Main assist at $0.155 collapsed underneath heavy promoting strain, but enhancing alternate flows and accelerating whale accumulation recommend draw back exhaustion could also be nearing.

Information Background

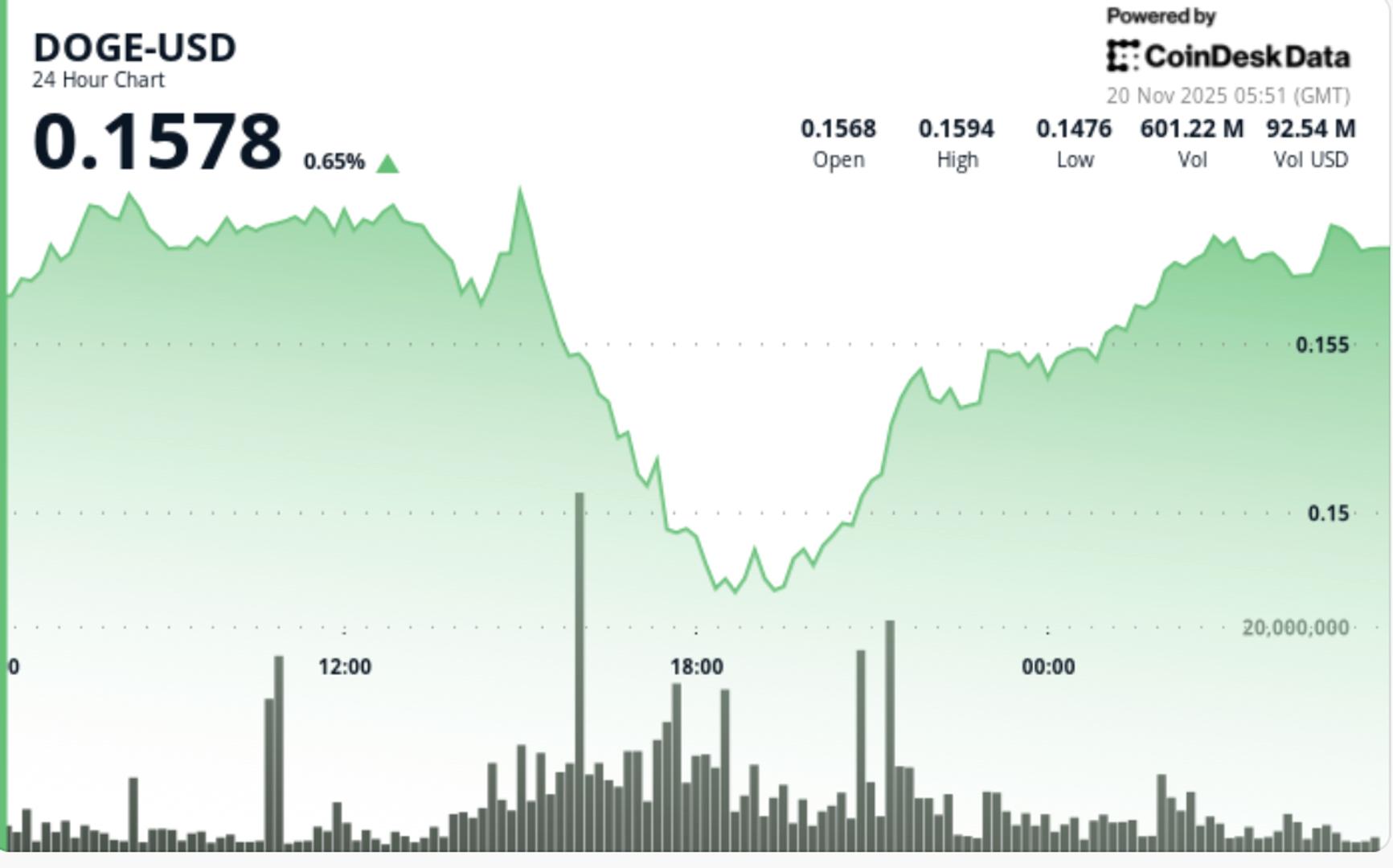

• DOGE dropped from $0.160 to $0.149, breaking main assist at $0.155

• Change internet inflows turned constructive for the primary time in months — a historic precursor to aid rallies

• Analysts flag a possible DOGE ETF approval window underneath Part 8(a) throughout the subsequent seven days

• Whale accumulation totals 4.72B DOGE ($770M) over two weeks regardless of falling costs

• Broader crypto market stays in excessive worry, with sentiment at its lowest since April

Crypto markets proceed to deteriorate as Bitcoin’s “Loss of life Cross” and risk-off circumstances strain altcoins. Nevertheless, DOGE’s alternate stream dynamics flipped constructive — a structural shift that traditionally seems close to market bottoms. Analyst Ali Martinez notes related inflection factors preceded reversible capitulation phases in prior cycles.

Worth Motion Abstract

Dogecoin plunged 7.42% in the course of the 24-hour session, collapsing from $0.160 to $0.149 in a breakdown that shattered the essential $0.155 assist that anchored the earlier consolidation vary. Quantity jumped 18.39% above weekly averages, confirming institutional participation reasonably than retail panic.

The selloff marked a clear violation of the 0.5 Fibonacci retracement from the prior bull cycle and drove value straight into the decrease boundary of DOGE’s year-long descending triangle. The decline prolonged by a number of intraday flooring earlier than stabilizing close to $0.149-$0.151. Oversold circumstances emerged as RSI constructed bullish divergence in opposition to recent value lows, whereas short-lived MACD dying crosses hinted at exhaustion in downward momentum.

Technical Evaluation

Dogecoin now sits at a high-stakes intersection of breakdown affirmation versus reversal potential. The collapse beneath $0.155 completes the descending-triangle decision, historically projecting continuation down towards the $0.145-$0.140 zone. Nevertheless, counter-signals are constructing.

Whale accumulation has intensified materially, with high-value wallets absorbing over 4.7B DOGE as value dropped — an indication of sturdy arms stepping in in opposition to weak retail flows. Concurrently, alternate internet inflows have flipped constructive for the primary time in months, a structural shift that beforehand preceded tradable bottoms.

Momentum indicators assist this divergence: RSI continues to push greater whilst value prints decrease lows, and MACD’s bearish alerts are quickly fading. This creates a combined however more and more attention-grabbing setup the place the technical breakdown clashes with early reversal alerts rooted in on-chain habits.

DOGE’s value will doubtless stay compressed between $0.149 assist and $0.158 resistance till ETF catalysts or macro sentiment present a decisive push.

What Merchants Ought to Watch

Merchants face a binary setup formed by each regulatory catalysts and technical inflection:

• Monday’s Part 8(a) DOGE ETF deadline — a shock approval might set off instant repricing

• Reclaim of $0.155 — important for negating the breakdown and reopening path to $0.162-$0.165

• Failure at $0.150 — exposes quick continuation towards $0.115-$0.085 demand zones

• Change stream course — continued constructive internet inflows would strengthen reversal thesis

• Macro sentiment — excessive worry throughout BTC and altcoins could produce sharp aid strikes, but in addition will increase breakdown threat

The chance/reward setup turns into extremely favorable for directional merchants as DOGE approaches the apex of a multi-year construction whereas ETF catalysts converge with on-chain accumulation dynamics.