Cochran believes that too many contributors are overexposing themselves emotionally by making an attempt to catch the underside of the market on every dip.

This conduct has elevated the probability that the latest value motion might not mark the underside but. Cochran suggests {that a} sentiment reset, a decline within the 3-month annualized foundation by round 25%, and an extra lower in open curiosity would offer a more healthy setting for main performs available in the market.

Finally, Cochran emphasizes the necessity for a reset in expectations, highlighting {that a} interval of doom and despair is critical for market contributors to reassess their positions.

Cochran factors out {that a} vary between $35,000 and $37,000 BTC might be an appropriate degree for bigger spot buys in the long term. Nonetheless, Cochran additionally notes {that a} potential drop to the $28,000 to $32,000 vary might present best circumstances for assured, leveraged deployment.

Presently, BTC is buying and selling at $39,800, up a slight 0.6% previously 24 hours, however down over 14% previously fourteen days.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site completely at your individual danger.