Information exhibits the Bitcoin Mayer A number of has declined to the decrease sure of its vary just lately, which suggests a slowdown in momentum for BTC.

Bitcoin Mayer A number of Is Now Retesting Its Decrease Certain

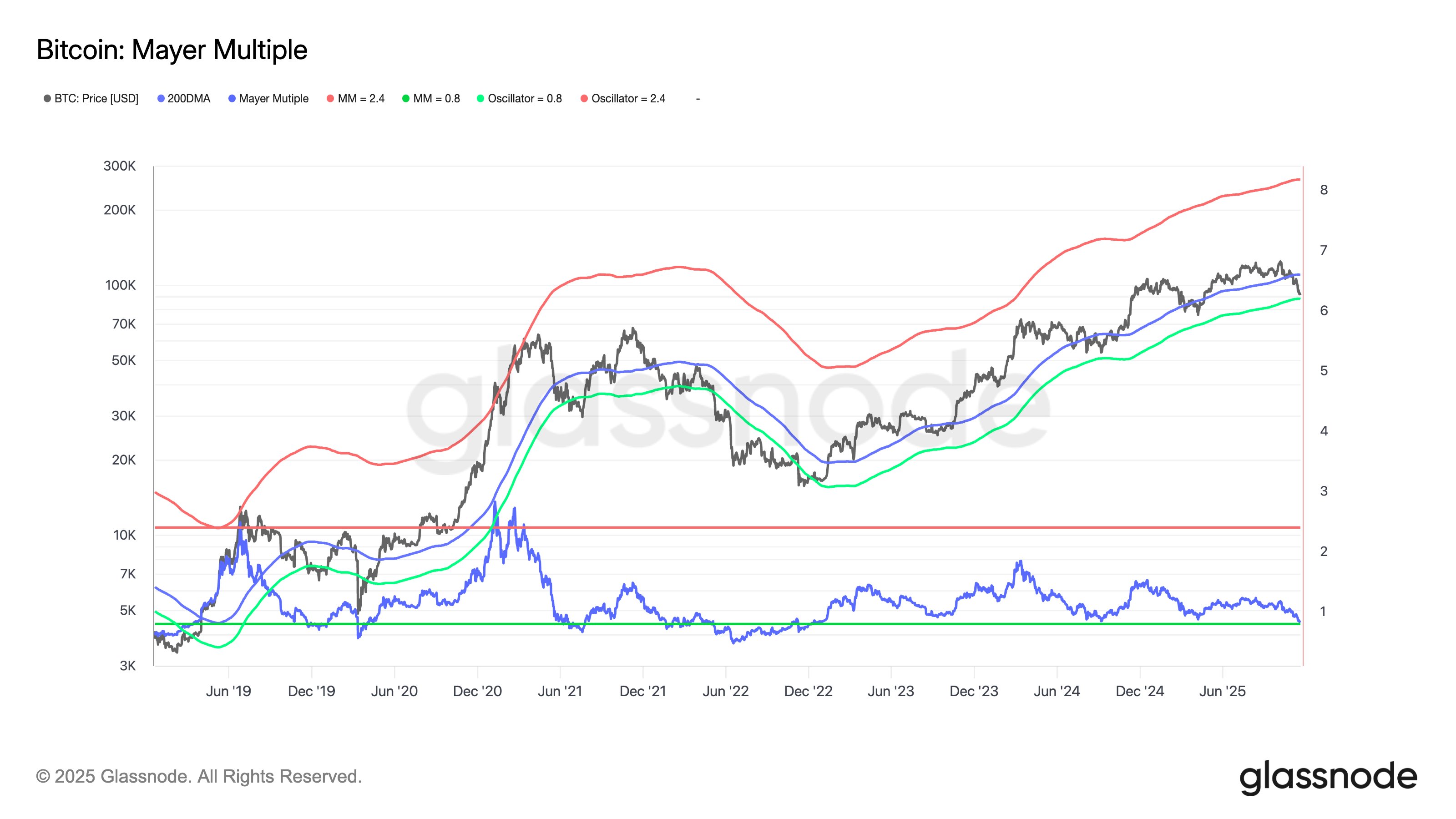

As defined by on-chain analytics agency Glassnode in a brand new submit on X, the Bitcoin Mayer A number of has retraced to the decrease sure of its long-term vary. The “Mayer A number of” refers to an indicator that retains monitor of the ratio between the BTC spot value and its 200-day transferring common (MA).

In technical evaluation (TA), the 200-day MA is taken into account as a boundary between macro bullish and bearish tendencies. Each time BTC is buying and selling above this line, a bullish bias could also be assumed to be in play. Equally, the asset being underneath the mark can suggest a market downturn.

For the reason that Mayer A number of compares the spot value with this degree, it primarily tells us about how far above or beneath Bitcoin is from the bull-bear boundary. The cryptocurrency gaining a big distance over the 200-day MA could suggest it’s turning into overpriced, whereas it being too far underneath might improve the possibilities of a rebound to the upside happening.

Now, right here is the chart shared by Glassnode that exhibits how the Bitcoin Mayer A number of is wanting proper now:

As displayed within the above graph, the Bitcoin spot value has damaged beneath the 200-day MA with its latest downtrend, which has resulted within the Mayer A number of approaching a worth of 0.8.

This 0.8 degree occurs to be the place the indicator’s long-term vary has discovered its decrease boundary up to now. The final time the metric fell beneath this line was through the 2022 bear market.

“Traditionally, such compressions have aligned with value-driven phases the place value consolidates and demand begins to step in,” famous the analytics agency. It now stays to be seen whether or not a break beneath is coming for Bitcoin or not.

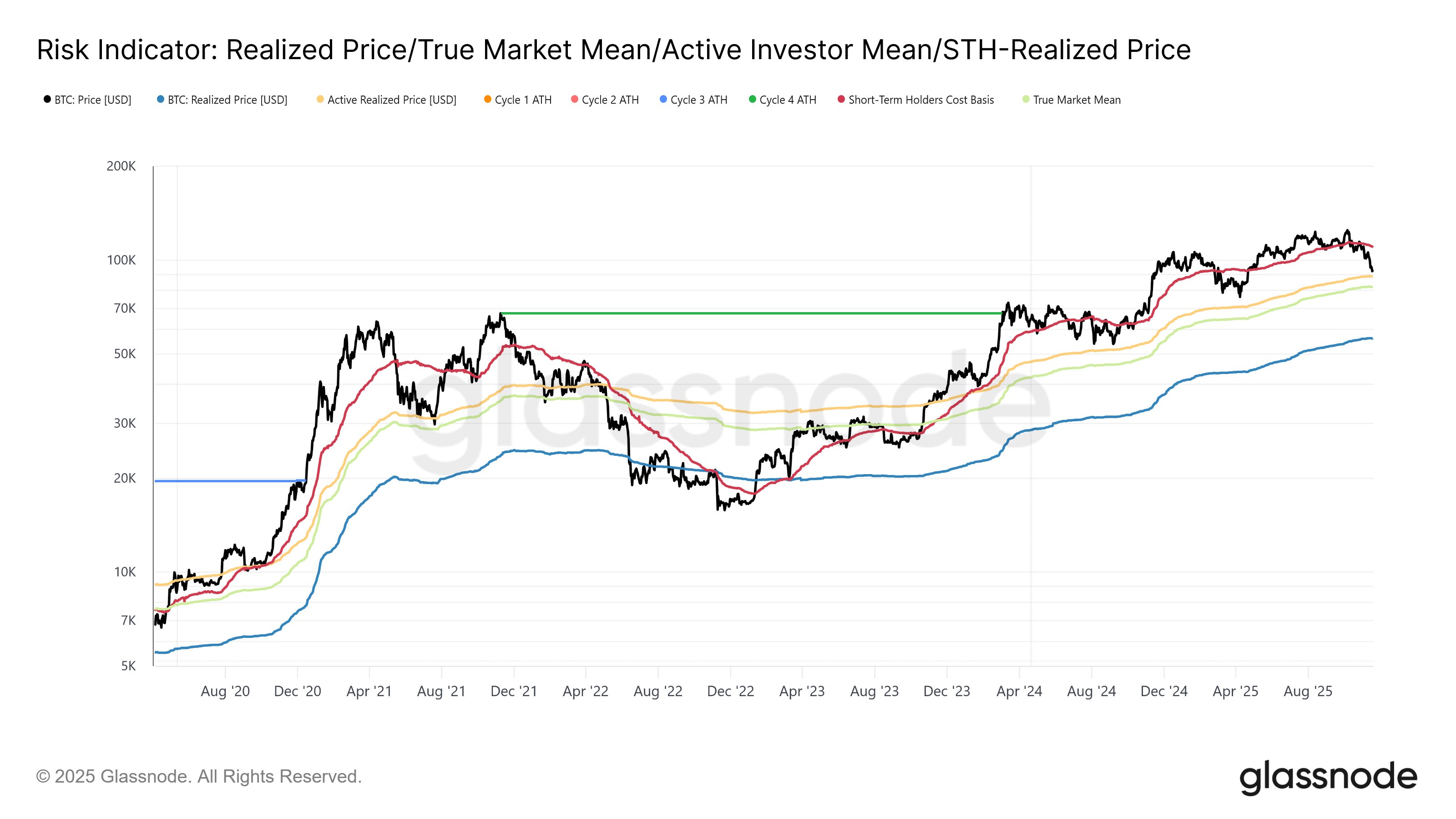

This technical boundary isn’t the one one which BTC is retesting; there are additionally a few vital on-chain ranges that the cryptocurrency occurs to be buying and selling round proper now, making the present vary a probably vital one.

In a submit on X, Glassnode senior researcher CryptoVizArt.₿ has shared among the main on-chain value fashions.

With its drop up to now day, Bitcoin has slipped underneath the Energetic Realized Worth located at $88,600, comparable to the typical price foundation of the lively market members.

The subsequent closest degree is the True Market Imply, which is one other price foundation mannequin for the BTC community. Presently, this degree is situated at $82,000. “A breakdown beneath each Energetic Traders and the True Market Imply would mark the primary main affirmation of a deeper bear pattern since Might 2022,” defined the Glassnode researcher.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $87,200, down 13% over the past week.