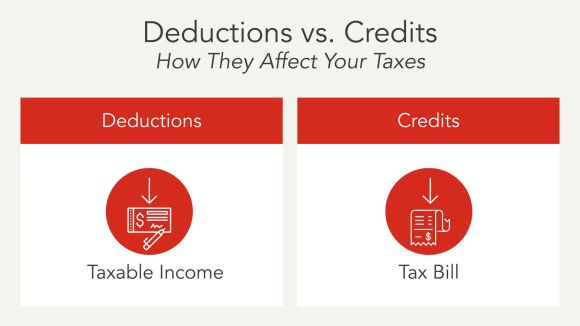

What are tax deductions? Deductions are used to scale back taxable revenue. And a decrease taxable revenue reduces what you owe. Deductions are completely different from tax credit. Tax credit instantly minimize your tax invoice by lowering the precise taxes owed. Each contribute to decreasing your tax legal responsibility.

This information will cowl the fundamentals of how tax deductions work. We’ll focus on how they will profit you and the way you should use them to your benefit.

We’ll deal with a few of the mostly requested questions throughout tax season. Then, we’ll offer you a rundown on the distinction between commonplace and itemized deductions. We’ll additionally spotlight a few of the commonest deductions you’ll wish to have in your radar.

With a foundational understanding of tax deductions, you’ll be higher geared up to tackle tax season. Use the hyperlinks beneath or hold studying to be taught extra.

What are tax deductions?

Tax deductions are primarily objects or prices the IRS permits to scale back your taxable revenue in your tax return. Put merely, tax deductions decrease the amount of cash you need to pay taxes on.A tax deduction can be known as a tax write-off. It’s because you may “write off” or subtract these quantities out of your private taxable revenue.

Deductions may end up in huge financial savings. Be sure to look into which of them apply to you–we’ll cowl a few of the commonest ones beneath. Needless to say tax legal guidelines and eligible deductions can differ from 12 months to 12 months. Ensure you examine in on what’s on the desk. That approach, you may plan accordingly.

Customary vs. itemized deductions

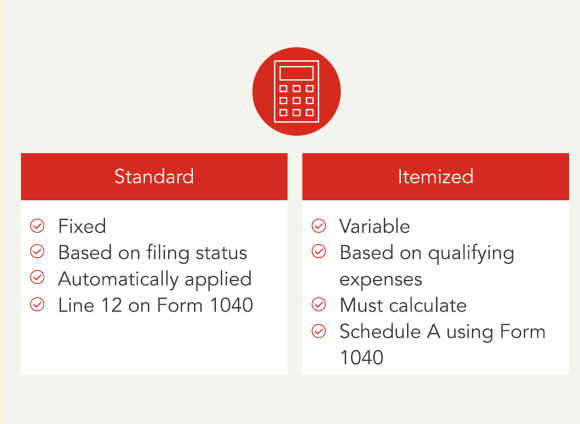

Customary and itemized deductions are two choices used to scale back your adjusted gross revenue (AGI), which is then used to find out your taxable revenue. Usually, the kind of deduction used will differ from 12 months to 12 months based mostly upon the very best general tax profit offered by every deduction. Just one technique can be utilized in any given 12 months. The most suitable choice is to make use of the deduction that ends in the bottom AGI. In case your itemized deductions are greater, you’ll itemize. Nevertheless, if the usual deduction is greater, you’ll take the usual deduction. Let’s break down the variations between every deduction.

The usual deduction is a hard and fast quantity that’s based mostly in your submitting standing. It could actually differ every tax 12 months. It permits you to subtract a certain quantity out of your adjusted gross revenue.

The usual deduction for 2023 is $13,850 for single filers, $27,700 for joint filers, or $20,800 for heads of family.

Itemized deductions are particular allowable reductions you can checklist in your tax return as a substitute of taking the usual deduction.

We’ll discover some widespread itemized deductions beneath, however a couple of examples embody:

- Property taxes and state revenue taxes

- Mortgage curiosity

- Medical bills

- Charitable contributions

For those who itemize deductions in your tax return, you need to hold detailed data and receipts. Do that for every merchandise that you just declare as an itemized deduction within the case of an audit.

So, do you have to select the usual or itemized deduction? Usually, TurboTax will choose the strategy that ends in the upper tax profit to your state of affairs. It will in flip end in a decrease AGI and taxable revenue.

Are tax credit the identical as tax deductions?

Whereas tax credit and deductions perform otherwise, they each assist to attenuate your general taxes. Let’s dive into the variations between tax deductions vs. credit. That approach, you may higher perceive the benefits of every.

Not like deductions, tax credit instantly cut back the quantity of taxes you owe. Bear in mind, tax deductions solely cut back taxable revenue.

The excellent news is you don’t have to decide on between tax deductions or credit. If eligible, you may obtain each tax credit and deductions to assist decrease your general tax obligation.

There are a number of tax credit accessible to you when you qualify, starting from training to energy-saving objects. A typical tax credit score is the Baby Tax Credit score, which permits dad and mom to say as much as $2,000 per youngster underneath 17 years previous. Tax credit might be both refundable or nonrefundable. The Further Baby Tax Credit score is refundable as much as $1,600. Meaning you might obtain this quantity as a refund even when you don’t have a tax legal responsibility.

How are you aware when you can declare tax deductions?

The very first thing you need to do is analysis the widespread deductible bills and be sure that you meet the standards for every.

In case your whole itemized deductions exceed the usual deduction, itemizing will doubtless be the most suitable choice to your state of affairs. You’ll declare itemized tax deductions on Schedule A of your Type 1040. The Schedule A kind is used to calculate and report every deduction individually to calculate your whole itemized deductions.

Nevertheless, if the usual deduction quantity is greater than itemizing, TurboTax will choose the usual deduction for you. The usual deduction is reported on Type 1040, line 12. Not like itemized deductions, the usual deduction doesn’t require documentation of particular bills.

8 well-liked tax deductions

What are widespread deductions you need to hold a watch out for? These well-liked tax deductions are a straightforward approach to cut back your taxable revenue. In flip, they will decrease the amount of cash you owe.

Some deductions function incentives and embody objects, comparable to:

- Proudly owning a house

- Donating to charity

- Medical Bills

Deductions are as diverse as taxpayers. Check out the checklist beneath to begin planning which deductions you’re going to benefit from:

Itemized Deductions

- Medical expense – itemized deduction

You may deduct qualifying medical bills as a part of your itemized deductions in the event that they exceed 7.5% of your AGI. This may embody prices associated to medical care and consists of prescriptions.

- Private property tax – itemized deduction

Deduct taxes paid on private property, comparable to car registration charges, with this itemized deduction. Private property taxes may also embody taxes on boats and even some enterprise tools.

- Mortgage curiosity – itemized deduction

For those who’re a house owner, you may deduct the curiosity paid in your mortgage loans. This might help not solely cut back your taxable revenue but additionally make homeownership a extra reasonably priced course of.

- Charitable contributions – itemized deduction

You may also deduct donations made to 501(c)(3) nonprofit organizations all year long. A charitable contribution helps to scale back your taxable revenue relying on the worth of your contribution.

Above the road Deductions

- Scholar mortgage curiosity – above-the-line deduction

This deduction permits you to write off a specific amount of paid curiosity on certified scholar loans. Deducting scholar mortgage curiosity might help ease the monetary burden of scholar mortgage reimbursement. These funds are reported on Schedule 1, half II, line 21 and are used to scale back your adjusted gross revenue.

- IRA contributions – above-the-line deduction

Have a standard particular person retirement account (IRA)? You could possibly deduct any contributions that you just made all through the tax 12 months. These contributions are reported on Schedule 1, half II, line 20 and are used to scale back your adjusted gross revenue.

- HSA contributions – above-the-line deduction

A well being financial savings account (HSA) helps these with excessive well being plan deductibles handle their cash for medical bills. For those who contribute to a HSA, you may be capable of deduct it out of your taxable revenue on Schedule 1, half II, line 13. If the contributions are made through your employer, then the HSA contribution might be reported in your W-2 Type in Field 12.

Self-Employed Deductions

- Enterprise bills for self-employed people

A enterprise expense might be something from workplace provides to journey prices. For those who’re self-employed, you may write off obligatory bills for working your corporation. These bills are used to offset any revenue earned from your corporation and are reported on Schedule C.

Are the identical deductions supplied yearly?

Whereas some tax deductions could keep the identical from 12 months to 12 months, others can change as a consequence of updates in tax laws or the financial system. For any given tax 12 months:

- New deductions might be launched

- Present deductions might be modified

- Sure deductions is likely to be eliminated

How will you maximize your tax deductions?

Optimizing your tax deductions requires strategic planning, group, and information of eligible bills.

Tax deductions can embody many actions. You is likely to be higher off claiming the usual deduction when you don’t have important bills.

However, you may select to itemize deductions to maximise your potential financial savings. When itemizing, you may proactively plan for added bills within the upcoming 12 months.

Throughout the years that you just’re planning to itemize, discover all deduction alternatives, together with these for:

- Homeownership

- Medical prices

- Charitable donations

Moreover, pay attention to generally neglected deductions which will apply to your state of affairs. You may need the chance to learn from sudden prices like:

As a part of your tax technique, you might bunch common bills into one tax 12 months as a substitute of spreading them out. Bunching your deductions additionally helps to maximise their worth since some tax deductions require a minimal expense to qualify.

One other technique to maximise your tax deductions consists of conserving organized data of all of your eligible prices. Throughout the 12 months, preserve copies of huge and small bills so you’ve them prepared come tax time.

Decrease your tax legal responsibility by leveraging deductions

Scale back the monetary stress of tax season by leveraging the facility of deductions. By decreasing your taxable revenue, deductions unlock alternatives to economize–who wouldn’t need that?

It’s good to have a fundamental understanding of the principles. That stated, we make it simple to determine when you qualify for deductions once you use TurboTax. It doesn’t matter what strikes you made final 12 months, TurboTax will make them rely in your taxes. Whether or not you wish to do your taxes your self or have a TurboTax skilled file for you, we’ll be sure you get each greenback you deserve and your greatest potential refund – assured.

11 responses to “What Are Tax Deductions? A 101 Information”